What is the accumulated depreciation for equipment ID # 1876 after it was sold for $42,000 on April 1, 2022?

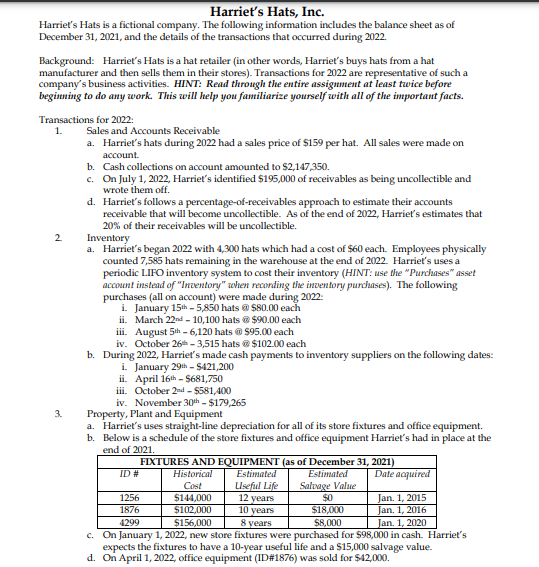

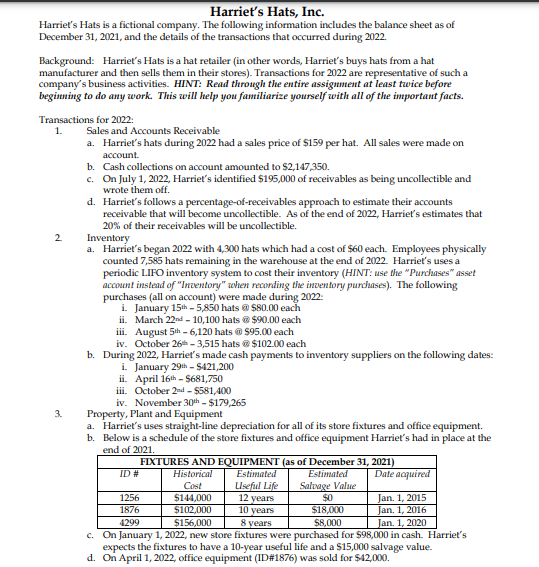

Harriet's Hats, Inc. Harriet's Hats is a fictional company. The following information includes the balance sheet as of December 31, 2021, and the details of the transactions that occurred during 2022 . Background: Harriet's Hats is a hat retailer (in other words, Harriet's buys hats from a hat manufacturer and then sells them in their stores). Transactions for 2022 are representative of such a company's business activities. HINT: Read through the entire assigument at least twice before beginning to do any work. This will help you familiarize yourself with all of the important facts. Transactions for 2022 1. Sales and Accounts Receivable a. Harriet's hats during 2022 had a sales price of $159 per hat. All sales were made on account. b. Cash collections on account amounted to $2,147,350. c. On July 1, 2022, Harriet's identified $195,000 of receivables as being uncollectible and wrote them off. d. Harriet's follows a percentage-of-receivables approach to estimate their accounts receivable that will become uncollectible. As of the end of 2022 , Harriet's estimates that 20% of their receivables will be uncollectible. 2. Inventory a. Harriet's began 2022 with 4,300 hats which had a cost of $60 each. Employees physically counted 7,585 hats remaining in the warehouse at the end of 2022. Harriet's uses a periodic LIFO inventory system to cost their inventory (HINT: use the "Purchases" asset account instend of "Inventory" when reconding the inventory purchases). The following purchases (all on account) were made during 2022: i. January 15th5,850 hats $80.00 each ii. March 22nd10,100 hats $90.00 each iii. August 5th6,120 hats it $95.00 each iv. October 26th3,515 hats \& $102.00 each b. During 2022, Harriet's made cash payments to inventory suppliers on the following dates: i. January 29th$421,200 ii. April 16th$681,750 iii. October 2 -ad $581,400 iv. November 30th$179,265 3. Property, Plant and Equipment a. Harriet's uses straight-line depreciation for all of its store fixtures and office equipment. b. Below is a schedule of the store fixtures and office equipment Harriet's had in place at the end of 2021. c. On January 1, 2022, new store fixtures were purchased for $98,000 in cash. Harriet's expects the fixtures to have a 10-year useful life and a $15,000 salvage value. d. On April 1, 2022, office equipment (ID#1876) was sold for $42,000