What is the average number of days that Shermin, Inc., took to collect its receivables in 20X2?

a) 10.07

b) 8.23

c) 6.48

d) 54.19

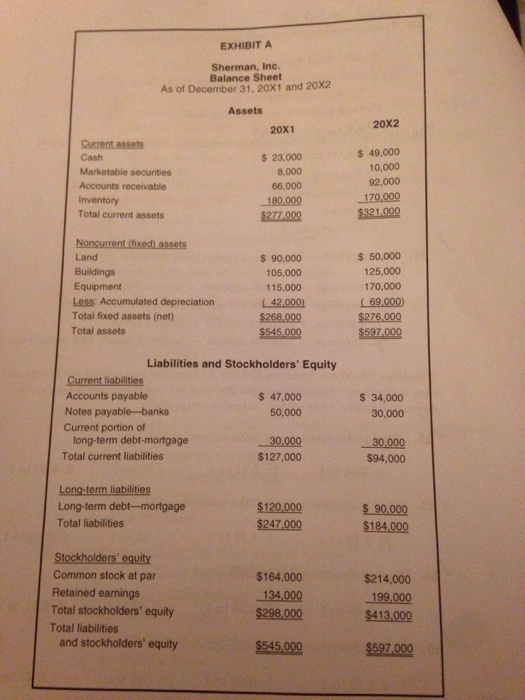

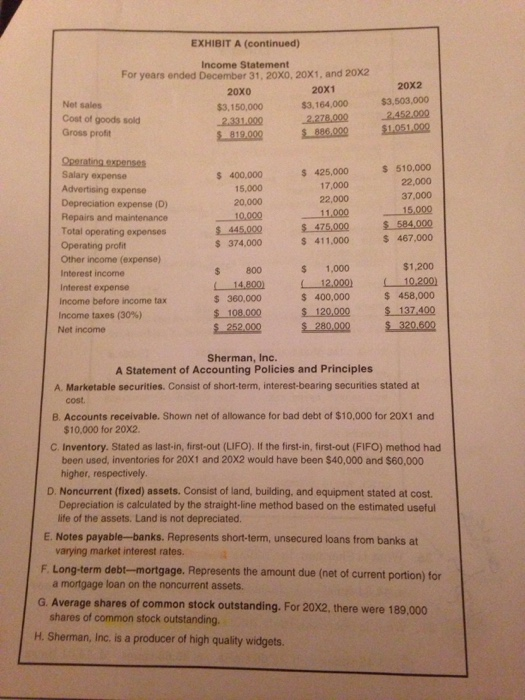

EXHIBIT A Sherman, Inc. Balance Sheet As of December 31, 20X1 and 20X2 Assets 20X1 20X2 $ 49,000 10,000 Current assets Cash Marketable securities Accounts receivable Inventory Total current assets $ 23,000 8,000 66.000 180.000 $277.000 92,000 170,000 $321.000 Noncurrent (fixed) assets Land Buildings Equipment Less: Accumulated depreciation Total fixed assets (net) Total assets $ 90,000 105,000 115,000 42,000) $268,000 $545,000 $ 50,000 125.000 170.000 (69.000) $276.000 $597.000 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 47,000 Notes payable-banks 50,000 Current portion of long-term debt-mortgage 30,000 Total current liabilities $127,000 $ 34,000 30,000 30,000 $94.000 Long-term liabilities Long-term debt-mortgage Total liabilities $120,000 $247,000 $ 90,000 $184.000 Stockholders' equity Common stock at par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $164,000 134.000 $298.000 $214,000 199,000 $413,000 $545,000 $597.000 EXHIBIT A (continued) Income Statement For years ended December 31, 20X0, 20X1, and 20X2 20x0 20x1 Net sales $3,150,000 $3,164,000 Cost of goods sold 2.331.000 2.278,000 Gross profit $819.000 $ 886,000 20X2 $3,500,000 2.452.000 $1.051.000 Operating expenses Salary expense Advertising expense Depreciation expense (D) Repairs and maintenance Total operating expenses Operating profit Other income (expense) Interest income Interest expense Income before income tax Income taxes (30%) Net income $ 400,000 15.000 20,000 10.000 $445.000 $ 374,000 $425,000 17,000 22,000 11.000 $475,000 $ 411.000 $ 510,000 22,000 37,000 15.000 $ 584.000 $ 467.000 800 $ 14.800) $360,000 $ 108.000 $ 252.000 $ 1,000 12.000) $ 400,000 $ 120,000 $ 280,000 $1,200 10.200) $ 458,000 $ 137.400 $_320.600 Sherman, Inc. A Statement of Accounting Policies and Principles A. Marketable securities. Consist of short-term interest-bearing securities stated at cost. B. Accounts receivable. Shown net of allowance for bad debt of $10,000 for 20X1 and $10,000 for 20X2 C. Inventory. Stated as last-in, first-out (LIFO). If the first-in, first-out (FIFO) method had been used, inventories for 20X1 and 20X2 would have been $40,000 and $60,000 higher, respectively. D. Noncurrent (fixed) assets. Consist of land, building, and equipment stated at cost. Depreciation is calculated by the straight-line method based on the estimated useful life of the assets. Land is not depreciated. E. Notes payable-banks. Represents short-term, unsecured loans from banks at varying market interest rates. F. Long-term debt-mortgage. Represents the amount due (net of current portion) for a mortgage loan on the noncurrent assets. G. Average shares of common stock outstanding. For 20X2, there were 189,000 shares of common stock outstanding. H. Sherman, Inc. is a producer of high quality widgets