Question

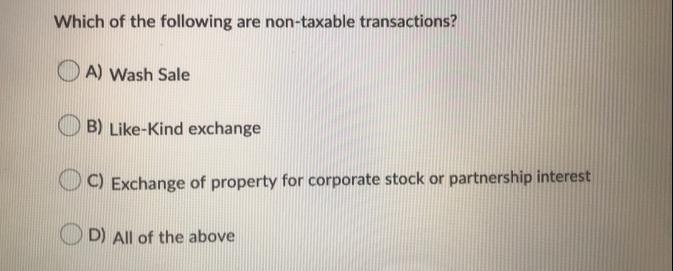

Which of the following are non-taxable transactions? A) Wash Sale B) Like-Kind exchange C) Exchange of property for corporate stock or partnership interest D)

Which of the following are non-taxable transactions? A) Wash Sale B) Like-Kind exchange C) Exchange of property for corporate stock or partnership interest D) All of the above

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

D All of the above Explanation Nontaxable tra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Marketing Real People, Real Choices

Authors: Michael R. Solomon, Greg W. Marshall, Elnora W. Stuart, J. Brock Smith, Sylvain Charlebois, Bhupesh Shah

4th Canadian Edition

132913178, 978-0134365954, 013436595X, 978-0132913171

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App