Question

What is the maximum share price at which Herbert Kohler should be willing to settle with the dissenting shareholders in order to stop the trial

What is the maximum share price at which Herbert Kohler should be willing to settle with the dissenting

shareholders in order to stop the trial on April 11, 2000? Assume that:

a. If the trial proceeds, it is expected to last less than a month and result in one of two possible

outcomes in terms of the price per share established in court: the $273,000 being claimed by

the plaintiffs, or the $55,400 being defended by Herbert Kohler.

b. Kohler estimates the probabilities of these two outcomes at 30% and 70%, respectively.

Assume that legal fees can be ignored.

(Hint: Expected value = Probability1* Price1 + Probability2*Price2).

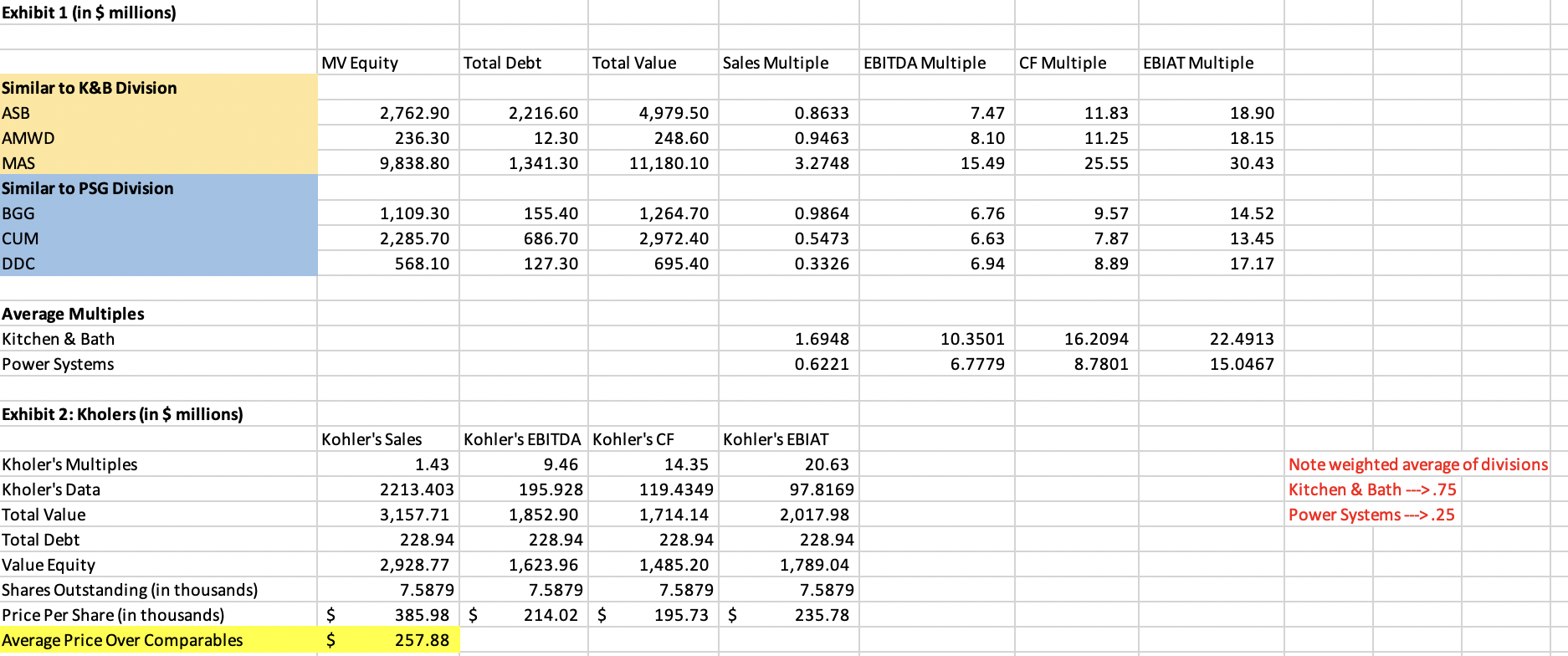

Exhibit 1 (in $ millions) MV Equity Total Debt Total Value Sales Multiple EBITDA Multiple CF Multiple EBIAT Multiple 2,762.90 236.30 9,838.80 2,216.60 12.30 1,341.30 4,979.50 248.60 11,180.10 0.8633 0.9463 3.2748 7.47 8.10 11.83 11.25 25.55 18.90 18.15 15.49 30.43 Similar to K&B Division ASB AMWD MAS Similar to PSG Division BGG CUM DDC 14.52 1,109.30 2,285.70 568.10 155.40 686.70 127.30 1,264.70 2,972.40 695.40 0.9864 0.5473 0.3326 6.76 6.63 6.94 9.57 7.87 13.45 8.89 17.17 Average Multiples Kitchen & Bath Power Systems 1.6948 10.3501 6.7779 16.2094 8.7801 22.4913 15.0467 0.6221 Exhibit 2: Kholers (in $ millions) Note weighted average of divisions Kitchen & Bath --->.75 Power Systems --->.25 Kholer's Multiples Kholer's Data Total Value Total Debt Value Equity Shares Outstanding (in thousands) Price Per Share (in thousands) Average Price Over Comparables Kohler's Sales Kohler's EBITDA Kohler's CF Kohler's EBIAT 1.43 9.46 14.35 20.63 2213.403 195.928 119.4349 97.8169 3,157.71 1,852.90 1,714.14 2,017.98 228.94 228.94 228.94 228.94 2,928.77 1,623.96 1,485.20 1,789.04 7.5879 7.5879 7.5879 7.5879 $ 385.98 $ 214.02 $ 195.73 $ 235.78 $ 257.88 Exhibit 1 (in $ millions) MV Equity Total Debt Total Value Sales Multiple EBITDA Multiple CF Multiple EBIAT Multiple 2,762.90 236.30 9,838.80 2,216.60 12.30 1,341.30 4,979.50 248.60 11,180.10 0.8633 0.9463 3.2748 7.47 8.10 11.83 11.25 25.55 18.90 18.15 15.49 30.43 Similar to K&B Division ASB AMWD MAS Similar to PSG Division BGG CUM DDC 14.52 1,109.30 2,285.70 568.10 155.40 686.70 127.30 1,264.70 2,972.40 695.40 0.9864 0.5473 0.3326 6.76 6.63 6.94 9.57 7.87 13.45 8.89 17.17 Average Multiples Kitchen & Bath Power Systems 1.6948 10.3501 6.7779 16.2094 8.7801 22.4913 15.0467 0.6221 Exhibit 2: Kholers (in $ millions) Note weighted average of divisions Kitchen & Bath --->.75 Power Systems --->.25 Kholer's Multiples Kholer's Data Total Value Total Debt Value Equity Shares Outstanding (in thousands) Price Per Share (in thousands) Average Price Over Comparables Kohler's Sales Kohler's EBITDA Kohler's CF Kohler's EBIAT 1.43 9.46 14.35 20.63 2213.403 195.928 119.4349 97.8169 3,157.71 1,852.90 1,714.14 2,017.98 228.94 228.94 228.94 228.94 2,928.77 1,623.96 1,485.20 1,789.04 7.5879 7.5879 7.5879 7.5879 $ 385.98 $ 214.02 $ 195.73 $ 235.78 $ 257.88

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started