Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What entry for income taxes should be recorded for years: 2021, 2022, 2023, 2024, 2025, 2026? Pina Corporation has pretax financial income (or loss) equal

What entry for income taxes should be recorded for years: 2021, 2022, 2023, 2024, 2025, 2026?

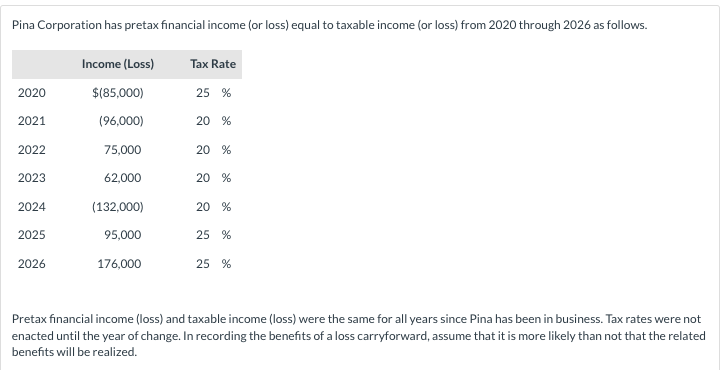

Pina Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2020 through 2026 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Pina has been in business. Tax rates were not enacted until the year of change. In recording the benefits of a loss carryforward, assume that it is more likely than not that the related benefits will be realized. Pina Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2020 through 2026 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Pina has been in business. Tax rates were not enacted until the year of change. In recording the benefits of a loss carryforward, assume that it is more likely than not that the related benefits will be realized

Pina Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2020 through 2026 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Pina has been in business. Tax rates were not enacted until the year of change. In recording the benefits of a loss carryforward, assume that it is more likely than not that the related benefits will be realized. Pina Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2020 through 2026 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Pina has been in business. Tax rates were not enacted until the year of change. In recording the benefits of a loss carryforward, assume that it is more likely than not that the related benefits will be realized Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started