what is the current ratio and Accounts Receivable turnover ratio in the "liquidity and Efficiency" category

then find the debit ratio and the equity ratio in the "Solvency" category

lastly find the profit margin ratio and the return on assets ratio under the category "Profitability"

can you show your work and not just the answer so I can understand step by step so how your getting these rations.

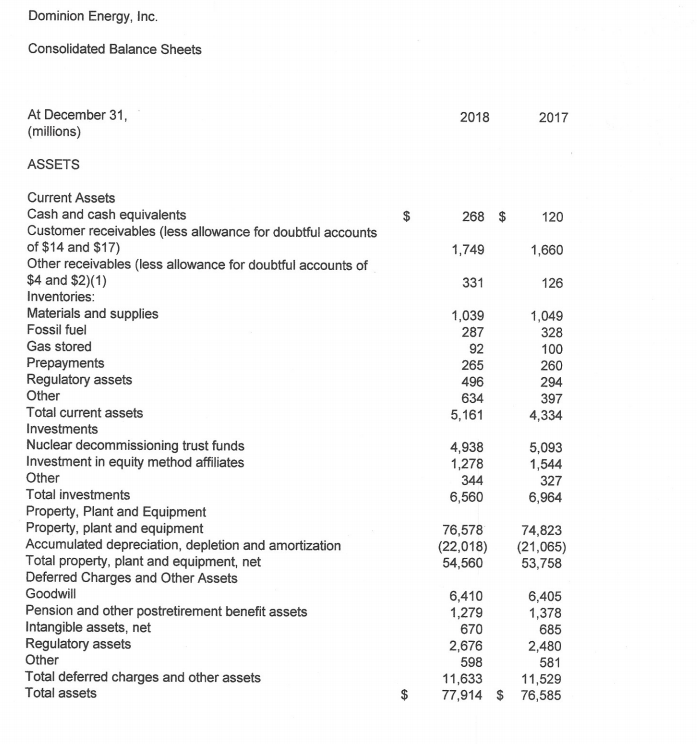

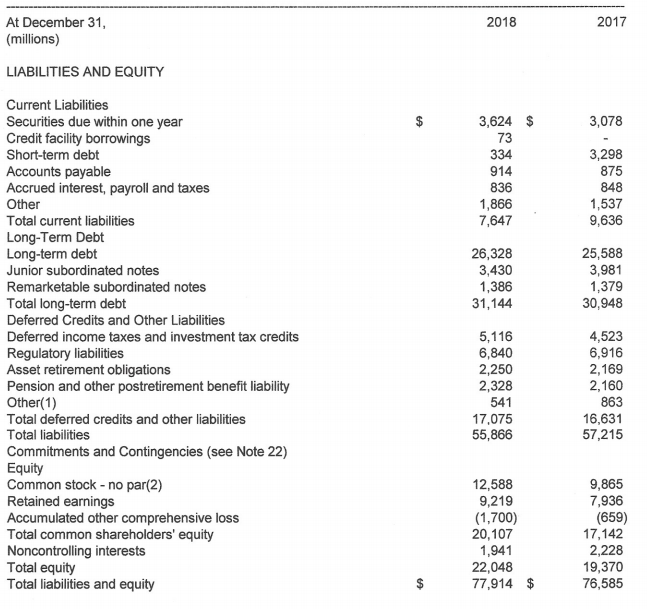

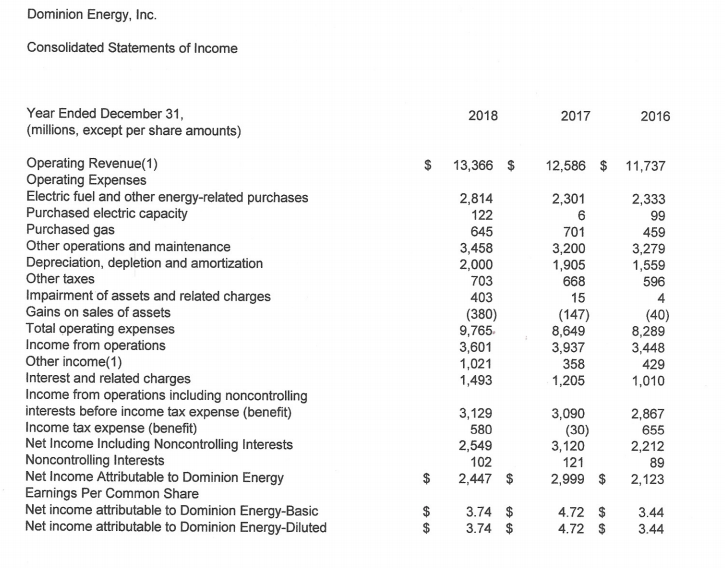

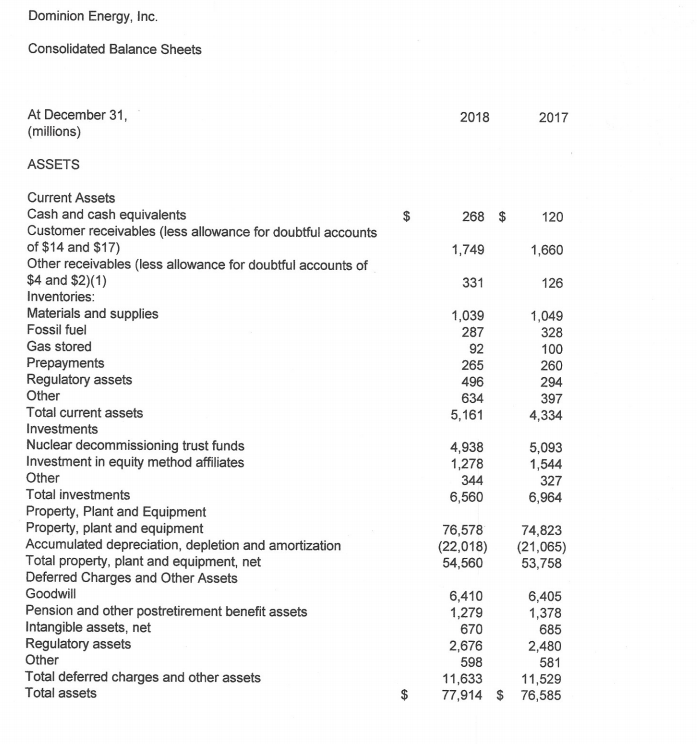

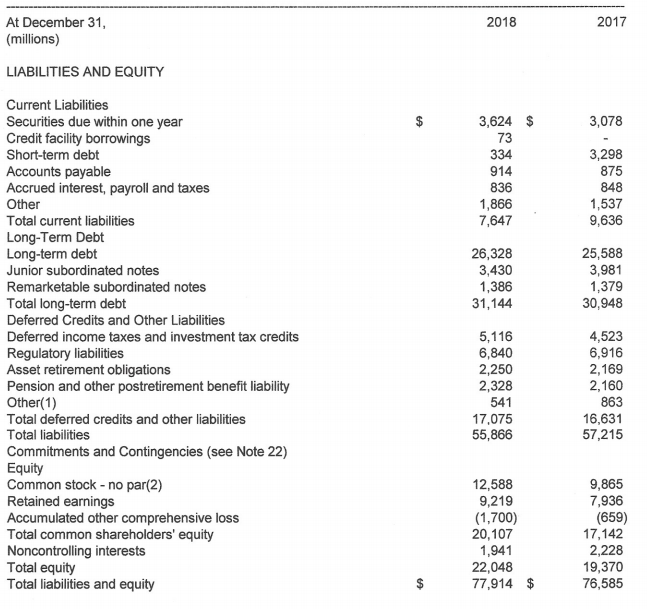

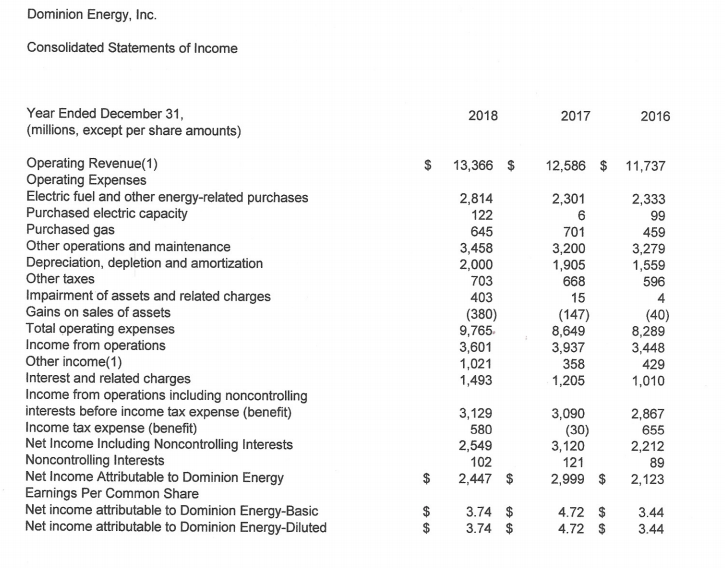

Dominion Energy, Inc. Consolidated Balance Sheets 2018 2017 At December 31, (millions) ASSETS 268 $ 120 1,749 1,660 331 126 1,039 287 92 265 496 634 5,161 1,049 328 100 260 294 397 4,334 Current Assets Cash and cash equivalents Customer receivables (less allowance for doubtful accounts of $14 and $17) Other receivables (less allowance for doubtful accounts of $4 and $2)(1) Inventories: Materials and supplies Fossil fuel Gas stored Prepayments Regulatory assets Other Total current assets Investments Nuclear decommissioning trust funds Investment in equity method affiliates Other Total investments Property, Plant and Equipment Property, plant and equipment Accumulated depreciation, depletion and amortization Total property, plant and equipment, net Deferred Charges and Other Assets Goodwill Pension and other postretirement benefit assets Intangible assets, net Regulatory assets Other Total deferred charges and other assets Total assets 4,938 1,278 344 6,560 5,093 1,544 327 6,964 76,578 (22,018) 54,560 74,823 (21,065) 53,758 6,410 1,279 670 2,676 598 11,633 77,914 $ 6,405 1,378 685 2,480 581 11,529 76,585 $ 2018 2017 At December 31, (millions) LIABILITIES AND EQUITY $ 3,078 3,624 73 334 914 836 1,866 7,647 3,298 875 848 1,537 9,636 26,328 3,430 1,386 31,144 25,588 3,981 1,379 30,948 Current Liabilities Securities due within one year Credit facility borrowings Short-term debt Accounts payable Accrued interest, payroll and taxes Other Total current liabilities Long-Term Debt Long-term debt Junior subordinated notes Remarketable subordinated notes Total long-term debt Deferred Credits and Other Liabilities Deferred income taxes and investment tax credits Regulatory liabilities Asset retirement obligations Pension and other postretirement benefit liability Other(1) Total deferred credits and other liabilities Total liabilities Commitments and Contingencies (see Note 22) Equity Common stock - no par(2) Retained earnings Accumulated other comprehensive loss Total common shareholders' equity Noncontrolling interests Total equity Total liabilities and equity 5,116 6,840 2,250 2,328 541 17.075 55,866 4,523 6,916 2,169 2,160 863 16,631 57,215 12,588 9,219 (1,700) 20,107 1,941 22,048 77,914 9,865 7,936 (659) 17,142 2,228 19,370 76,585 $ Dominion Energy, Inc. Consolidated Statements of Income 2018 2017 2016 Year Ended December 31, (millions, except per share amounts) $ 13,366 $ 12,586 $ 11,737 2,301 2,333 99 459 3,279 1,559 596 Operating Revenue(1) Operating Expenses Electric fuel and other energy-related purchases Purchased electric capacity Purchased gas Other operations and maintenance Depreciation, depletion and amortization Other taxes Impairment of assets and related charges Gains on sales of assets Total operating expenses Income from operations Other income(1) Interest and related charges Income from operations including noncontrolling interests before income tax expense (benefit) Income tax expense (benefit) Net Income Including Noncontrolling Interests Noncontrolling Interests Net Income Attributable to Dominion Energy Earnings Per Common Share Net income attributable to Dominion Energy-Basic Net income attributable to Dominion Energy-Diluted 2,814 122 645 3,458 2,000 703 403 (380) 9,765 3,601 1,021 1,493 701 3,200 1,905 668 15 (147) 8,649 3,937 358 1,205 (40) 8,289 3,448 429 1,010 3,129 580 2,549 102 2,447 3,090 (30) 3,120 2,867 655 2,212 89 2,123 121 $ 2,999 $ $ 3.74 $ 3.74 $ 4.72 $ 4.72 $ 3.44 3.44