Answered step by step

Verified Expert Solution

Question

1 Approved Answer

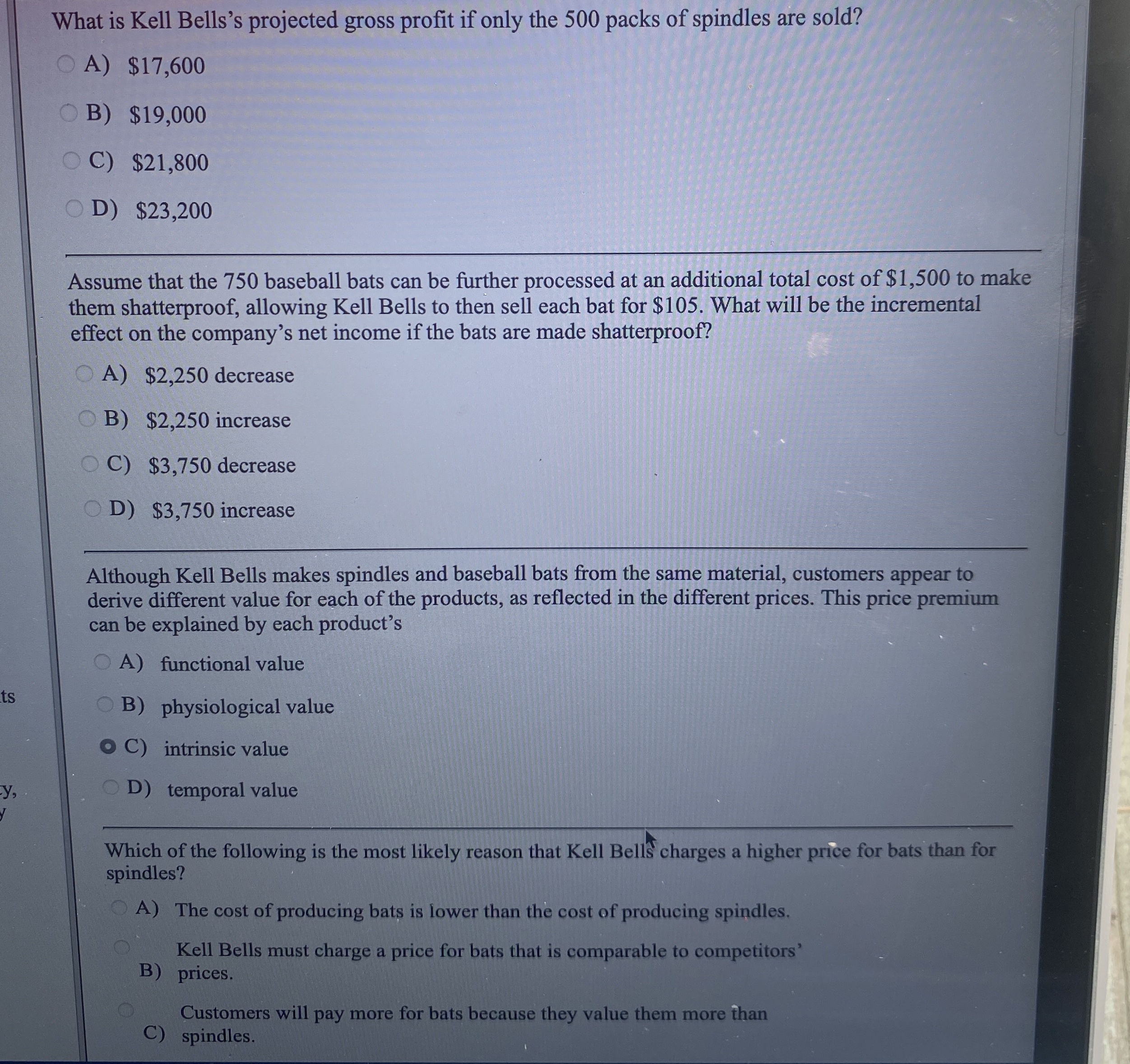

What is Kell Bells's projected gross profit if only the 5 0 0 packs of spindles are sold? A ) $ 1 7 , 6

What is Kell Bells's projected gross profit if only the packs of spindles are sold?

A $

B $

C $

D $

Assume that the baseball bats can be further processed at an additional total cost of $ to make them shatterproof, allowing Kell Bells to then sell each bat for $ What will be the incremental effect on the company's net income if the bats are made shatterproof?

A $ decrease

B $ increase

C $ decrease

D $ increase

Although Kell Bells makes spindles and baseball bats from the same material, customers appear to derive different value for each of the products, as reflected in the different prices. This price premium can be explained by each product's

A functional value

B physiological value

C intrinsic value

D temporal value

Which of the following is the most likely reason that Kell Bells charges a higher price for bats than for spindles?

A The cost of producing bats is lower than the cost of producing spindles.

Kell Bells must charge a price for bats that is comparable to competitors'

B prices.

Customers will pay more for bats because they value them more than

C spindles.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started