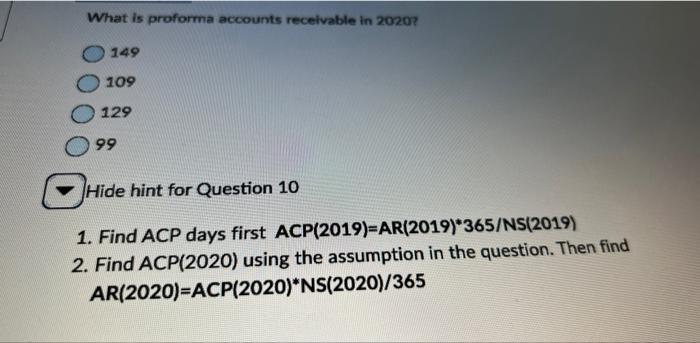

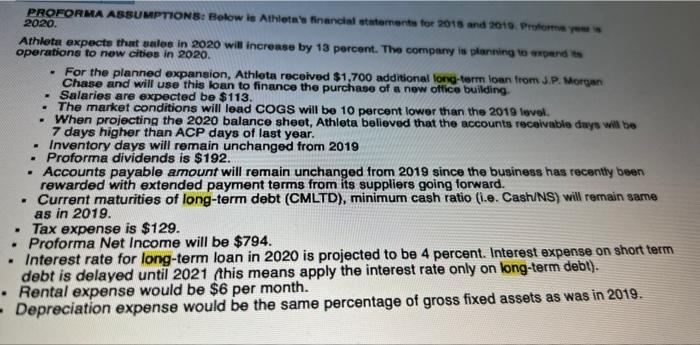

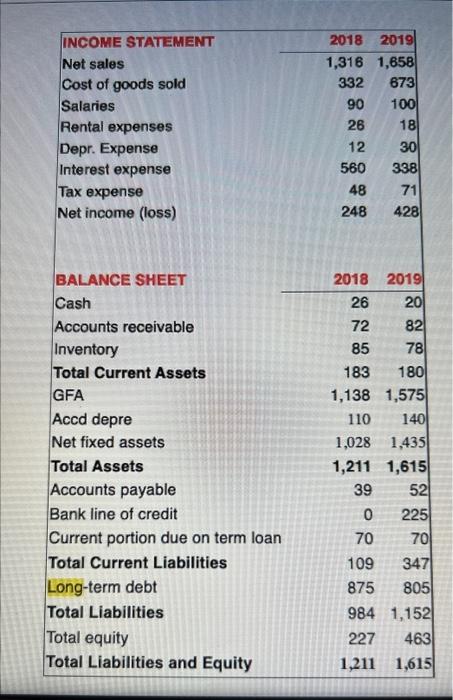

What is proforma accounts receivable in 2020 ? 149 109 129 99 Hide hint for Question 10 1. Find ACP days first ACP(2019)=AR(2019)365/NS(2019) 2. Find ACP(2020) using the assumption in the question. Then find AR(2020)=ACP(2020)NS(2020)/365 PROFOAMA ASBUMPTIONB: Bolow is Athilete' financial statemente for 2018 and 2019 . Proforten ywer is 2020. Athleta expects that uales in 2020 wie increase by 13 percent. The company is plarnieva to axpend ts operatione to new cities in 2020 . - For the planned expansion, Athlota recelved \$1,700 additional lond-term loan from S.P. Morgan Chase and will use this loan to finance the purchase of a new oftice building. - Salaries are expected be $113. - The market conditions will lead COGS will be 10 percent lower than the 2019 level - When projecting the 2020 balance sheet, Athleta believed that the accounts receivable days wil be 7 days higher than ACP days of last year. - Inventory days will remain unchanged from 2019 - Proforma dividends is $192. - Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward. - Current maturities of long-term debt (CMLTD), minimum cash ratio (i.e. Cash/NS) will remain same as in 2019. - Tax expense is $129. - Proforma Net Income will be $794. - Interest rate for long-term loan in 2020 is projected to be 4 percent. Interest expense on short term debt is delayed until 2021 (this means apply the interest rate only on long-term debl). - Rental expense would be $6 per month. Depreciation expense would be the same percentage of gross fixed assets as was in 2019. \begin{tabular}{|lrr|} \hline INCOME STATEMENT & 2018 & 2019 \\ \hline Net sales & 1,316 & 1,658 \\ Cost of goods sold & 332 & 673 \\ Salaries & 90 & 100 \\ Rental expenses & 26 & 18 \\ Depr. Expense & 12 & 30 \\ Interest expense & 560 & 338 \\ Tax expense & 48 & 71 \\ Net income (loss) & 248 & 428 \\ \hline Total & & \\ \hline BALANCE SHEET & & \\ \hline Cash & 2018 & 2019 \\ \hline Accounts receivable & 26 & 20 \\ Inventory & 72 & 82 \\ Total Current Assets & 85 & 78 \\ GFA & 183 & 180 \\ Accd depre & 1,138 & 1,575 \\ Net fixed assets & 110 & 140 \\ Total Assets & 1,028 & 1,435 \\ Accounts payable & 1,211 & 1,615 \\ Bank line of credit & 39 & 52 \\ Current portion due on term loan & 0 & 225 \\ Total Current Liabilities & 70 & 70 \\ Long-term debt & 109 & 347 \\ Total Liabilities & 875 & 805 \\ \hline \end{tabular}