Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 The following financial information is for Priscoll Company. Priscoll Company Balance Sheets December 31 Assets 2020 2019 Cash $ 136,500 $ 126,750 Debt

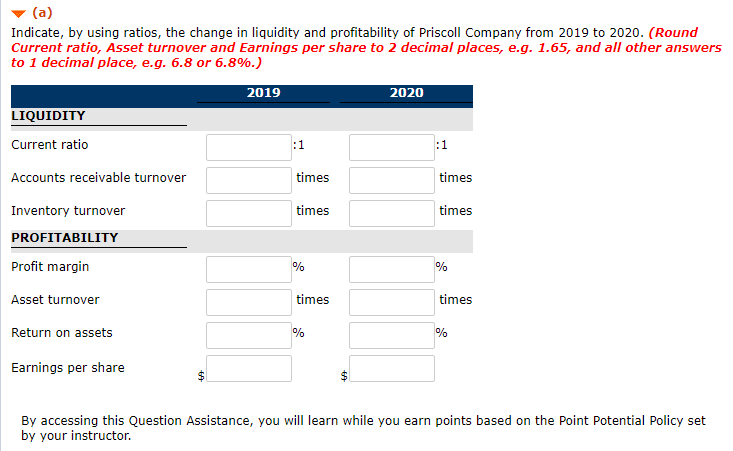

Question 3

The following financial information is for Priscoll Company.

| Priscoll Company Balance Sheets December 31 | ||||||

| Assets | 2020 | 2019 | ||||

| Cash | $ 136,500 | $ 126,750 | ||||

| Debt investments (short-term) | 107,250 | 78,000 | ||||

| Accounts receivable | 202,800 | 175,500 | ||||

| Inventory | 448,500 | 321,750 | ||||

| Prepaid expenses | 48,750 | 44,850 | ||||

| Land | 253,500 | 253,500 | ||||

| Building and equipment (net) | 507,000 | 360,750 | ||||

| Total assets | $1,704,300 | $1,361,100 | ||||

| Liabilities and Stockholders Equity | ||||||

| Notes payable (short-term) | $331,500 | $234,000 | ||||

| Accounts payable | 126,750 | 101,400 | ||||

| Accrued liabilities | 78,000 | 78,000 | ||||

| Bonds payable, due 2023 | 487,500 | 331,500 | ||||

| Common stock, $10 par | 390,000 | 390,000 | ||||

| Retained earnings | 290,550 | 226,200 | ||||

| Total liabilities and stockholders equity | $1,704,300 | $1,361,100 | ||||

| Priscoll Company Income Statement For the Years Ended December 31 | ||||||||

| 2020 | 2019 | |||||||

| Sales revenue | $1,719,900 | $1,540,500 | ||||||

| Cost of goods sold | 1,248,000 | 1,121,250 | ||||||

| Gross profit | 471,900 | 419,250 | ||||||

| Operating expenses | 370,500 | 325,650 | ||||||

| Net income | $ 101,400 | $ 93,600 | ||||||

Additional information:

| 1. | Inventory at the beginning of 2019 was $224,250. | |

| 2. | Accounts receivable (net) at the beginning of 2019 were $167,700. | |

| 3. | Total assets at the beginning of 2019 were $1,287,000. | |

| 4. | No common stock transactions occurred during 2019 or 2020. | |

| 5. | All sales were on account. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started