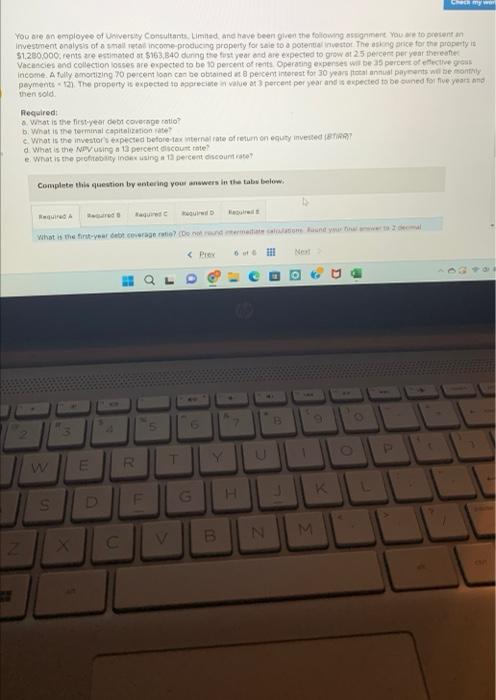

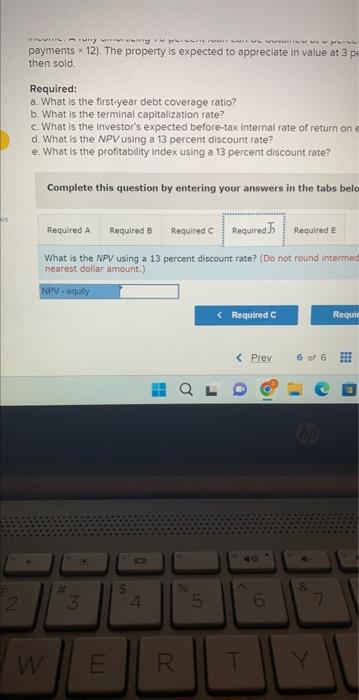

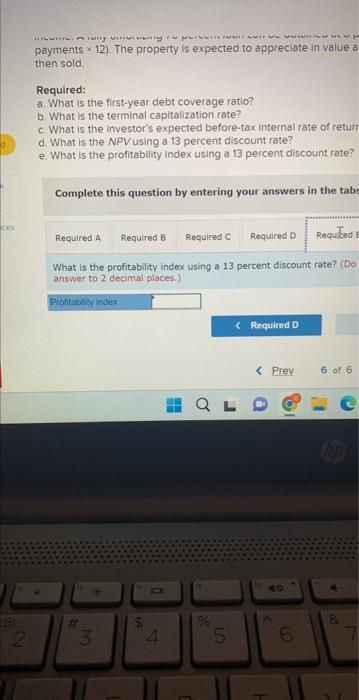

What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investors expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 13 percent discount rate? e. What is the profitability index using a 13 percent discount rate?

Yoo die an employee of Uoivertity Consultants. Limited and have been girent the followng assgnment You we to pretert an Ifvestunent onalysis of a strall tepall income-producing properfy for sale to a potentie invectot. The asking arice for the property it 51,250,000, rents 2re estimated ot $163,840 dunng the fost year a'd are expected to graw at 2.5 peiceri per year thetreeftet Vacascies and collection iosses are erpected to be 19 percent of rents Operating experses wit be 35 percest of entective graub then sold Required: a. Visat is the firstyear debt coverage rotio? b. What is the terminal eagitalizitiod tate? c. What is the investor expected betoiedex internal rate of return on equty invetied te fiath? d. What is the Fievising a 13 peicent elscout rate? e. What is the profitablity indenx using in 12 dercert discount rate? Complete this guestion by antecing your anawers in the tabs below. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 13 percent discount rate? e. What is the profitability index using a 13 percent discount rate? Complete this question by entering your answers in the tabs below. What is the first-year debt coverage ratio? (Do not round intermediate calculations, Round your fina places.) payments 12 ). The property is expected to appreciate in value at 3 percen then soid. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of retuin on equity d. What is the NPV using a 13 percent discount rate? e. What is the profitablitity index using a 13 percent discount rate? Complete this question by entering your answers in the tabs below. What is the terminal capitalization rate? (Do not round intermediate calculation decimal places.) payments 12 ) The property is expected to appreciate in value at 3 percent p: then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity in d. What is the NPV using a 13 percent discount rote? e. What is the profitability index using a 13 percent discount rate? Complete this question by entering your answers in the tabs below. What is the investor's expected before-tax internal rate of retum on equity investe calculations. Enter your answer as a percent rounded to 2 decimal places.) payments 12 ). The property is expected to appreciate in value at 3 p then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on d. What is the NPV using a 13 percent discount rate? e. What is the profitablity index using a 13 percent discount rate? Complete this question by entering your answers in the tabs belo What is the NPV using a 13 percent discount rate? (Do not round intermed nearest dollar amount.) payments 12 ). The property is expected to appreciate in value a then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of returi d. What is the NPV using a 13 percent discount rate? e. What is the proftability index using a 13 percent discount rate? Complete this question by entering your answers in the tab: What is the profitability index using a 13 percent discount rate? (Do) answer to 2 decimal places.)