Answered step by step

Verified Expert Solution

Question

1 Approved Answer

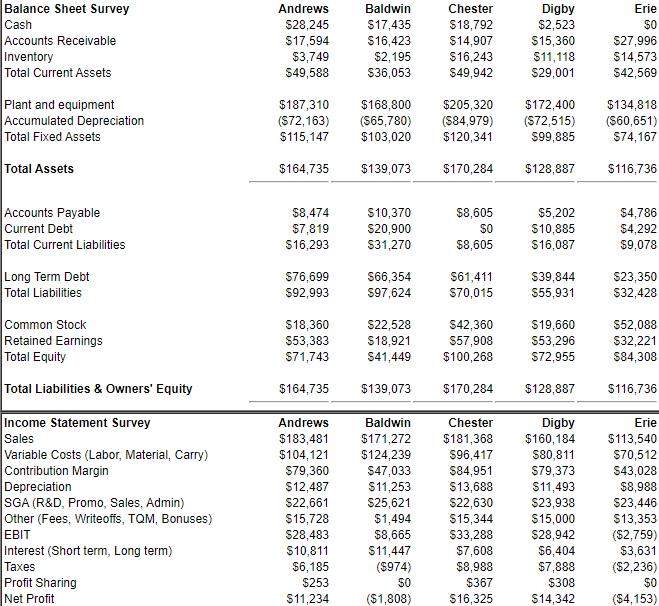

What is the optimal balance of Variable vs. Fixed costs for Digby? Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment

What is the optimal balance of Variable vs. Fixed costs for Digby?

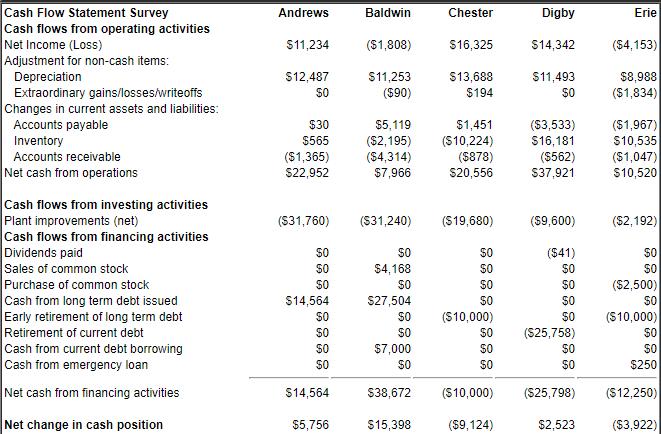

Cash Flow Statement Survey Cash flows from operating activities Net Income (Loss) Adjustment for non-cash items: Depreciation Extraordinary gains/losses/writeoffs Changes in current assets and liabilities: Andrews Baldwin Chester Digby Erie $11,234 ($1,808) S16,325 S14,342 ($4,153) $12,487 $11,253 S13,688 $11,493 $8,988 SO ($90) $194 $0 (S1,834) $30 $1,451 (S10,224) (S878) S20,556 ($1,967) S10,535 ($1,047) $10,520 Accounts payable $5,119 (S3,533) $16,181 ($562) Inventory $565 (S2,195) ($4,314) $7,966 Accounts receivable Net cash from operations (S1,365) S22,952 S37,921 Cash flows from investing activities Plant improvements (net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt (S31,760) (S31,240) (S19,680) ($9,600) ($2,192) SO SO S0 ($41) SO $4,168 $0 SO SO SO so $0 (S2,500) S14,564 S27,504 so $0 SO SO SO (S10,000) (S10,000) S0 $0 Retirement of current debt SO SO (S25,758) SO Cash from current debt borrowing Cash from emergency loan $7,000 S0 $0 S0 S0 SO S0 $0 $250 Net cash from financing activities $14,564 S38,672 (S10,000) ($25,798) (S12,250) Net change in cash position $5,756 $15,398 ($9,124) $2,523 ($3,922)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Variable cost is a corporate expense that fluctuate in proportion to ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started