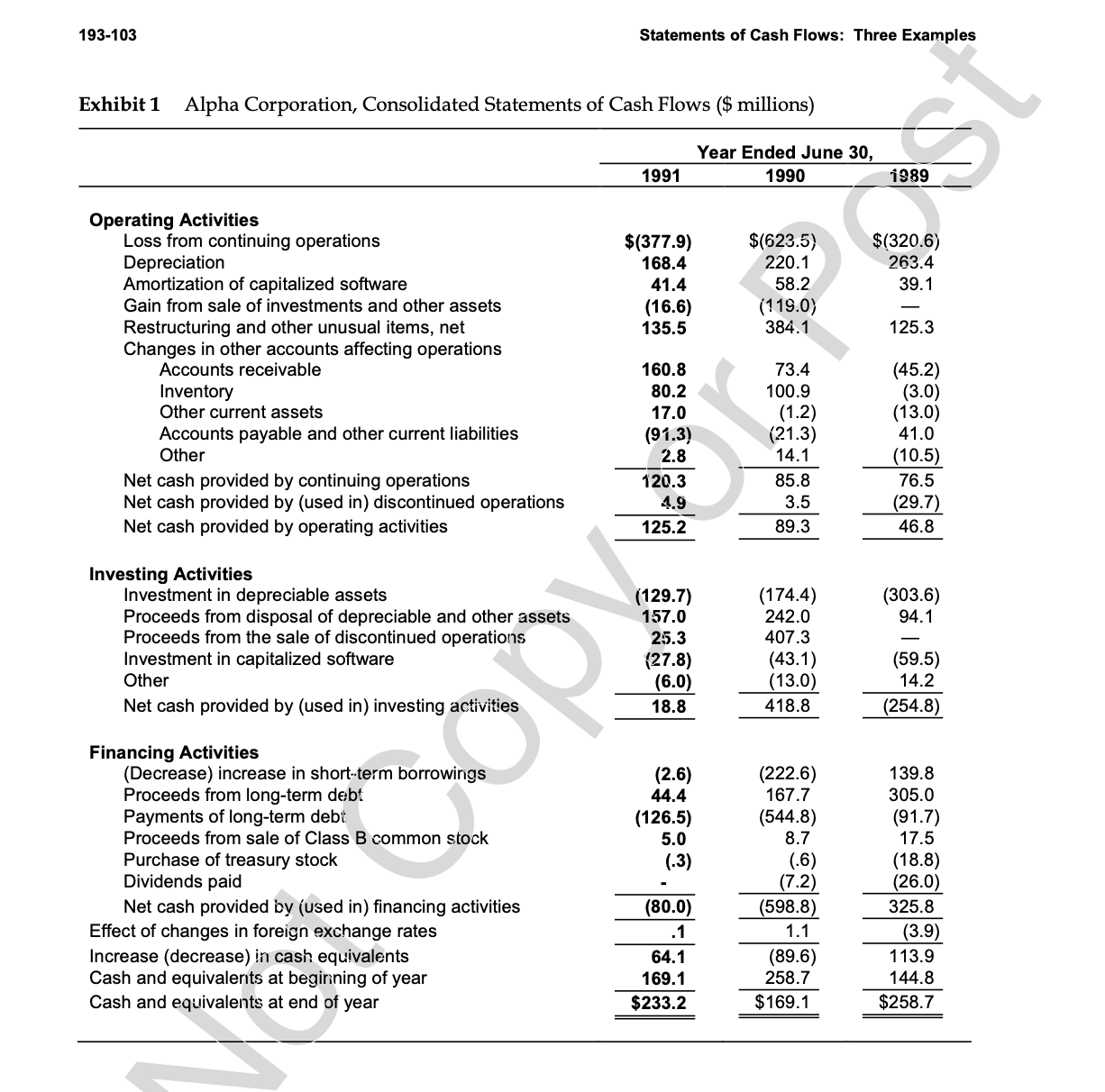

What has the trend in net income? 1989-1991 193-103 Statements of Cash Flows: Three Examples Exhibit 1 Alpha Corporation, Consolidated Statements of Cash Flows ($

What has the trend in net income? 1989-1991

193-103 Statements of Cash Flows: Three Examples Exhibit 1 Alpha Corporation, Consolidated Statements of Cash Flows ($ millions) 1991 Year Ended June 30, 1990 Operating Activities st 1989 Loss from continuing operations Depreciation $(377.9) $(623.5) 168.4 220.1 Amortization of capitalized software Gain from sale of investments and other assets 41.4 58.2 $(320.6) 263.4 39.1 (16.6) (119.0) Restructuring and other unusual items, net Changes in other accounts affecting operations 135.5 384.1 125.3 Accounts receivable Inventory 160.8 73.4 (45.2) 80.2 100.9 (3.0) Other current assets 17.0 (1.2) (13.0) Accounts payable and other current liabilities Other (91.3) (21.3) 41.0 2.8 14.1 (10.5) Net cash provided by continuing operations 120.3 85.8 76.5 Net cash provided by (used in) discontinued operations Net cash provided by operating activities 4.9 3.5 (29.7) 125.2 89.3 46.8 Investing Activities Investment in depreciable assets (129.7) (174.4) Proceeds from disposal of depreciable and other assets Proceeds from the sale of discontinued operations Investment in capitalized software 157.0 242.0 (303.6) 94.1 25.3 407.3 (27.8) (43.1) (59.5) Other (6.0) (13.0) 14.2 Net cash provided by (used in) investing activities 18.8 418.8 (254.8) Financing Activities (Decrease) increase in short-term borrowings Proceeds from long-term debt (2.6) 44.4 (222.6) 139.8 167.7 305.0 Payments of long-term debt (126.5) (544.8) (91.7) Proceeds from sale of Class B common stock 5.0 8.7 17.5 Purchase of treasury stock (.3) (.6) (18.8) Dividends paid (7.2) (26.0) Net cash provided by (used in) financing activities (80.0) (598.8) 325.8 Effect of changes in foreign exchange rates Increase (decrease) in cash equivalents Cash and equivalents at beginning of year Cash and equivalents at end of year .1 1.1 (3.9) 64.1 (89.6) 113.9 169.1 258.7 144.8 $233.2 $169.1 $258.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started