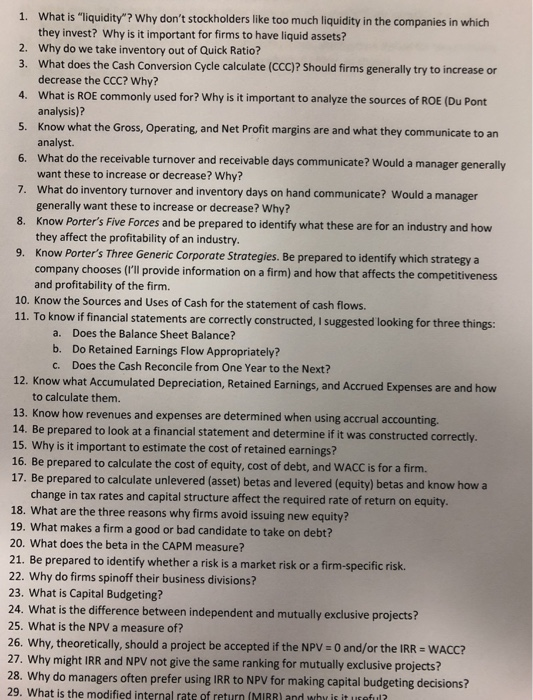

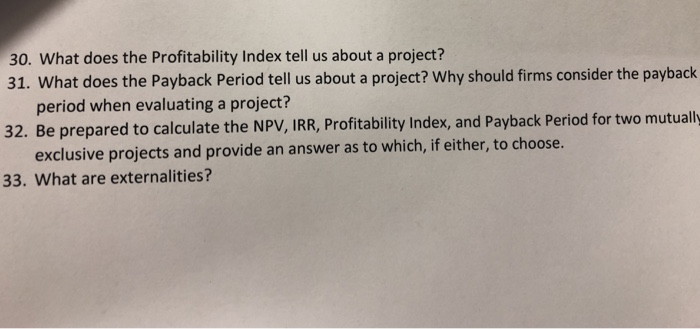

What is "liquidity"? Why don't stockholders like too much liquidity in the companies in which they invest? Why is it important for firms to have liquid assets? Why do we take inventory out of Quick Ratio? What does the Cash Conversion Cycle calculate (CCC)? Should firms generally try to increase or decrease the CCC? Why? 1. 2. 3. 4. What is ROE commonly used for? Why is it important to analyze the sources of ROE (Du Pont 5. Know what the Gross, Operating, and Net Profit margins are and what they communicate to an 6. What do the receivable tur 7. What do inventory turnover and inventory days on hand communicate? Would a manager 8. Know Porter's Five Forces and be prepared to identify what these are for an industry and how 9. Know Porter's Three Generic Corporate Strategies. Be prepared to identify which strategy a analysis)? analyst want these to increase or decrease? Why? generally want these to increase or decrease? Why? they affect the profitability of an industry. nover and receivable days communicate? Would a manager generally company chooses (I'll provide information on a firm) and how that affects the competitiveness and profitability of the firm. 10. Know the Sources and Uses of Cash for the statement of cash flows 11. To know if financial statements are correctly constructed, I suggested looking for three things: a. b. c. Does the Balance Sheet Balance? Do Retained Earnings Flow Appropriately? Does the Cash Reconcile from One Year to the Next? 12. Know what Accumulated Depreciation, Retained Earnings, and Accrued Expenses are and how to calculate them. 13. Know how revenues and expenses are determined when using accrual accountin 14. Be prepared to look at a financial statement and determine if it was constructed correctly 15. Why is it important to estimate the cost of retained earnings? 16. Be prepared to calculate the cost of equity, cost of debt, and WACC is for a firm. 17. Be prepared to calculate unlevered (asset) betas and levered (equity) betas and know how a change in tax rates and capital structure affect the required rate of return on equity 18. What are the three reasons why firms avoid issuing new equity? 19. What makes a firm a good or bad candidate to take on debt? 20. What does the beta in the CAPM measure? 21. Be prepared to identify whether a risk is a market risk or a firm-specific risk 22. Why do firms spinoff their business divisions? 23. What is Capital Budgeting? 24. What is the difference between independent and mutually exclusive projects? 25. What is the NPV a measure of? 26. Why, theoretically, should a project be accepted if the NPV- 0 and/or the IRR- WACC? 27. Why might IRR and NPV not give the same ranking for mutually exclusive projects? 28. Why do managers often prefer using IRR to NPV for making capital budgeting decisions? 29. What is the modified internal rate of return (MIRRI and why is it ureful? 30. What does the Profitability Index tell us about a project? 31. What does the Payback Period tell us about a project? Why should firms consider the paybadk period when evaluating a project? 32. Be prepared to calculate the NPV, IRR, Profitability Index, and Payback Period for two mutuls exclusive projects and provide an answer as to which, if either, to choose. 33. What are externalities