Question

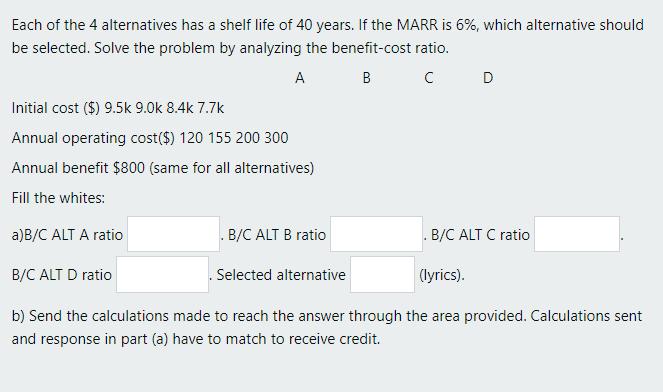

Each of the 4 alternatives has a shelf life of 40 years. If the MARR is 6%, which alternative should be selected. Solve the

Each of the 4 alternatives has a shelf life of 40 years. If the MARR is 6%, which alternative should be selected. Solve the problem by analyzing the benefit-cost ratio. A B C Initial cost ($) 9.5k 9.0k 8.4k 7.7k Annual operating cost ($) 120 155 200 300 Annual benefit $800 (same for all alternatives) Fill the whites: . B/C ALT B ratio a)B/C ALT A ratio B/C ALT D ratio (lyrics). b) Send the calculations made to reach the answer through the area provided. Calculations sent and response in part (a) have to match to receive credit. D Selected alternative . B/C ALT C ratio

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 2 WN 3 4 5 LO 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A B PVAF6 150463 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advertising and Promotion An Integrated Marketing Communications Perspective

Authors: George E Belch, Michael A Belch

11th Edition

1259548147, 978-1260152302

Students also viewed these Marketing questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App