Question

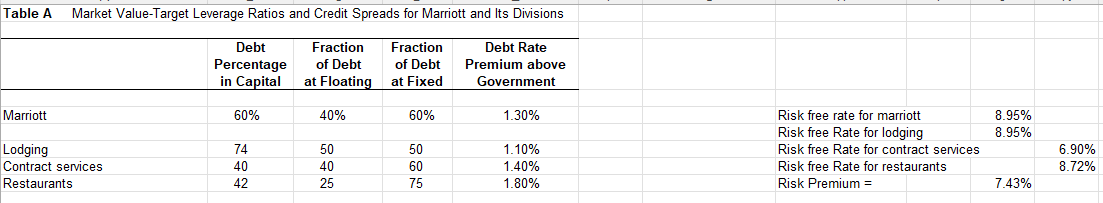

WHAT IS THE COST OF DEBT, COST OF EQUITY, AND WACC OF MARRIOTT Debt Percentage in Capital Table A Market Value-Target Leverage Ratios and Credit

WHAT IS THE COST OF DEBT, COST OF EQUITY, AND WACC OF MARRIOTT

Debt Percentage in Capital Table A Market Value-Target Leverage Ratios and Credit Spreads for Marriott and Its Divisions Debt Rate Premium above Government Fraction of Debt at Floating Fraction of Debt at Fixed Marriott 60% 40% 60% 1.30% Risk free rate for marriott 8.95% Risk free Rate for lodging 8.95% Lodging 74 50 50 1.10% Risk free Rate for contract services 6.90% Contract services 40 40 60 1.40% Risk free Rate for restaurants 8.72% Restaurants 42 25 75 1.80% Risk Premium = 7.43%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F Brigham, Phillip R Daves

14th Edition

0357516664, 978-0357516669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App