Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What do these ratios tell you about each company ? Which one of the two companies would you invest in and why? (State any other

What do these ratios tell you about each company ?

Which one of the two companies would you invest in and why? (State any other information would you require to make your decision)

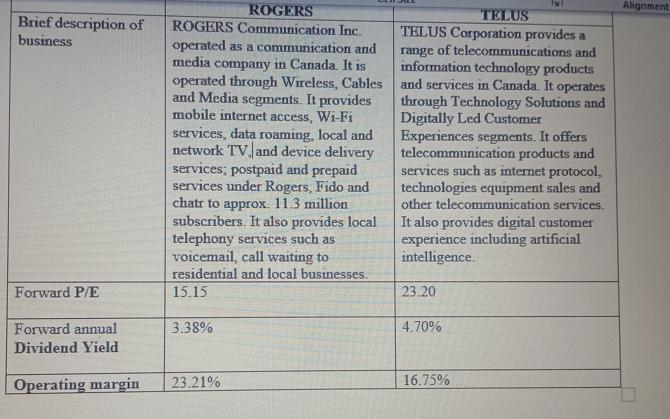

Brief description of business Forward P/E Forward annual Dividend Yield Operating margin ROGERS ROGERS Communication Inc. operated as a communication and media company in Canada. It is operated through Wireless, Cables and Media segments. It provides mobile internet access, Wi-Fi services, data roaming, local and network TV and device delivery services; postpaid and prepaid services under Rogers, Fido and chatr to approx. 11.3 million subscribers. It also provides local telephony services such as voicemail, call waiting to residential and local businesses. 15.15 3.38% 23.21% TELUS TELUS Corporation provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally Led Customer Experiences segments. It offers telecommunication products and services such as internet protocol, technologies equipment sales and other telecommunication services. It also provides digital customer experience including artificial intelligence. 23.20 4.70% 16.75% Alignment

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Ratio Analysis It is a mathematical expression of the two or more items of the financial stat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started