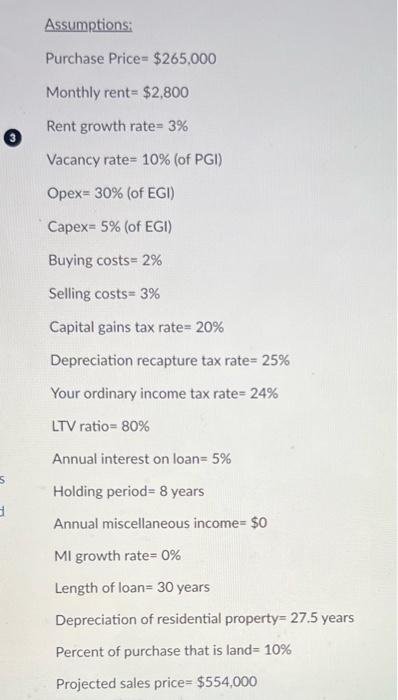

What if your buying and selling costs were increased. Assume new buying costs are 3% and selling costs are 5%. What is the new ATIRR? (After you answer the question correctly switch assumptions to the baseline assumptions). Enter as a number without % sign Question 6 1 pts What if tax rates were lowered. What is the new ATIRR when the new capital gains tax rate is 15% and the depreciation recapture is 20% ? (After you answer the question correctly switch assumptions to the baseline assumptions) Enter as a number without % sign Assumptions: Purchase Price =$265,000 Monthly rent =$2,800 Rent growth rate =3% Vacancy rate =10% (of PGI) Opex =30% (of EGI) Capex =5% (of EGI) Buying costs =2% Selling costs =3% Capital gains tax rate =20% Depreciation recapture tax rate =25% Your ordinary income tax rate =24% LTV ratio =80% Annual interest on loan =5% Holding period =8 years Annual miscellaneous income =$0 Ml growth rate =0% Length of loan=30 years Depreciation of residential property= 27.5 year Percent of purchase that is land =10% Projected sales price =$554,000 What if your buying and selling costs were increased. Assume new buying costs are 3% and selling costs are 5%. What is the new ATIRR? (After you answer the question correctly switch assumptions to the baseline assumptions). Enter as a number without % sign Question 6 1 pts What if tax rates were lowered. What is the new ATIRR when the new capital gains tax rate is 15% and the depreciation recapture is 20% ? (After you answer the question correctly switch assumptions to the baseline assumptions) Enter as a number without % sign Assumptions: Purchase Price =$265,000 Monthly rent =$2,800 Rent growth rate =3% Vacancy rate =10% (of PGI) Opex =30% (of EGI) Capex =5% (of EGI) Buying costs =2% Selling costs =3% Capital gains tax rate =20% Depreciation recapture tax rate =25% Your ordinary income tax rate =24% LTV ratio =80% Annual interest on loan =5% Holding period =8 years Annual miscellaneous income =$0 Ml growth rate =0% Length of loan=30 years Depreciation of residential property= 27.5 year Percent of purchase that is land =10% Projected sales price =$554,000