what is the answer for exercise 3.6

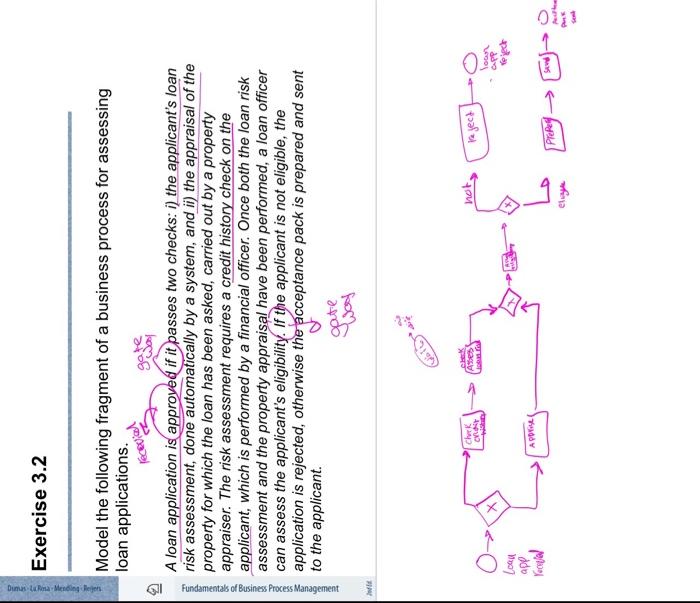

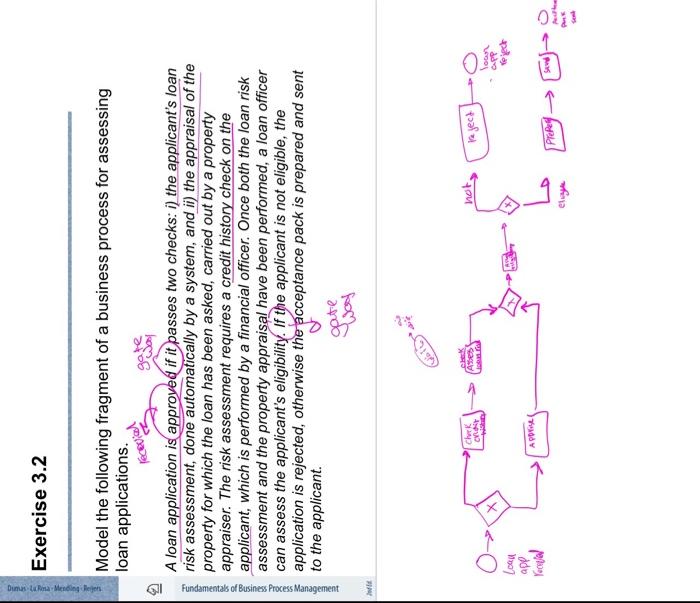

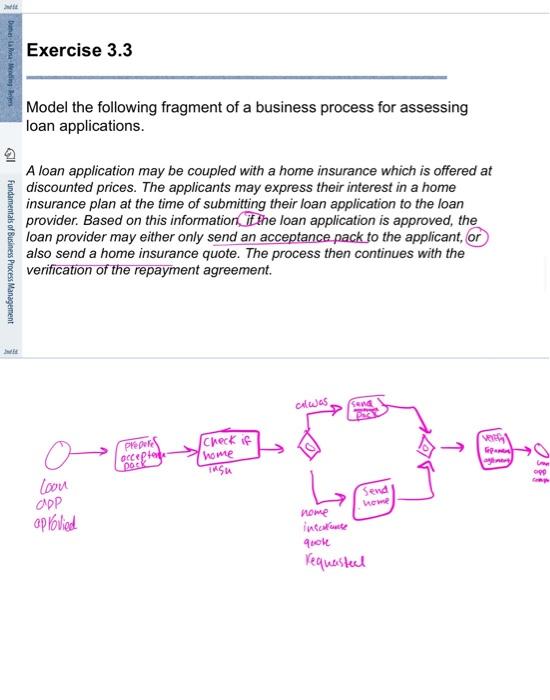

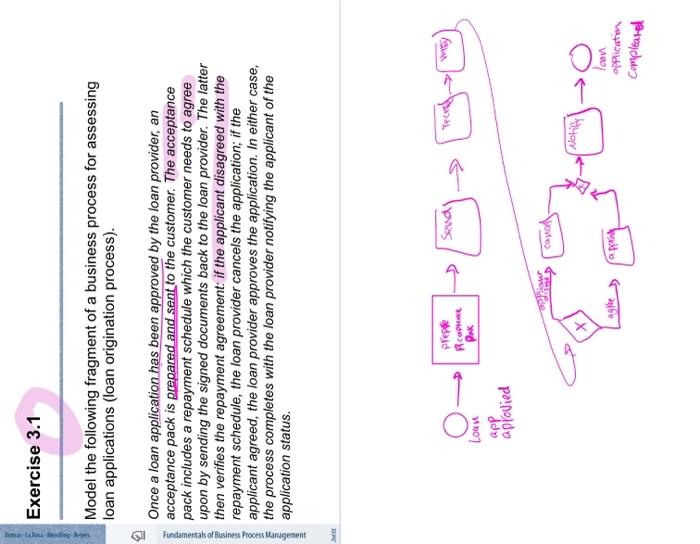

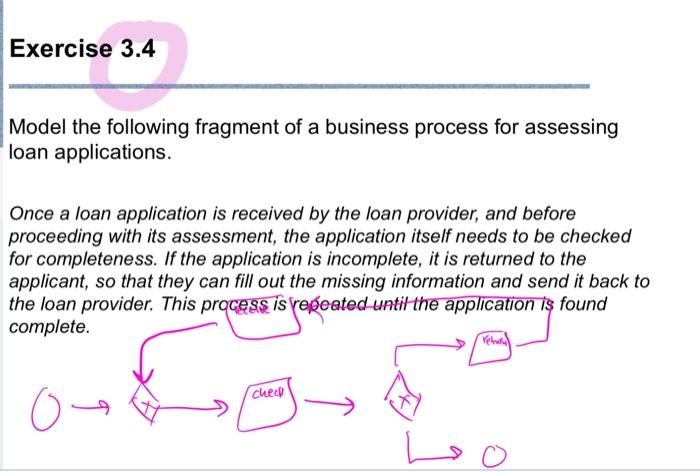

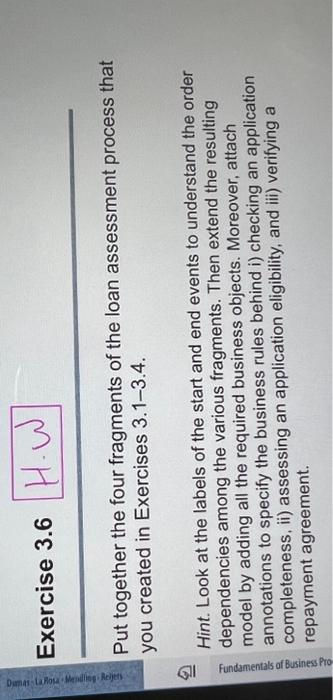

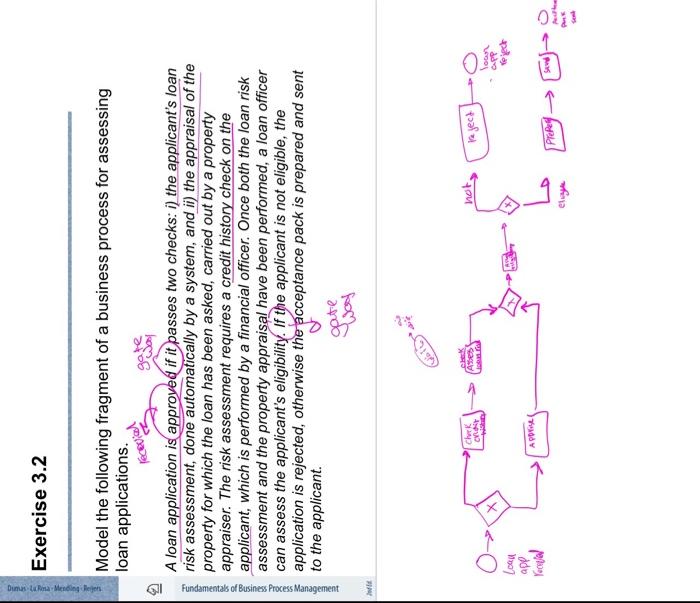

Model the following fragment of a business process for assessing loan applications (loan origination process). Once a loan application has been approved by the loan provider, an acceptance pack is prepared and sent to the customer. The acceptance pack includes a repayment schedule which the customer needs to agree upon by sending the signed documents back to the loan provider. The latter then verifies the repayment agreement: if the applicant disagreed with the repayment schedule, the loan provider cancels the application; if the applicant agreed, the loan provider approves the application. In either case, the process completes with the loan provider notifying the applicant of the application status. Model the following fragment of a business process for assessing loan applications. A loan application may be coupled with a home insurance which is offered at discounted prices. The applicants may express their interest in a home insurance plan at the time of submitting their loan application to the loan provider. Based on this information, it the loan application is approved, the loan provider may either only send an acceptance pack to the applicant, or also send a home insurance quote. The process then continues with the verification of the repayment agreement. Model the following fragment of a business process for assessing loan applications. Once a loan application is received by the loan provider, and before proceeding with its assessment, the application itself needs to be checked for completeness. If the application is incomplete, it is returned to the applicant, so that they can fill out the missing information and send it back to the loan provider. This prqcesss is rejeated untit the application is found Exercise 3.6 Put together the four fragments of the loan assessment process that you created in Exercises 3.1-3.4. Hint. Look at the labels of the start and end events to understand the order dependencies among the various fragments. Then extend the resulting model by adding all the required business objects. Moreover, attach annotations to specify the business rules behind i) checking an application completeness, ii) assessing an application eligibility, and iii) verifying a repayment agreement. Exercise 3.2 Model the following fragment of a business process for assessing Ioan applications. A loan application is approye if it passes two checks: i) the applicant's loan risk assessment, done automatically by a system, and ii) the appraisal of the property for which the loan has been asked, carried out by a property appraiser. The risk assessment requires a credit history check on the applicant, which is performed by a financial officer. Once both the loan risk assessment and the property appraisal have been performed, a loan officer can assess the applicant's eligibility. If the applicant is not eligible, the application is rejected, otherwise the acceptance pack is prepared and sent to the applicant. gate Model the following fragment of a business process for assessing loan applications (loan origination process). Once a loan application has been approved by the loan provider, an acceptance pack is prepared and sent to the customer. The acceptance pack includes a repayment schedule which the customer needs to agree upon by sending the signed documents back to the loan provider. The latter then verifies the repayment agreement: if the applicant disagreed with the repayment schedule, the loan provider cancels the application; if the applicant agreed, the loan provider approves the application. In either case, the process completes with the loan provider notifying the applicant of the application status. Model the following fragment of a business process for assessing loan applications. A loan application may be coupled with a home insurance which is offered at discounted prices. The applicants may express their interest in a home insurance plan at the time of submitting their loan application to the loan provider. Based on this information, it the loan application is approved, the loan provider may either only send an acceptance pack to the applicant, or also send a home insurance quote. The process then continues with the verification of the repayment agreement. Model the following fragment of a business process for assessing loan applications. Once a loan application is received by the loan provider, and before proceeding with its assessment, the application itself needs to be checked for completeness. If the application is incomplete, it is returned to the applicant, so that they can fill out the missing information and send it back to the loan provider. This prqcesss is rejeated untit the application is found Exercise 3.6 Put together the four fragments of the loan assessment process that you created in Exercises 3.1-3.4. Hint. Look at the labels of the start and end events to understand the order dependencies among the various fragments. Then extend the resulting model by adding all the required business objects. Moreover, attach annotations to specify the business rules behind i) checking an application completeness, ii) assessing an application eligibility, and iii) verifying a repayment agreement. Exercise 3.2 Model the following fragment of a business process for assessing Ioan applications. A loan application is approye if it passes two checks: i) the applicant's loan risk assessment, done automatically by a system, and ii) the appraisal of the property for which the loan has been asked, carried out by a property appraiser. The risk assessment requires a credit history check on the applicant, which is performed by a financial officer. Once both the loan risk assessment and the property appraisal have been performed, a loan officer can assess the applicant's eligibility. If the applicant is not eligible, the application is rejected, otherwise the acceptance pack is prepared and sent to the applicant. gate