Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the journal entry for the following adjusted entry for supplies adjusted entry for rent adjusted entry for utilities expenses adjusted entry for salaries

what is the journal entry for the following adjusted entry for supplies adjusted entry for rent adjusted entry for utilities expenses adjusted entry for salaries and wages adjusted entry for income tax

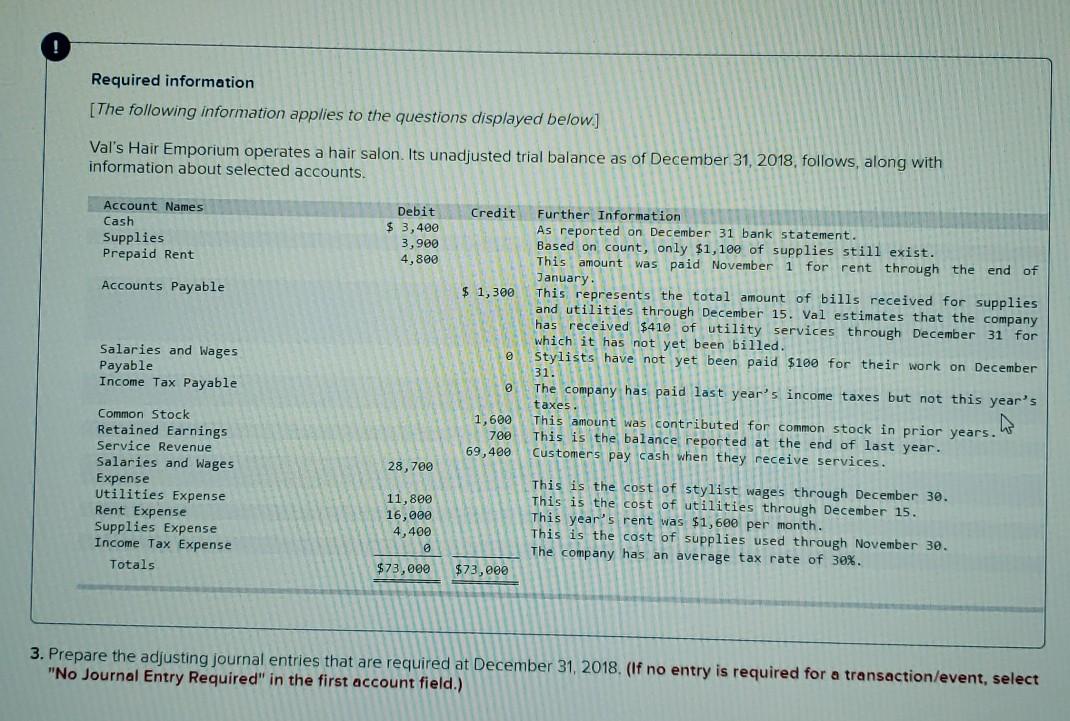

Required information [The following information applies to the questions displayed below.] Val's Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2018, follows, along with information about selected accounts. Credit Account Names Cash Supplies Prepaid Rent Debit $ 3,400 3,900 4,800 Further Information As reported on December 31 bank statement. Based on count, only $1,100 of supplies still exist. This amount was paid November 1 for rent through the end of Accounts Payable January $ 1,300 This represents the total amount of bills received for supplies and utilities through December 15. Val estimates that the company has received $410 of utility services through December 31 for which it has not yet been billed. Stylists have not yet been paid $100 for their work on December 0 Salaries and Wages Payable Income Tax Payable 1,600 700 69,400 The company has paid last year's income taxes but not this year's taxes This amount was contributed for common stock in prior years. This is the balance reported at the end of last year. Customers pay cash when they receive services. 28,700 Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Utilities Expense Rent Expense Supplies Expense Income Tax Expense Totals 11,800 16,000 This is the cost of stylist wages through December 30. This is the cost of utilities through December 15. This year's rent was $1,600 per month. This is the cost of supplies used through November 30. The company has an average tax rate of 30% 4,400 0 $73,000 $73,00 3. Prepare the adjusting journal entries that are required at December 31, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started