Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is his deduction for each year and what goes on his 2019 tax return? 3. On March 5, 2017, Bill purchased a new Ford

what is his deduction for each year and what goes on his 2019 tax return?

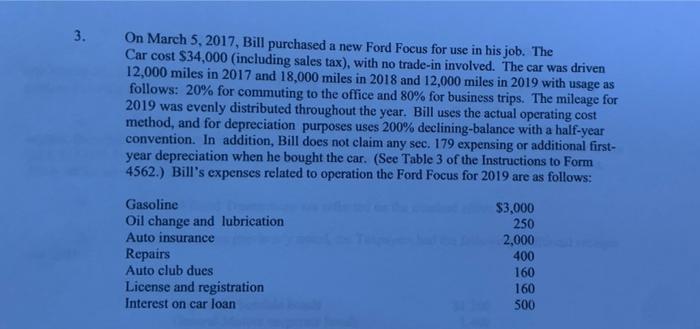

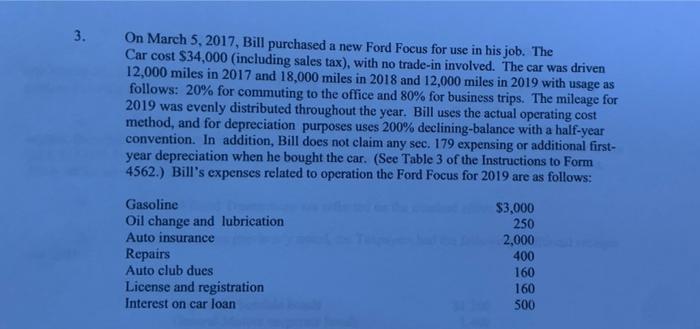

3. On March 5, 2017, Bill purchased a new Ford Focus for use in his job. The Car cost $34,000 (including sales tax), with no trade-in involved. The car was driven 12,000 miles in 2017 and 18,000 miles in 2018 and 12,000 miles in 2019 with usage as follows: 20% for commuting to the office and 80% for business trips. The mileage for 2019 was evenly distributed throughout the year. Bill uses the actual operating cost method, and for depreciation purposes uses 200% declining-balance with a half-year convention. In addition, Bill does not claim any sec. 179 expensing or additional first- year depreciation when he bought the car. (See Table 3 of the Instructions to Form 4562.) Bill's expenses related to operation the Ford Focus for 2019 are as follows: Gasoline $3,000 Oil change and lubrication 250 Auto insurance 2,000 Repairs 400 Auto club dues 160 License and registration 160 Interest on car loan 500 3. On March 5, 2017, Bill purchased a new Ford Focus for use in his job. The Car cost $34,000 (including sales tax), with no trade-in involved. The car was driven 12,000 miles in 2017 and 18,000 miles in 2018 and 12,000 miles in 2019 with usage as follows: 20% for commuting to the office and 80% for business trips. The mileage for 2019 was evenly distributed throughout the year. Bill uses the actual operating cost method, and for depreciation purposes uses 200% declining-balance with a half-year convention. In addition, Bill does not claim any sec. 179 expensing or additional first- year depreciation when he bought the car. (See Table 3 of the Instructions to Form 4562.) Bill's expenses related to operation the Ford Focus for 2019 are as follows: Gasoline $3,000 Oil change and lubrication 250 Auto insurance 2,000 Repairs 400 Auto club dues 160 License and registration 160 Interest on car loan 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started