Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is Sally's gross annual retirement income need (from all income sources) in TODAY's dollars at the beginning of her first year in retirement? What

What is Sally's gross annual retirement income need (from all income sources) in TODAY's dollars at the beginning of her first year in retirement?

What is Sally's net annual retirement income need (from her investment portfolio) in TODAY's dollars at the beginning of her first year in retirement?

What is Sally's net annual retirement income need (from her investment portfolio) in FUTURE dollars at the beginning of her first year in retirement?

What is the investment capital needed at retirement to cover Sally's retirement lifestyle AND financial legacy goal (round PMT to 2 decimal points)?

If Sally expected to receive a $250,000 inheritance from her grandmother today, how much would she need to save annually to meet her retirement goals, assuming she fully invested the inheritance immediately upon receipt?

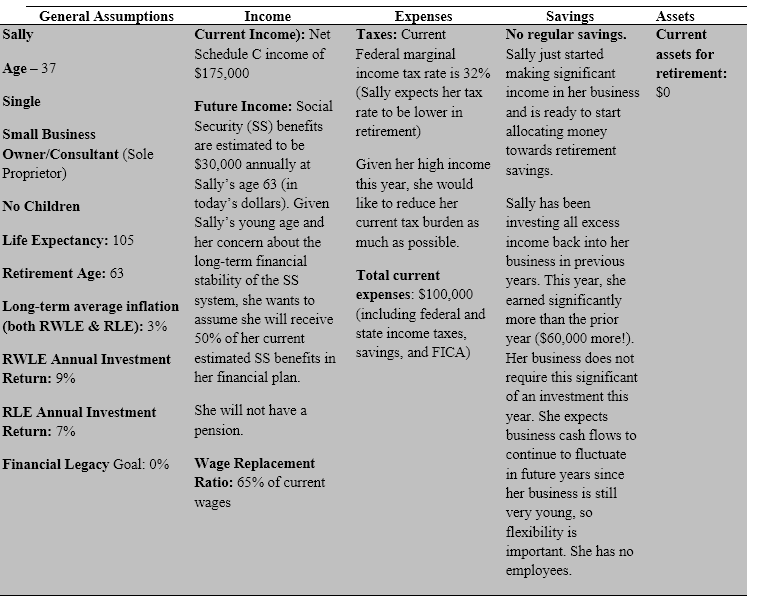

General Assumptions Sally Age-37 Single Small Business Owner/Consultant (Sole Proprietor) No Children Life Expectancy: 105 Retirement Age: 63 Long-term average inflation (both RWLE & RLE): 3% RWLE Annual Investment Return: 9% RLE Annual Investment Return: 7% Financial Legacy Goal: 0% Income Current Income): Net Schedule C income of $175,000 Future Income: Social Security (SS) benefits are estimated to be $30,000 annually at Sally's age 63 (in today's dollars). Given Sally's young age and her concern about the long-term financial stability of the SS system, she wants to assume she will receive 50% of her current estimated SS benefits in her financial plan. She will not have a pension. Wage Replacement Ratio: 65% of current wages Expenses Taxes: Current Federal marginal income tax rate is 32% (Sally expects her tax rate to be lower in retirement) Given her high income this year, she would like to reduce her current tax burden as much as possible. Total current expenses: $100,000 (including federal and state income taxes, savings, and FICA) Savings No regular savings. Sally just started making significant income in her business and is ready to start allocating money towards retirement savings. Sally has been investing all excess income back into her business in previous years. This year, she earned significantly more than the prior year ($60,000 more!). Her business does not require this significant of an investment this year. She expects business cash flows to continue to fluctuate in future years since her business is still very young, so flexibility is important. She has no employees. Assets Current assets for retirement: $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started