Question

What is the NPV at a discount rate of 6% and the IRR given the following assumptions? Revenue: Costs: Construction will take 2 full

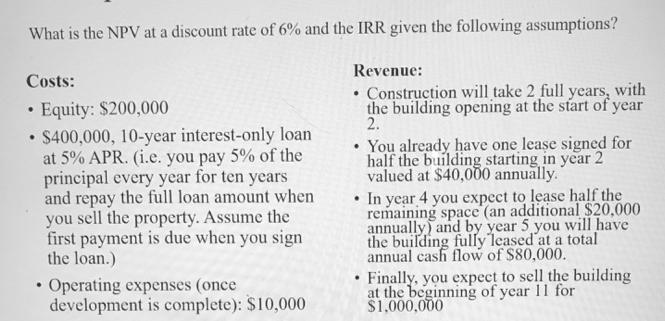

What is the NPV at a discount rate of 6% and the IRR given the following assumptions? Revenue: Costs: Construction will take 2 full years, with the building opening at the start of year 2. Equity: $200,000 $400,000, 10-year interest-only loan at 5% APR. (i.e. you pay 5% of the principal every year for ten years and repay the full loan amount when you sell the property. Assume the first payment is due when you sign the loan.) You already have one lease signed for half the building starting in year 2 valued at $40,000 annually." In year 4 you expect to lease half the remaining space (an additional $20,000 annually) and by year 5 you will have the building fully leased at a total annual cash flow of S80,000. Operating expenses (once development is complete): $10,000 Finally, you expect to sell the building at the beginning of year 11 for $1,000,000

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App