WHAT IS THE COST OF EQUITY!! (rs)

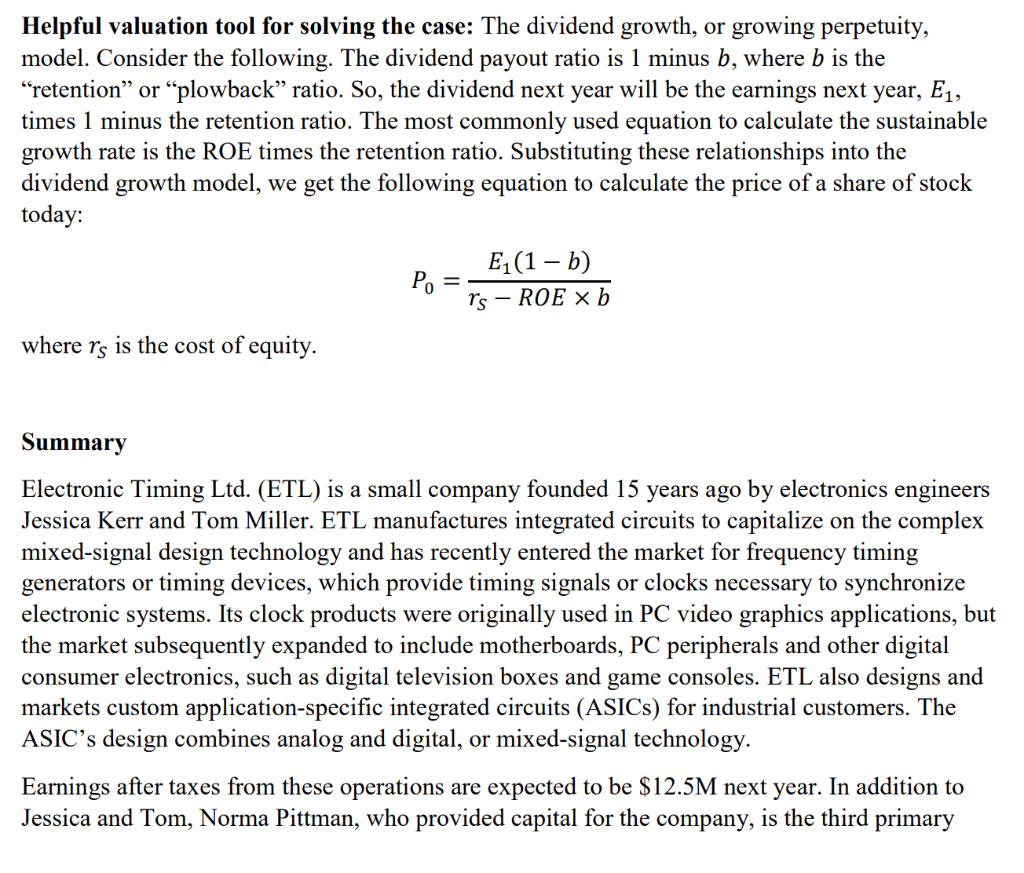

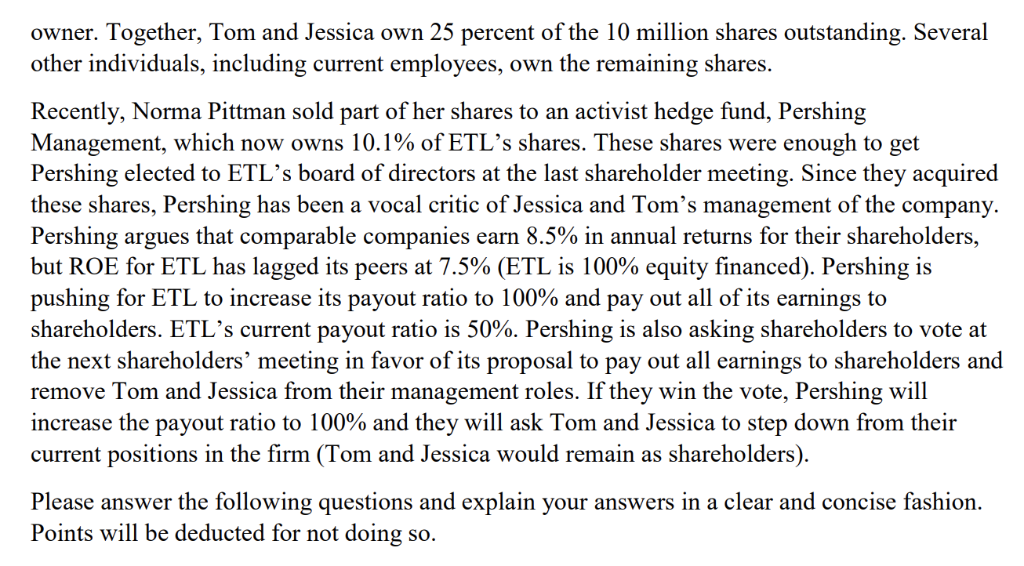

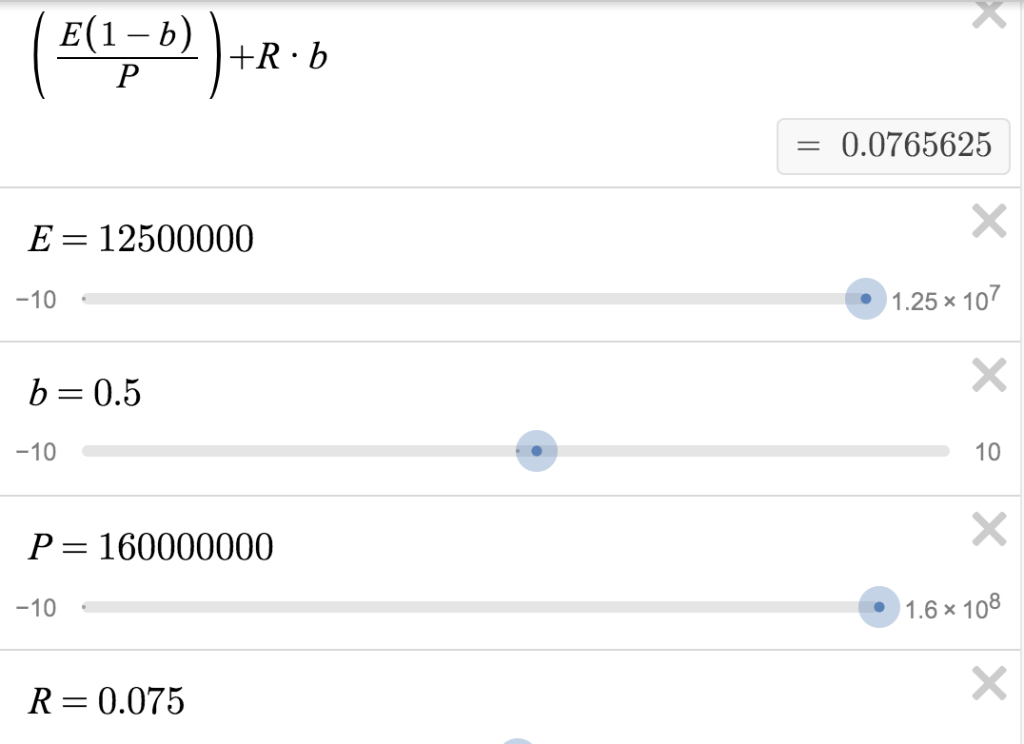

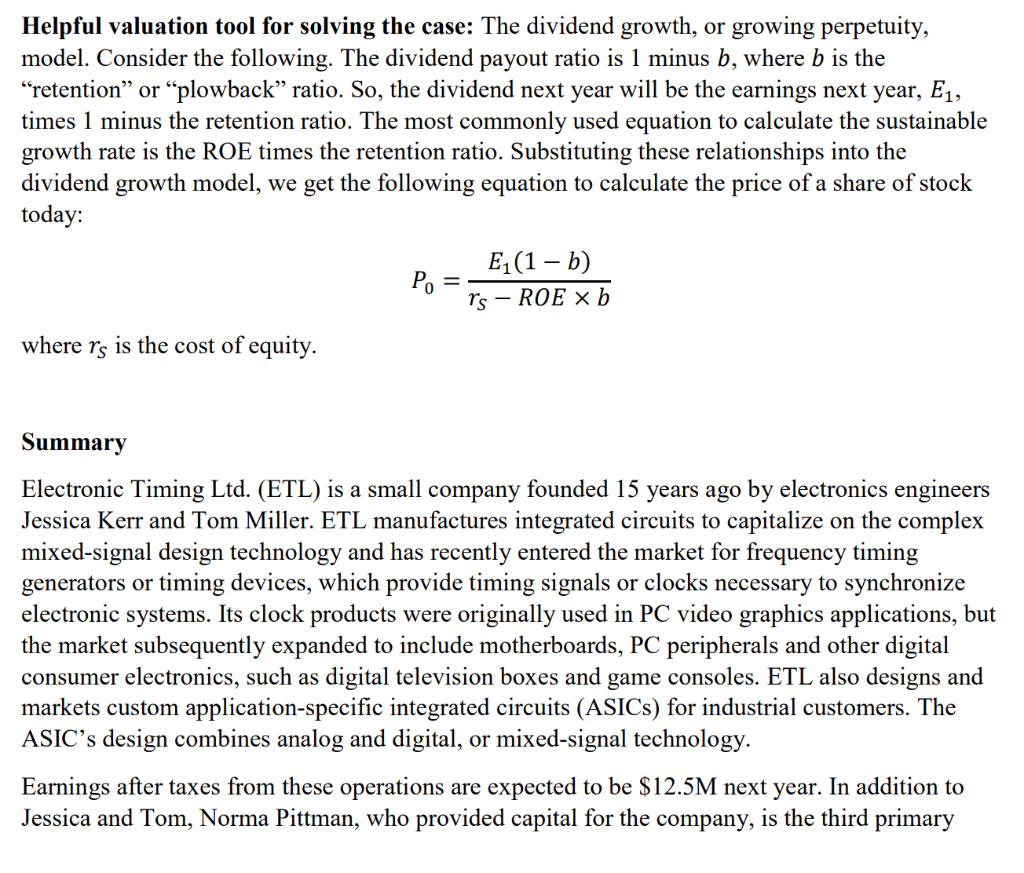

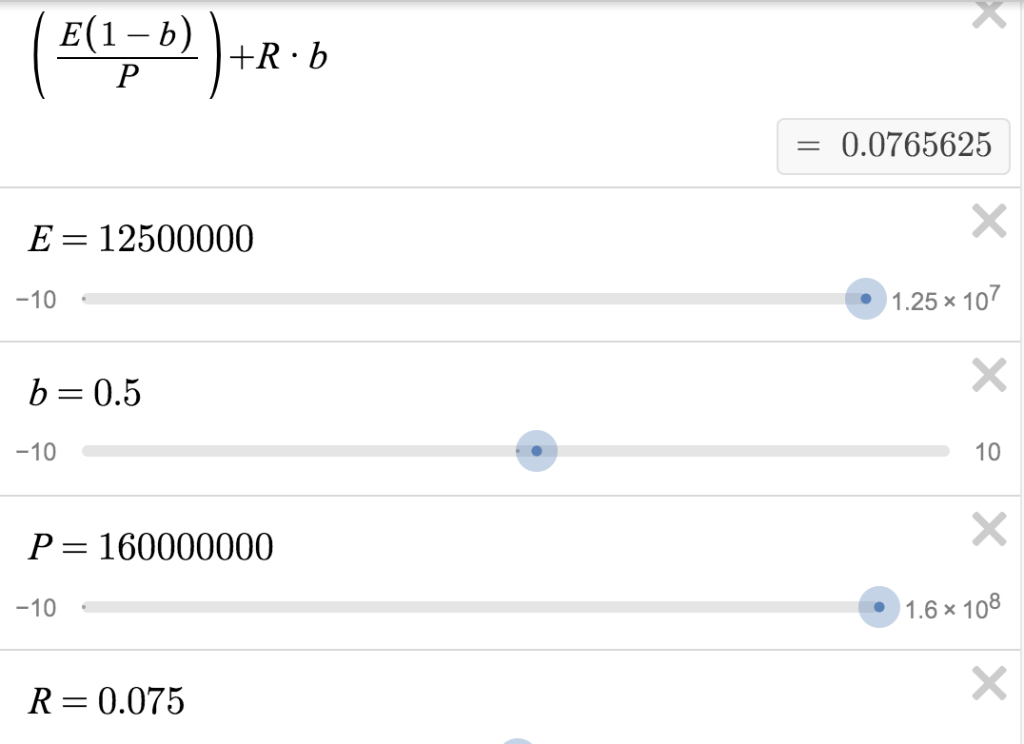

Helpful valuation tool for solving the case: The dividend growth, or growing perpetuity, model. Consider the following. The dividend payout ratio is 1 minus b, where b is the "retention" or "plowback" ratio. So, the dividend next year will be the earnings next year, E1, times 1 minus the retention ratio. The most commonly used equation to calculate the sustainable growth rate is the ROE times the retention ratio. Substituting these relationships into the dividend growth model, we get the following equation to calculate the price of a share of stock today: where rs is the cost of equity. Summary Electronic Timing Ltd. (ETL) is a small company founded 15 years ago by electronics engineers Jessica Kerr and Tom Miller. ETL manufactures integrated circuits to capitalize on the complex mixed-signal design technology and has recently entered the market for frequency timing generators or timing devices, which provide timing signals or clocks necessary to synchronize electronic systems. Its clock products were originally used in PC video graphics applications, but the market subsequently expanded to include motherboards, PC peripherals and other digital consumer electronics, such as digital television boxes and game consoles. ETL also designs and markets custom application-specific integrated circuits (ASICs) for industrial customers. The ASIC's design combines analog and digital, or mixed-signal technology Earnings after taxes from these operations are expected to be S12.5M next year. In addition to Jessica and Tom, Norma Pittman, who provided capital for the company, is the third primary owner. Together, Tom and Jessica own 25 percent of the 10 million shares outstanding. Several other individuals, including current employees, own the remaining shares. Recently, Norma Pittman sold part of her shares to an activist hedge fund, Pershing Management, which now owns 10.1% of ETL's shares. These shares were enough to get Pershing elected to ETL's board of directors at the last shareholder meeting. Since they acquired these shares, Pershing has been a vocal critic of Jessica and Tom's management of the company Pershing argues that comparable companies earn 8.5% in annual returns for their shareholders, but ROE for ETL has lagged its peers at 7.5% (ETL is 100% equity financed). Pershing is pushing for ETL to increase its payout ratio to 100% and pay out all of its earnings to shareholders. ETL's current payout ratio is 50%. Pershing is also asking shareholders to vote at the next shareholders' meeting in favor of its proposal to pay out all earnings to shareholders and remove Tom and Jessica from their management roles. If they win the vote, Pershing will increase the payout ratio to 100% and they will ask Tom and Jessica to step down fronm their current positions in the firm (Tom and Jessica would remain as shareholders). Please answer the following questions and explain your answers in a clear and concise fashion Points will be deducted for not doing s E(1- b) +R b 0.0765625 E 12500000 -10 1.25 x 107 b 0.5 -10 10 P- 160000000 -10 1.6x 108 R 0.075