What are the explanations to the question's answers? I know that

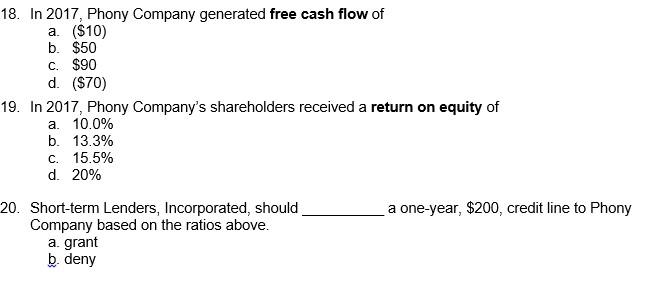

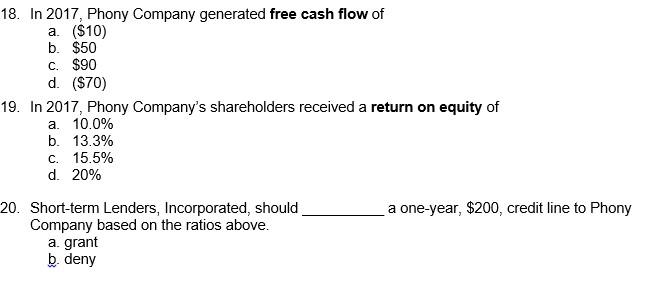

18) d

19) b

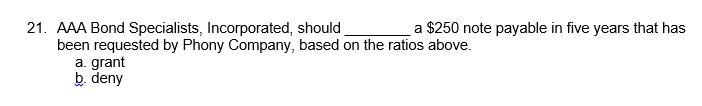

20) a

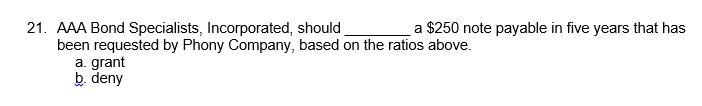

21) b

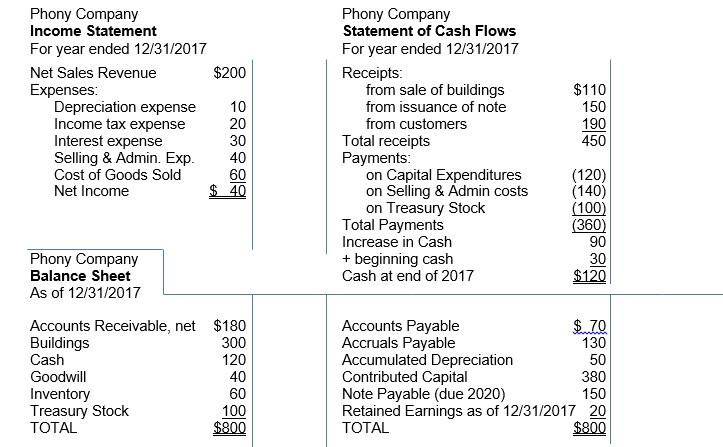

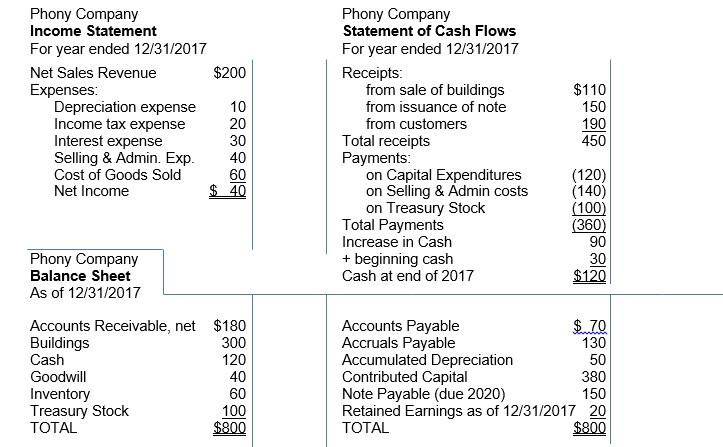

Phony Company Income Statement For year ended 12/31/2017 Net Sales Revenue Expenses: Depreciation expense Income tax expense Interest expense Selling & Admin. Exp. Cost of Goods Sold Net Income $200 10 20 30 40 60 $40 Phony Company Balance Sheet As of 12/31/2017 Accounts Receivable, net $180 Buildings 300 Cash 120 Goodwill 40 Inventory 60 100 Treasury Stock TOTAL $800 Phony Company Statement of Cash Flows For year ended 12/31/2017 Receipts: $110 from sale of buildings from issuance of note 150 from customers 190 450 on Capital Expenditures (120) (140) (100) (360) on Selling & Admin costs on Treasury Stock Total Payments Increase in Cash + beginning cash Cash at end of 2017 90 30 $120 Accounts Payable $70 Accruals Payable 130 Accumulated Depreciation 50 Contributed Capital 380 Note Payable (due 2020) 150 Retained Earnings as of 12/31/2017 20 TOTAL $800 Total receipts Payments: 18. In 2017, Phony Company generated free cash flow of a. ($10) b. $50 c. $90 d. ($70) 19. In 2017, Phony Company's shareholders received a return on equity of a. 10.0% b. 13.3% c. 15.5% d. 20% 20. Short-term Lenders, Incorporated, should Company based on the ratios above. a. grant b. deny a one-year, $200, credit line to Phony 21. AAA Bond Specialists, Incorporated, should been requested by Phony Company, based on the ratios above. a. grant b. deny a $250 note payable in five years that has Phony Company Income Statement For year ended 12/31/2017 Net Sales Revenue Expenses: Depreciation expense Income tax expense Interest expense Selling & Admin. Exp. Cost of Goods Sold Net Income $200 10 20 30 40 60 $40 Phony Company Balance Sheet As of 12/31/2017 Accounts Receivable, net $180 Buildings 300 Cash 120 Goodwill 40 Inventory 60 100 Treasury Stock TOTAL $800 Phony Company Statement of Cash Flows For year ended 12/31/2017 Receipts: $110 from sale of buildings from issuance of note 150 from customers 190 450 on Capital Expenditures (120) (140) (100) (360) on Selling & Admin costs on Treasury Stock Total Payments Increase in Cash + beginning cash Cash at end of 2017 90 30 $120 Accounts Payable $70 Accruals Payable 130 Accumulated Depreciation 50 Contributed Capital 380 Note Payable (due 2020) 150 Retained Earnings as of 12/31/2017 20 TOTAL $800 Total receipts Payments: 18. In 2017, Phony Company generated free cash flow of a. ($10) b. $50 c. $90 d. ($70) 19. In 2017, Phony Company's shareholders received a return on equity of a. 10.0% b. 13.3% c. 15.5% d. 20% 20. Short-term Lenders, Incorporated, should Company based on the ratios above. a. grant b. deny a one-year, $200, credit line to Phony 21. AAA Bond Specialists, Incorporated, should been requested by Phony Company, based on the ratios above. a. grant b. deny a $250 note payable in five years that has