Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the answer for this question? Income Statement for the Year Ended on December 31 (Millions of dollars) Based on the information given to

what is the answer for this question?

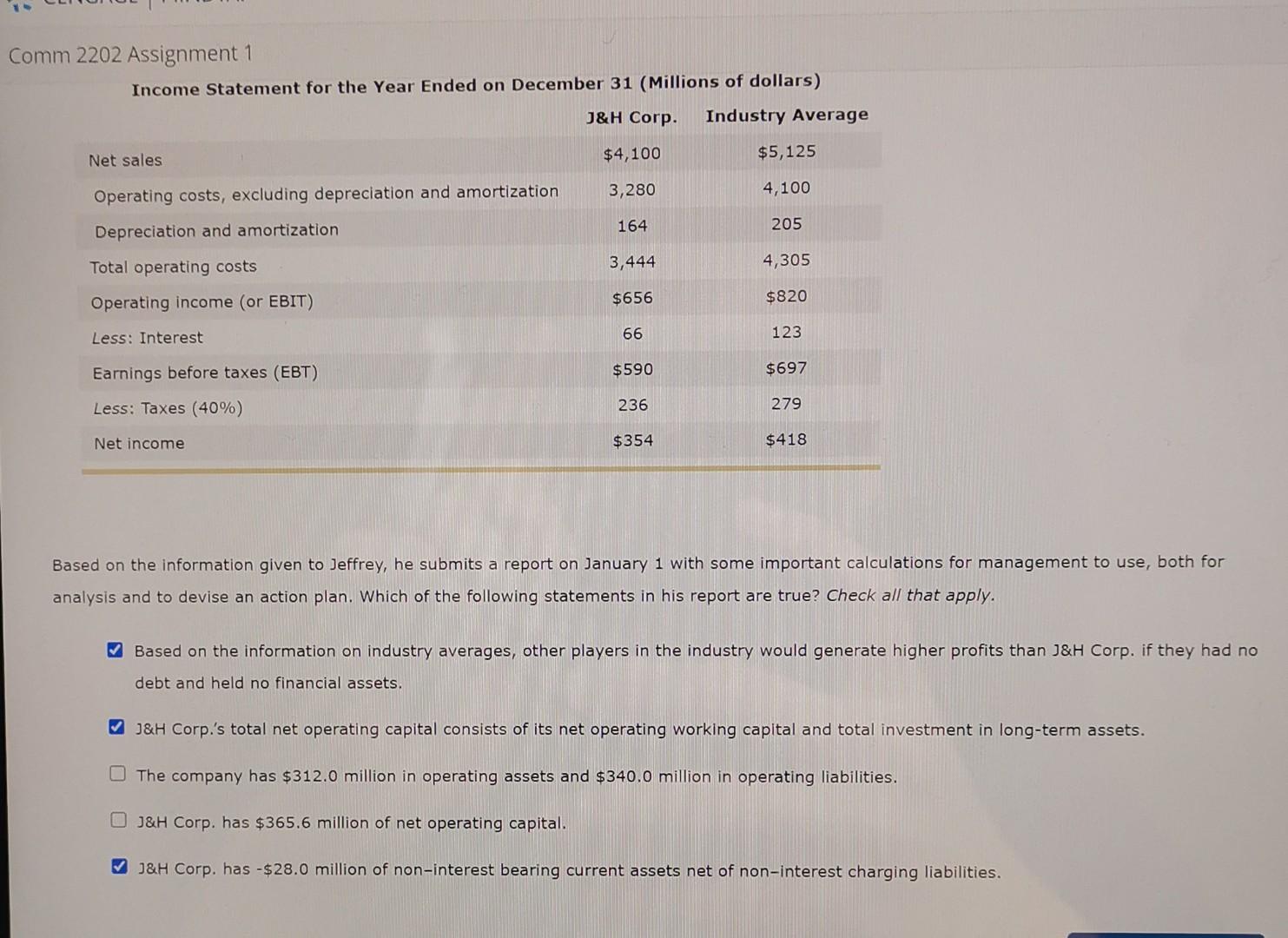

Income Statement for the Year Ended on December 31 (Millions of dollars) Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply. Based on the information on industry averages, other players in the industry would generate higher profits than J\&H Corp. if they had no debt and held no financial assets. J\&H Corp.'s total net operating capital consists of its net operating working capital and total investment in long-term assets. The company has $312.0 million in operating assets and $340.0 million in operating liabilities. J\&H Corp. has $365.6 million of net operating capital. J\&H Corp. has - $28.0 million of non-interest bearing current assets net of non-interest charging liabilities. Income Statement for the Year Ended on December 31 (Millions of dollars) Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply. Based on the information on industry averages, other players in the industry would generate higher profits than J\&H Corp. if they had no debt and held no financial assets. J\&H Corp.'s total net operating capital consists of its net operating working capital and total investment in long-term assets. The company has $312.0 million in operating assets and $340.0 million in operating liabilities. J\&H Corp. has $365.6 million of net operating capital. J\&H Corp. has - $28.0 million of non-interest bearing current assets net of non-interest charging liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started