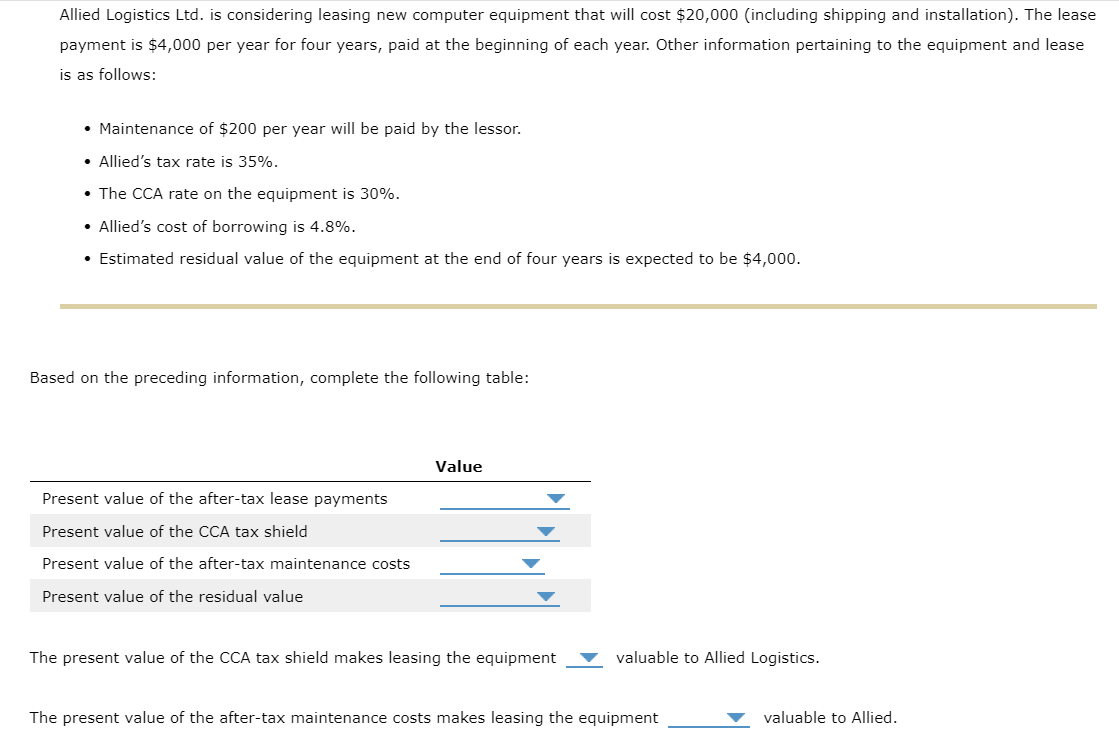

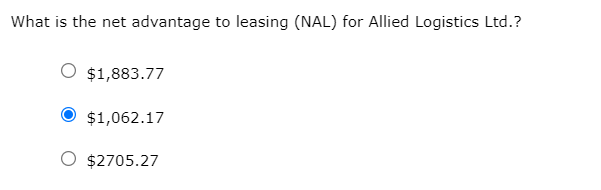

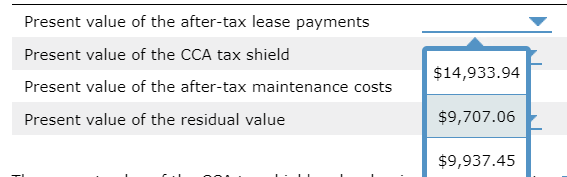

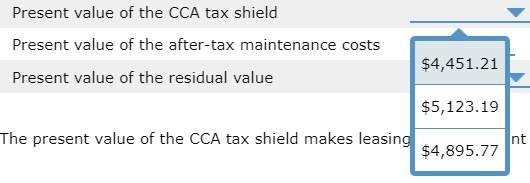

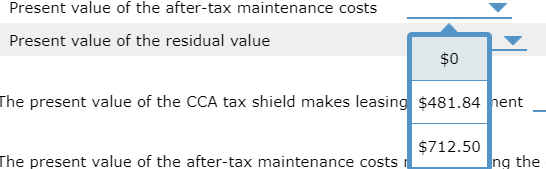

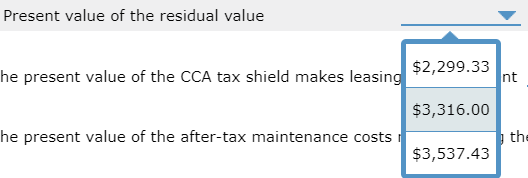

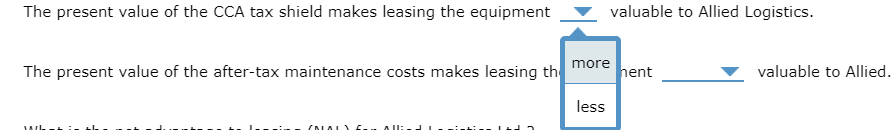

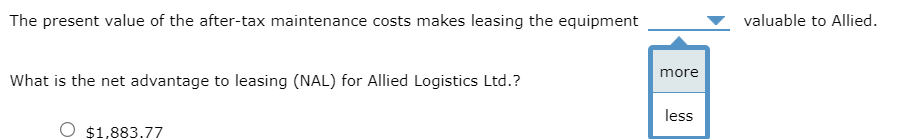

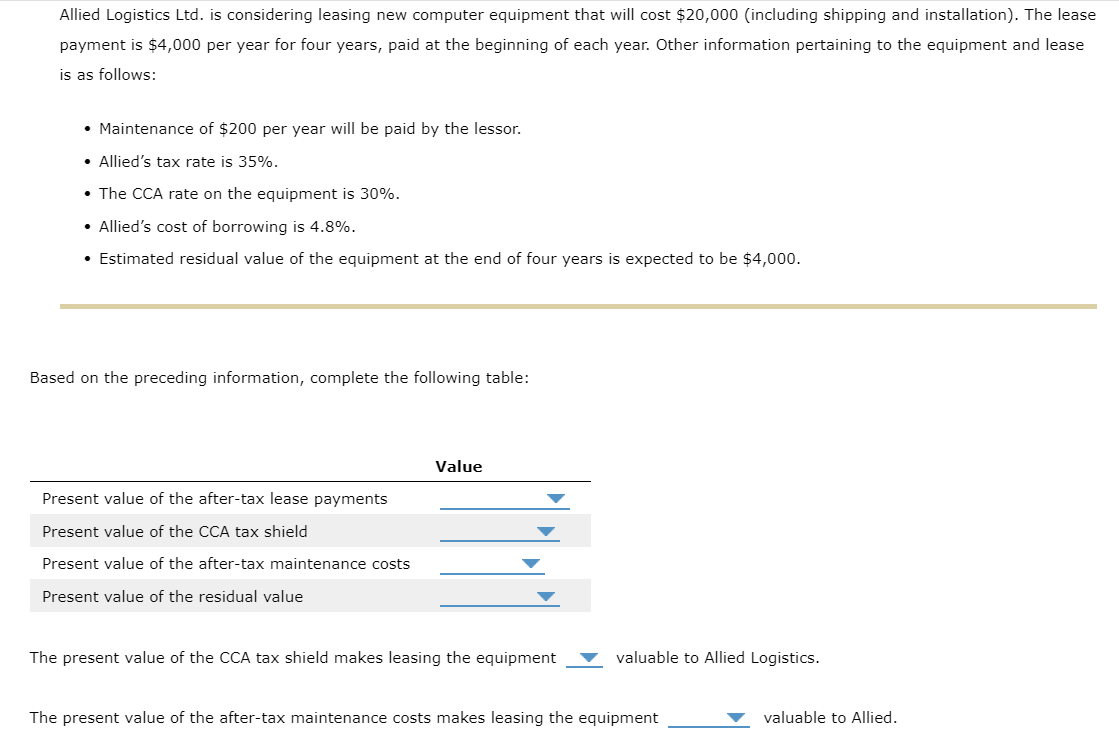

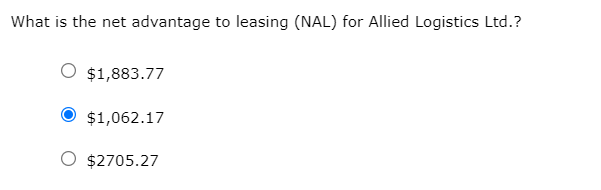

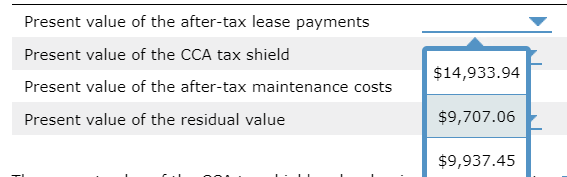

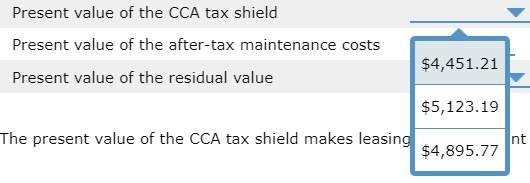

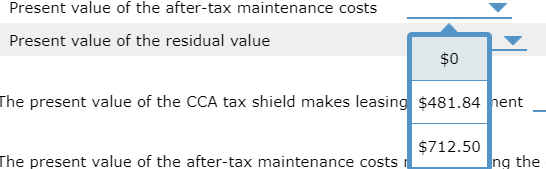

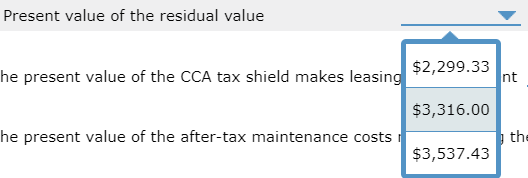

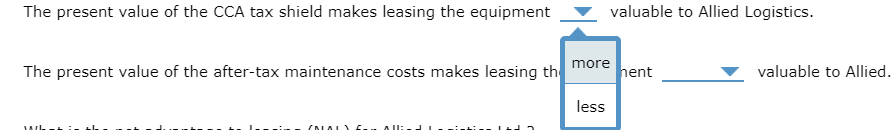

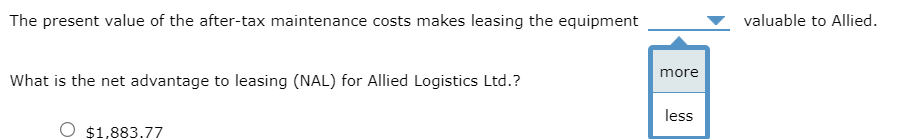

What is the net advantage to leasing (NAL) for Allied Logistics Ltd.? $1,883.77 $1,062.17 O $2705.27 Present value of the after-tax lease payments Present value of the CCA tax shield Present value of the after-tax maintenance costs Present value of the residual value $14,933.94 $9,707.06 $9,937.45 Present value of the CCA tax shield Present value of the after-tax maintenance costs $4,451.21 Present value of the residual value $5,123.19 The present value of the CCA tax shield makes leasing $4,895.77 nt Present value of the after-tax maintenance costs Present value of the residual value $0 The present value of the CCA tax shield makes leasing $481.84 hent $712.50 The present value of the after-tax maintenance costs ng the Present value of the residual value he present value of the CCA tax shield makes leasing $2,299.33 nt $3,316.00 he present value of the after-tax maintenance costs the $3,537.43 The present value of the CCA tax shield makes leasing the equipment valuable to Allied Logistics. The present value of the after-tax maintenance costs makes leasing th more hent valuable to Allied. less (MALL The present value of the after-tax maintenance costs makes leasing the equipment valuable to Allied. more What is the net advantage to leasing (NAL) for Allied Logistics Ltd.? less $1,883.77 What is the net advantage to leasing (NAL) for Allied Logistics Ltd.? $1,883.77 $1,062.17 O $2705.27 Present value of the after-tax lease payments Present value of the CCA tax shield Present value of the after-tax maintenance costs Present value of the residual value $14,933.94 $9,707.06 $9,937.45 Present value of the CCA tax shield Present value of the after-tax maintenance costs $4,451.21 Present value of the residual value $5,123.19 The present value of the CCA tax shield makes leasing $4,895.77 nt Present value of the after-tax maintenance costs Present value of the residual value $0 The present value of the CCA tax shield makes leasing $481.84 hent $712.50 The present value of the after-tax maintenance costs ng the Present value of the residual value he present value of the CCA tax shield makes leasing $2,299.33 nt $3,316.00 he present value of the after-tax maintenance costs the $3,537.43 The present value of the CCA tax shield makes leasing the equipment valuable to Allied Logistics. The present value of the after-tax maintenance costs makes leasing th more hent valuable to Allied. less (MALL The present value of the after-tax maintenance costs makes leasing the equipment valuable to Allied. more What is the net advantage to leasing (NAL) for Allied Logistics Ltd.? less $1,883.77