Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What do you understand by Ratio Analysis? Find out the value of Current Assets of a company from the following information: (i) Inventory Turnover

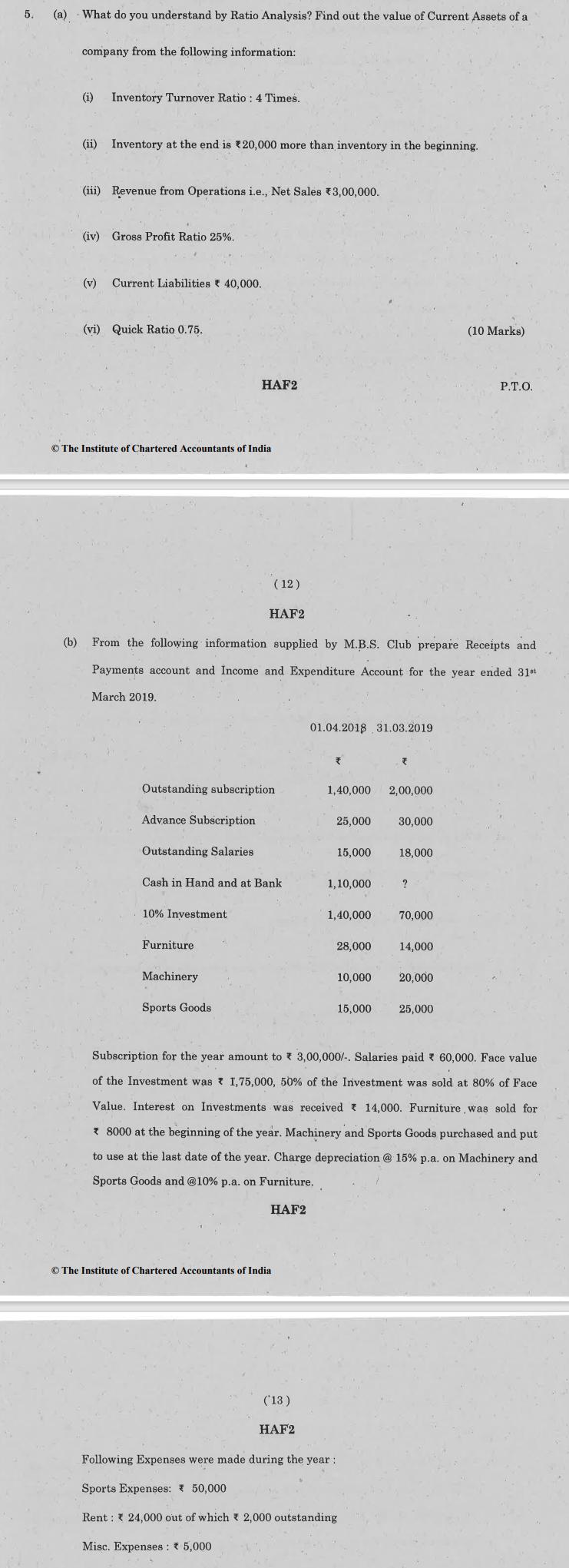

What do you understand by Ratio Analysis? Find out the value of Current Assets of a company from the following information: (i) Inventory Turnover Ratio: 4 Times. (ii) Inventory at the end is 20,000 more than inventory in the beginning. (iii) Revenue from Operations i.e., Net Sales 3,00,000. (iv) Gross Profit Ratio 25%. (v) Current Liabilities 40,000. (vi) Quick Ratio 0.75. The Institute of Chartered Accountants of India March 2019. Advance Subscription Outstanding Salaries HAF2 (b) From the following information supplied by M.B.S. Club prepare Receipts and Payments account and Income and Expenditure ount the year ende Outstanding subscription 10% Investment Furniture Cash in Hand and at Bank Machinery (12) HAF2 Sports Goods The Institute of Chartered Accountants of India (13) 01.04.2018 31.03.2019 HAF2 1,40,000 25,000 15,000 1,10,000 1,40,000 10,000 15,000 2,00,000 Following Expenses were made during the year: Sports Expenses: 50,000 Rent : * 24,000 out of which 2,000 outstanding Misc. Expenses : * 5,000 30,000 18,000 28,000 14,000 ? 70,000 20,000 Subscription for the year amount to 3,00,000/-. Salaries paid 60,000. Face value of the Investment was 1,75,000, 50% of the Investment was sold at 80% of Face Value. Interest on Investments was received 14,000. Furniture was sold for *8000 at the beginning of the year. Machinery and Sports Goods purchased and put to use at the last date of the year. Charge depreciation @ 15% p.a. on Machinery and Sports Goods and @10% p.a. on Furniture. HAF2 (10 Marks) 25,000 P.T.O.

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started