Answered step by step

Verified Expert Solution

Question

1 Approved Answer

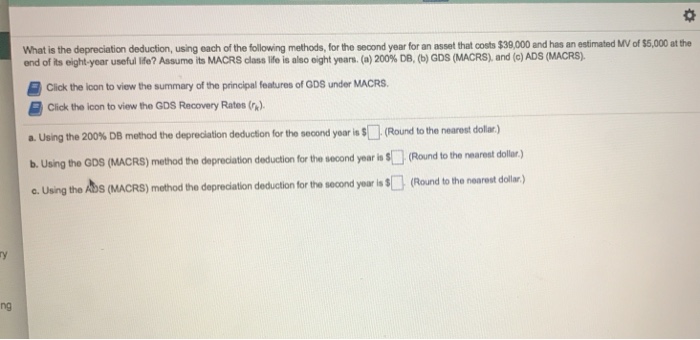

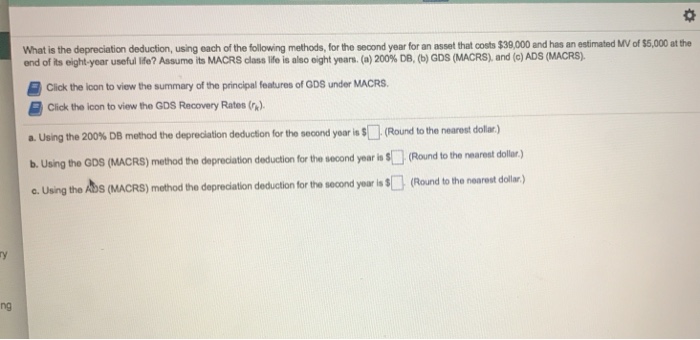

What is the depreciation deduction, using each of the following methods,for the second year for an asset that costs $38,000 and has an estimated MV

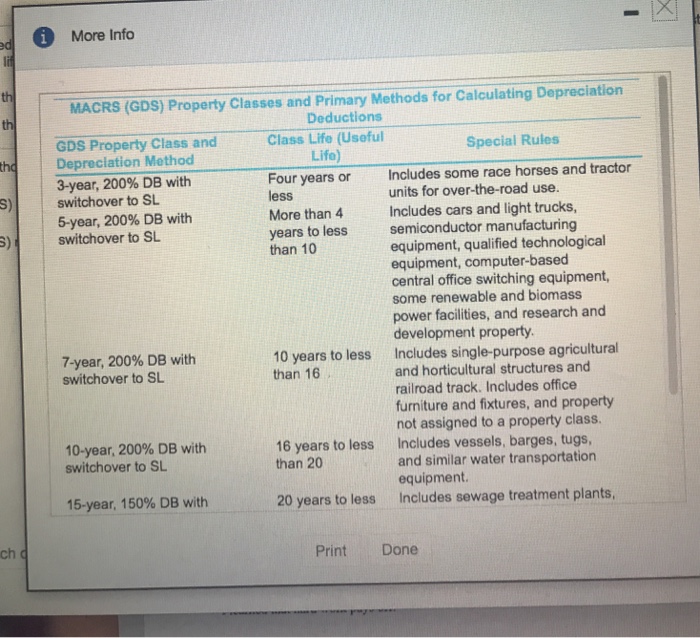

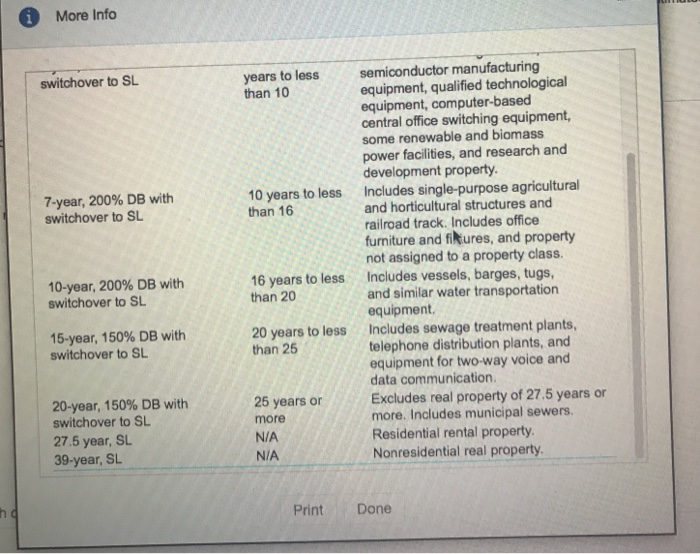

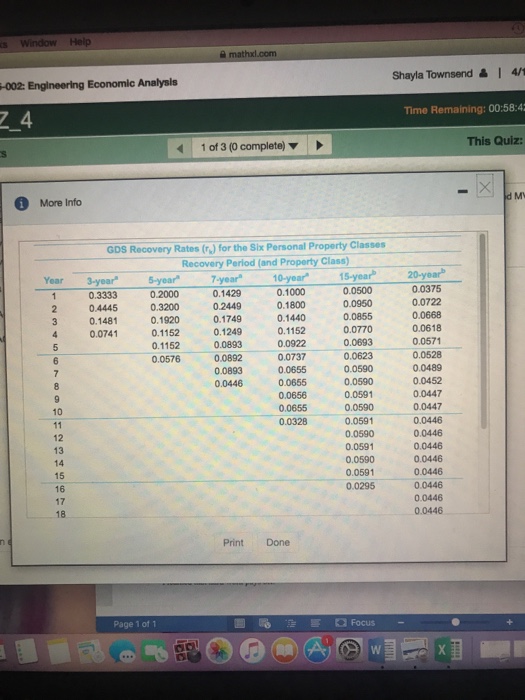

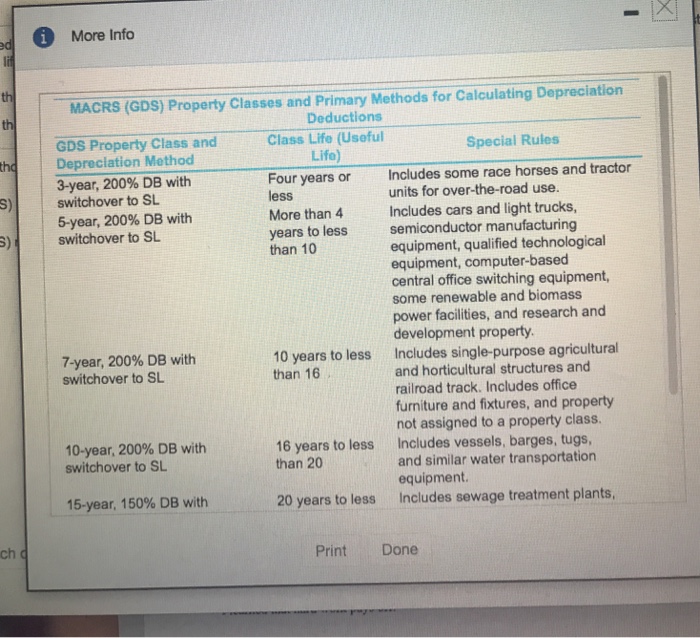

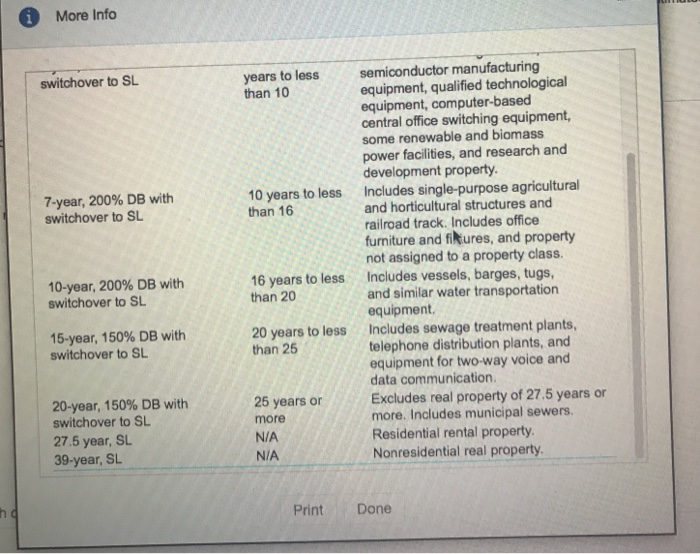

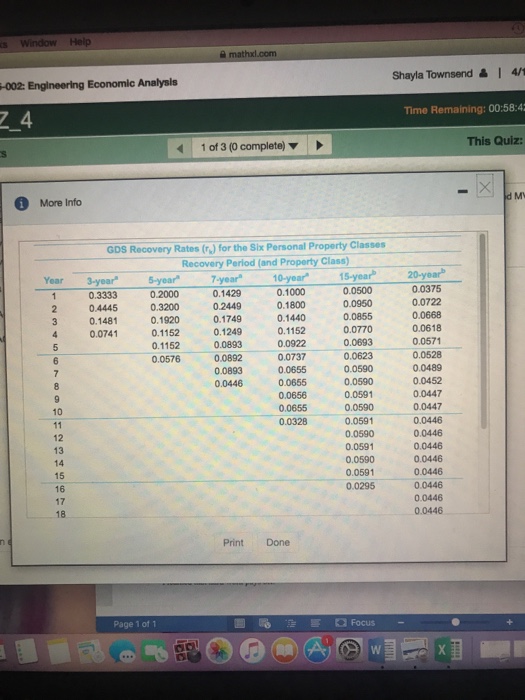

What is the depreciation deduction, using each of the following methods,for the second year for an asset that costs $38,000 and has an estimated MV of $5,000 at the end of its eight-year useful life? Assume its MACRS class life is also oight years. (a) 200% DB. (b) GDS (MACRS). and (c) ADS (MACRS). Click the loon to view the summary of the principal features of GDS under MACRS Click the lcon to view the GDS Recovery Rates ausing the 200% DB method the depreciation deduction for to second yoar is S Round to the nearest dolar.) b. Using the GDS (MACRS) method the depreciation dedution for the second year ib 5(Round to the nearest dol) Rond to the nearest dollar RS method the depreciation deduction for the second year is S ?.Using the SMA ng

What is the depreciation deduction, using each of the following methods,for the second year for an asset that costs $38,000 and has an estimated MV of $5,000 at the end of its eight-year useful life? Assume its MACRS class life is also oight years. (a) 200% DB. (b) GDS (MACRS). and (c) ADS (MACRS). Click the loon to view the summary of the principal features of GDS under MACRS Click the lcon to view the GDS Recovery Rates ausing the 200% DB method the depreciation deduction for to second yoar is S Round to the nearest dolar.) b. Using the GDS (MACRS) method the depreciation dedution for the second year ib 5(Round to the nearest dol) Rond to the nearest dollar RS method the depreciation deduction for the second year is S ?.Using the SMA ng

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started