What is the Operating Cash Flow and NOPLAT (Net operating profit less adjusted taxes) for the past 5 years for Microsoft Corp? Pick whichever one

What is the Operating Cash Flow and NOPLAT (Net operating profit less adjusted taxes) for the past 5 years for Microsoft Corp?

Pick whichever one method/formula you want to use to solve from below. Show your work.

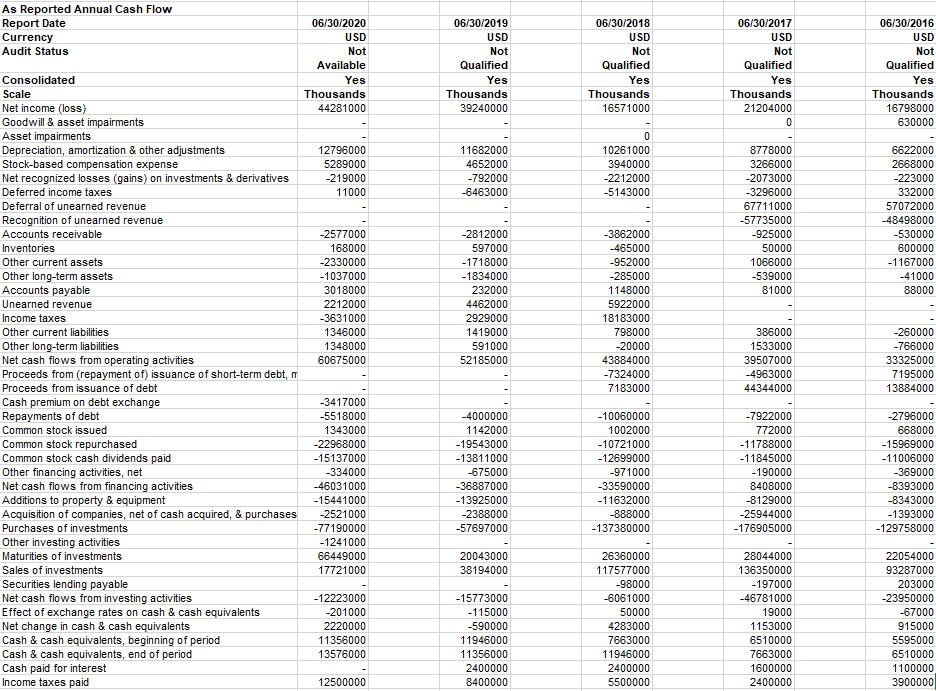

Operating Cash Flow

1. OCF = NOPLAT + Depreciation.

1A. OCF = (EBIT)(1-TC) + Depreciation.

2. OCF = Total Revenues - [(Cost of Goods Sold + Operating Expenses)] (1-Tax Rate) + Depreciation.

NOPLAT:

- NOPLAT = (EBIT)(1-Tax Rate)

- if you use another method/formula please show.

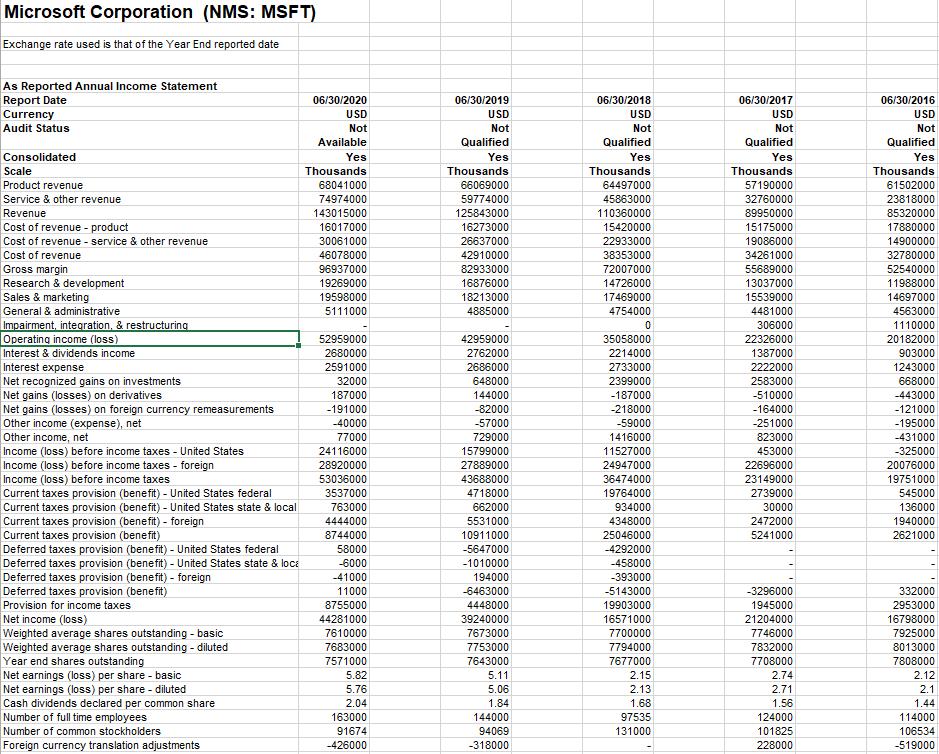

Microsoft Corporation (NMs: MSFT) Exchange rate used is that of the Year End reported date As Reported Annual Income Statement Report Date Currency 06/30/2020 06/30/2019 06/30/2018 06/30/2017 06/30/2016 USD USD USD USD USD Not Qualified Audit Status Not Not Not Not Available Qualified Qualified Qualified Consolidated Yes Yes Yes Yes Yes Scale Thousands Thousands Thousands Thousands Thousands Product revenue 68041000 66069000 64497000 57190000 61502000 Service & other revenue 74974000 59774000 45863000 32760000 23818000 Revenue 143015000 125843000 110360000 89950000 85320000 Cost of revenue - product Cost of revenue - service & other revenue Cost of revenue Gross margin Research & development Sales & marketing 16017000 16273000 15420000 15175000 17880000 30061000 26637000 22933000 19086000 14900000 46078000 42910000 38353000 34261000 32780000 96937000 82933000 72007000 55689000 52540000 19269000 16876000 14726000 13037000 11988000 19598000 18213000 17469000 15539000 14697000 General & administrative 5111000 4885000 4754000 4481000 4563000 Impairment, integration, & restructuring Operating income (loss) Interest & dividends income Interest expense Net recognized gains on investments Net gains (losses) on derivatives Net gains (losses) on foreign currency remeasurements Other income (expense), net 306000 1110000 52959000 42959000 35058000 22326000 20182000 2680000 2762000 2214000 1387000 903000 2591000 2686000 2733000 2222000 1243000 32000 648000 2399000 2583000 668000 187000 144000 -187000 -510000 -443000 -191000 -82000 -218000 -164000 -121000 -40000 -57000 -59000 -251000 -195000 Other income, net 77000 729000 1416000 823000 -431000 453000 22696000 -325000 Income (loss) before income taxes - United States Income (loss) before income taxes - foreign Income (loss) before income taxes Current taxes provision (benefit) - United States federal Current taxes provision (benefit) - United States state & local Current taxes provision (benefit) - foreign Current taxes provision (benefit) Deferred taxes provision (benefit) - United States federal Deferred taxes provision (benefit) - United States state & loce Deferred taxes provision (benefit) - foreign Deferred taxes provision (benefit) 24116000 15799000 11527000 28920000 27889000 24947000 20076000 53036000 43688000 36474000 23149000 19751000 3537000 4718000 19764000 2739000 545000 763000 662000 934000 30000 136000 4444000 5531000 4348000 2472000 1940000 8744000 10911000 25046000 5241000 2621000 58000 -5647000 -4292000 -6000 -1010000 -458000 -41000 194000 -393000 11000 -6463000 -5143000 -3296000 332000 8755000 Provision for income taxes Net income (loss) Weighted average shares outstanding - basic Weighted average shares outstanding - diluted Year end shares outstanding Net earnings (loss) per share - basic Net earnings (loss) per share - diluted Cash dividends declared per common share Number of full time employees Number of common stockholders 4448000 19903000 1945000 2953000 44281000 39240000 16571000 21204000 16798000 7610000 7673000 7700000 7746000 7925000 7683000 7753000 7794000 7832000 8013000 7571000 7643000 7677000 7708000 7808000 5.82 5.11 2.15 2.74 2.12 5.76 5.06 2.13 2.71 2.1 2.04 1.84 1.68 1.56 1.44 163000 144000 97535 124000 114000 91674 94069 131000 101825 106534 Foreign currency translation adjustments -426000 -318000 228000 -519000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

NOPLAT is earning after tax that is net incomeloss is here 2020 44281000 2019 39240...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started