Answered step by step

Verified Expert Solution

Question

1 Approved Answer

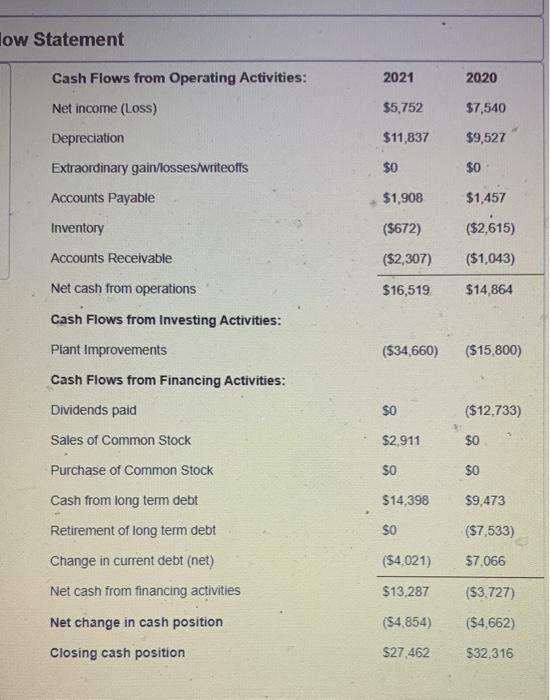

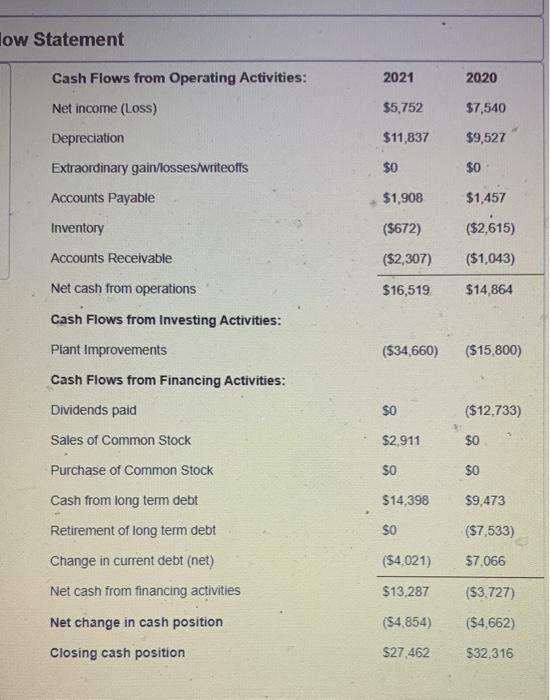

what is the profit margin according to the information given low Statement Cash Flows from Operating Activities: 2021 2020 Net income (Loss) $5,752 $7,540 Depreciation

what is the profit margin according to the information given

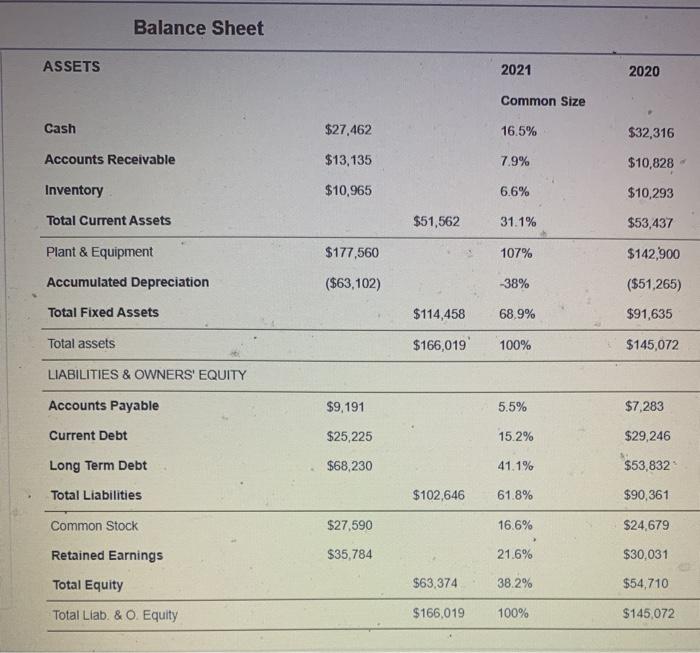

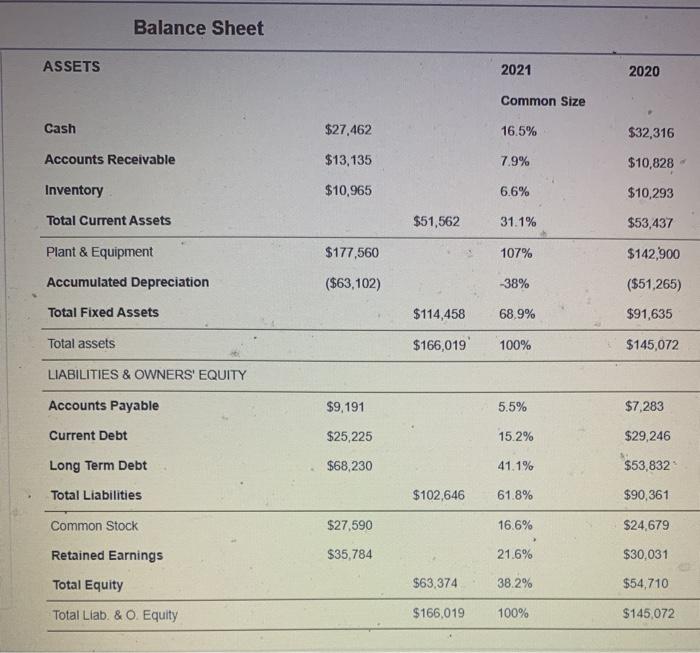

low Statement Cash Flows from Operating Activities: 2021 2020 Net income (Loss) $5,752 $7,540 Depreciation $11,837 $9,527 Extraordinary gain/losses/writeoffs $0 $0 Accounts Payable $1,908 $1,457 Inventory ($672) ($2,615) Accounts Receivable ($2,307) ($1,043) Net cash from operations $16,519 $14,864 Cash Flows from Investing Activities: Plant Improvements (534,660) ($15,800) Cash Flows from Financing Activities: Dividends paid $0 ($12.733) Sales of Common Stock $2.911 $0 Purchase of Common Stock $0 $0 $14,398 $9.473 $0 ($7,533) Cash from long term debt Retirement of long term debt Change in current debt (net) Net cash from financing activities ($4,021) $7,066 $13,287 ($3.727) Net change in cash position ($4,854) ($4.662) Closing cash position $27.462 $32,316 Balance Sheet ASSETS 2021 2020 Common Size Cash $27,462 16.5% $32,316 Accounts Receivable $13,135 7.9% $10,828 Inventory $10,965 6.6% $10,293 Total Current Assets $51,562 31.1% $53,437 Plant & Equipment $177,560 107% $142,900 Accumulated Depreciation ($63,102) 38% ($51,265) Total Fixed Assets $114,458 68.9% $91,635 Total assets $166,019 100% $145,072 LIABILITIES & OWNERS' EQUITY Accounts Payable $9,191 5.5% $7,283 Current Debt $25,225 15.2% $29,246 Long Term Debt $68,230 41.1% $53,832 Total Liabilities $102,646 61.8% $90,361 Common Stock $27,590 16.6% $24.679 Retained Earnings $35,784 21.6% $30,031 Total Equity $63,374 38.2% $54,710 Total Liab. & O. Equity $166,019 100% $145,072

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started