Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the firm's 2 0 1 4 current ratio? Round your answer to two decimal places. Attempts 7 : Analysis of Financial Statements: Tying

What is the firm's current ratio? Round your answer to two decimal places. Attempts

: Analysis of Financial Statements: Tying the Ratios Together

Tying the Ratios Together

The DuPont equation shows the relationships among asset management, debt management, and

profitability

ratios. Management can use the DuPont equation to analyze ways of improving the firm's performance. Its equation is:

ROE Profit margin Total assets turnover Equity multiplier

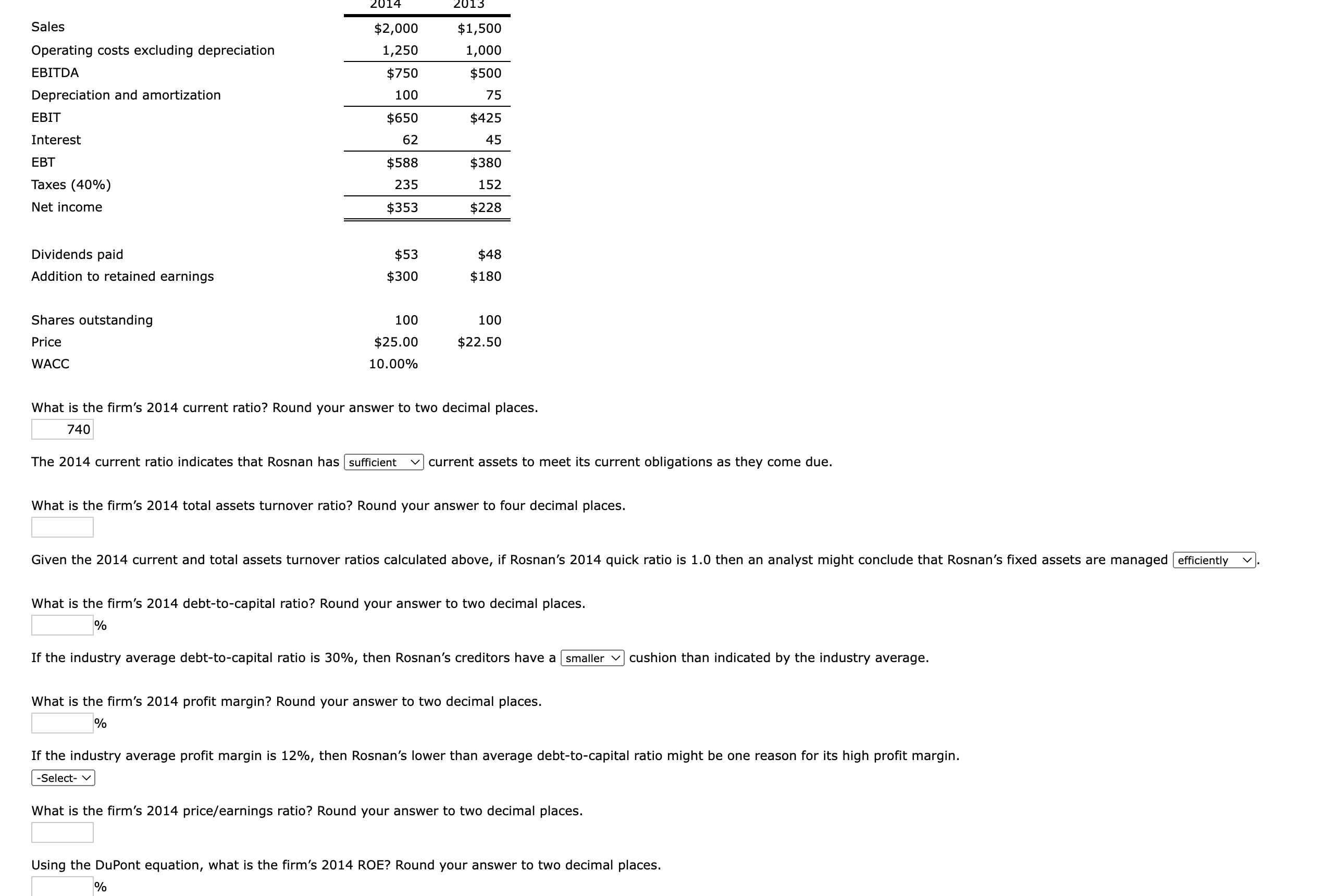

Quantitative Problem: Rosnan Industries' and balance sheets and income statements are shown below.

Balance Sheets:

Cash and equivalents

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

Accounts payable

Accruals

Notes payable

Total current liabilities

Longterm debt

Common stock

Retained earnings

Total liabilities and equity

The current ratio indicates that Rosnan has sufficient current assets to meet its current obligations as they come due.

What is the firm's total assets turnover ratio? Round your answer to four decimal places.

What is the firm's debttocapital ratio? Round your answer to two decimal places.

If the industry average debttocapital ratio is then Rosnan's creditors have a

cushion than indicated by the industry average.

What is the firm's profit margin? Round your answer to two decimal places.

If the industry average profit margin is then Rosnan's lower than average debttocapital ratio might be one reason for its high profit margin.

What is the firm's priceearnings ratio? Round your answer to two decimal places.

Using the DuPont equation, what is the firm's ROE? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started