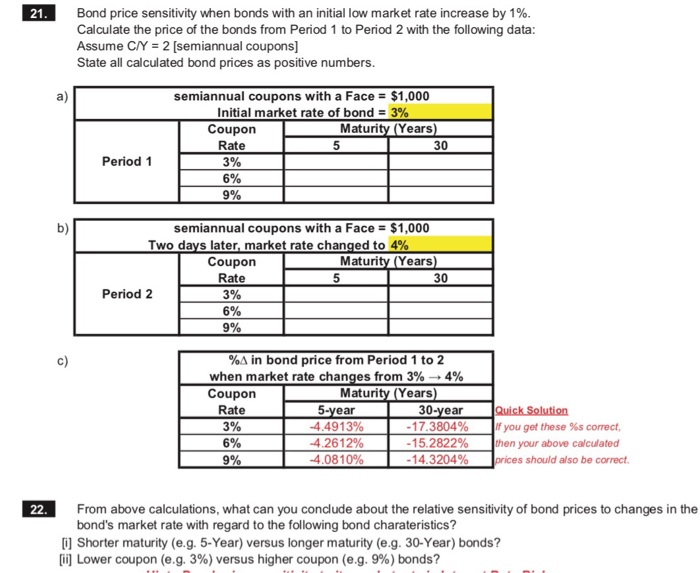

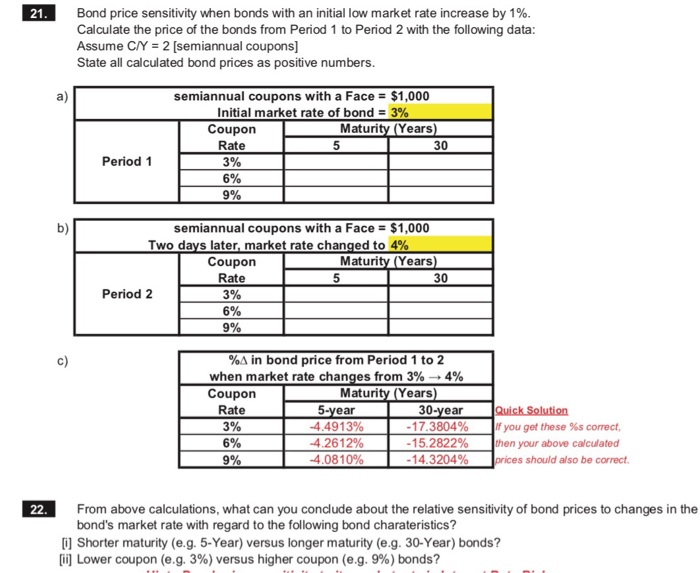

Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can conveniently input integral number of periods in our financi al calculator or spreadsheet. What if the transaction date of falls on a date in-between two coupon dates? There will be complications: - Fractional periods "w' will be needed to calculate the price (NPV) of the bond. -The seller and the buyer will own complementary fractional value of the next coupon. Consider the following bond: - Bond issued on 1/1/2015. - 20-year maturity, face value $1000, coupon rate 8%, semi-annual coupons. - Bond transacted on 9/1/2020 at a bond market rate of 10% -Use 30/360 day count convention. a) Draw a timeline of the bond's cash flow and label it with the following dates: issued, previous coupon [P), transaction, next coupon [N], maturity Bond price sensitivity when bonds with an initial low market rate increase by 1 % Calculate the price of the bonds from Period 1 to Period 2 with the following data: Assume CY 2 [semiannual coupons] State all calculated bond prices as positive numbers. 21 semiannual coupons with a Face = $1,000 ) Initial market rate of bond = 3% Coupon Rate Maturity (Years) 5 30 Period 1 3% 6% 9% semiannual coupons with a Face = $1,000 Two days later, market rate changed to 4% Maturity (Years) b) Coupon Rate 5 30 Period 2 3% 6% 9% %A in bond price from Period 1 to 2 when market rate changes from 3% 4% c) Maturity (Years) 30-year -17.3804% Coupon Rate Quick Solution If you get these %s correct, then your above calcula ted prices should also be correct 5-year 4.4913% 4.2612% 3% 6% 15.2822% 9% 4.0810% -14.3204% 22 From above calculations, what can you conclude about the relative sensitivity of bond prices to changes in the bond's market rate with regard to the following bond charateristics? (] Shorter maturity (e.g. 5-Year) versus longer maturity (e.g. 30-Year) bonds? i] Lower coupon (e.g. 3%) versus higher coupon (e.g. 9%) bonds? Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can conveniently input integral number of periods in our financi al calculator or spreadsheet. What if the transaction date of falls on a date in-between two coupon dates? There will be complications: - Fractional periods "w' will be needed to calculate the price (NPV) of the bond. -The seller and the buyer will own complementary fractional value of the next coupon. Consider the following bond: - Bond issued on 1/1/2015. - 20-year maturity, face value $1000, coupon rate 8%, semi-annual coupons. - Bond transacted on 9/1/2020 at a bond market rate of 10% -Use 30/360 day count convention. a) Draw a timeline of the bond's cash flow and label it with the following dates: issued, previous coupon [P), transaction, next coupon [N], maturity Bond price sensitivity when bonds with an initial low market rate increase by 1 % Calculate the price of the bonds from Period 1 to Period 2 with the following data: Assume CY 2 [semiannual coupons] State all calculated bond prices as positive numbers. 21 semiannual coupons with a Face = $1,000 ) Initial market rate of bond = 3% Coupon Rate Maturity (Years) 5 30 Period 1 3% 6% 9% semiannual coupons with a Face = $1,000 Two days later, market rate changed to 4% Maturity (Years) b) Coupon Rate 5 30 Period 2 3% 6% 9% %A in bond price from Period 1 to 2 when market rate changes from 3% 4% c) Maturity (Years) 30-year -17.3804% Coupon Rate Quick Solution If you get these %s correct, then your above calcula ted prices should also be correct 5-year 4.4913% 4.2612% 3% 6% 15.2822% 9% 4.0810% -14.3204% 22 From above calculations, what can you conclude about the relative sensitivity of bond prices to changes in the bond's market rate with regard to the following bond charateristics? (] Shorter maturity (e.g. 5-Year) versus longer maturity (e.g. 30-Year) bonds? i] Lower coupon (e.g. 3%) versus higher coupon (e.g. 9%) bonds