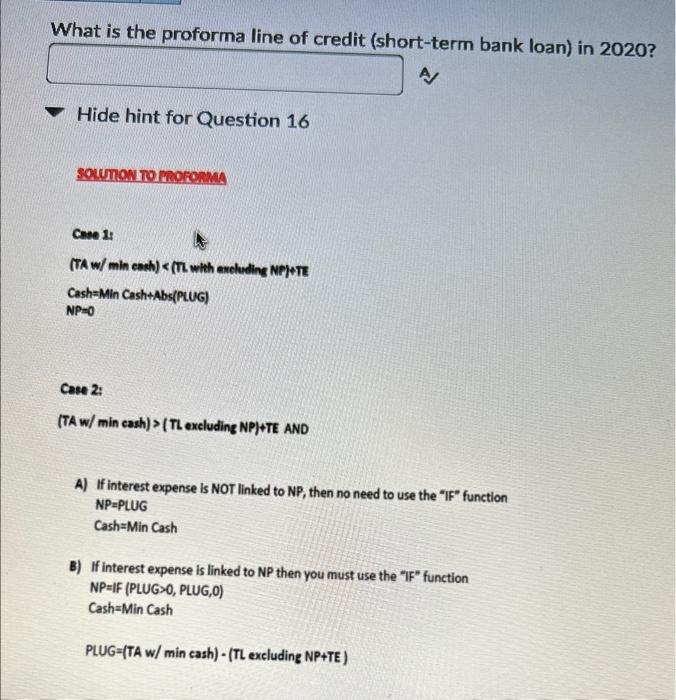

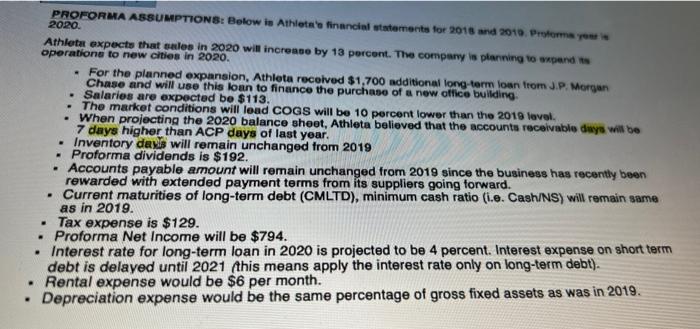

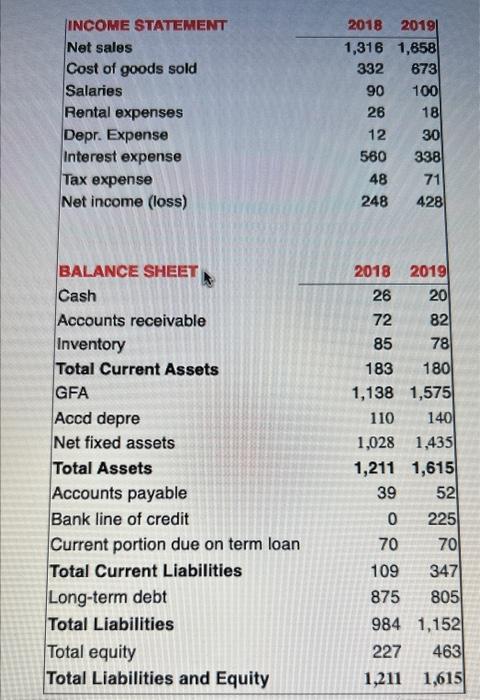

What is the proforma line of credit (chart-term bank loan) in 2020? Hide hint for Question 16 soumow to paronea Case 2: (TA w/ min eash) NP=0 Case 2: (TAw/min Cash )>(T excluding NP)+TE AND A) If interest expense is NoT linked to NP, then no need to use the "IF" function NP=PLUG Cash=Min Cash B) If interest expense is linked to NP then you must use the "IF" function NP=1F(PLGGO,PLUG,0) Cash = Min Cash PLUG=(TAw/ min cash) - (TL excluding NP+TE) PRORORMA A8SUSEPTIONS: Below is Athleta' financial wtatements for 2018 and 2010 . Broformo roe is 2020. Athlota expecte that sales in 2020 will increase by 13 percent. The company ia planning to axpend is oporatione to new cities in 2020 . - For the planned expansion, Athleta recolved \$1,700 additional long-term lown from J.P. Morgan Chase and will use this loan to finance the purchase of a new office buliding. - Salaries are expected be $113. - The market conditions will lead COGS will be 10 percent lower than the 2018 level. - When projecting the 2020 balance sheet, Athleta believed that the accounts receivable dwys whil be - Inventory davis will remain unchanged from 2019 - Proforma dividends is $192. - Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward. - Current maturities of long-term debt (CMLTD), minimum cash ratio (i.e. Cash/NS) will remain same as in 2019. - Tax expense is $129. - Proforma Net Income will be $794. - Interest rate for long-term loan in 2020 is projected to be 4 percent. Interest expense on short term debt is delayed until 2021 this means apply the interest rate only on long-term debt). - Rental expense would be $6 per month. Depreciation expense would be the same percentage of gross fixed assets as was in 2019. \begin{tabular}{|lrr|} \hline INCOME STATEMENT & 2018 & 2019 \\ \hline Net sales & 1,316 & 1,658 \\ Cost of goods sold & 332 & 673 \\ Salaries & 90 & 100 \\ Rental expenses & 26 & 18 \\ Depr. Expense & 12 & 30 \\ Interest expense & 560 & 338 \\ Tax expense & 48 & 71 \\ Net income (loss) & 248 & 428 \\ & & \\ BALANCE SHEEt & & \\ Cash & 2018 & 2019 \\ Accounts receivable & 26 & 20 \\ Inventory & 72 & 82 \\ Total Current Assets & 85 & 78 \\ GFA & 183 & 180 \\ Accd depre & 1,138 & 1,575 \\ Net fixed assets & 110 & 140 \\ Total Assets & 1,028 & 1,435 \\ Accounts payable & 1,211 & 1,615 \\ Bank line of credit & 39 & 52 \\ Current portion due on term loan & 0 & 225 \\ Total Current Liabilities & 70 & 70 \\ Long-term debt & 109 & 347 \\ Total Liabilities equity & 875 & 805 \\ Total Liabilities and Equity & 1,152 \\ \hline \end{tabular} What is the proforma line of credit (chart-term bank loan) in 2020? Hide hint for Question 16 soumow to paronea Case 2: (TA w/ min eash) NP=0 Case 2: (TAw/min Cash )>(T excluding NP)+TE AND A) If interest expense is NoT linked to NP, then no need to use the "IF" function NP=PLUG Cash=Min Cash B) If interest expense is linked to NP then you must use the "IF" function NP=1F(PLGGO,PLUG,0) Cash = Min Cash PLUG=(TAw/ min cash) - (TL excluding NP+TE) PRORORMA A8SUSEPTIONS: Below is Athleta' financial wtatements for 2018 and 2010 . Broformo roe is 2020. Athlota expecte that sales in 2020 will increase by 13 percent. The company ia planning to axpend is oporatione to new cities in 2020 . - For the planned expansion, Athleta recolved \$1,700 additional long-term lown from J.P. Morgan Chase and will use this loan to finance the purchase of a new office buliding. - Salaries are expected be $113. - The market conditions will lead COGS will be 10 percent lower than the 2018 level. - When projecting the 2020 balance sheet, Athleta believed that the accounts receivable dwys whil be - Inventory davis will remain unchanged from 2019 - Proforma dividends is $192. - Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward. - Current maturities of long-term debt (CMLTD), minimum cash ratio (i.e. Cash/NS) will remain same as in 2019. - Tax expense is $129. - Proforma Net Income will be $794. - Interest rate for long-term loan in 2020 is projected to be 4 percent. Interest expense on short term debt is delayed until 2021 this means apply the interest rate only on long-term debt). - Rental expense would be $6 per month. Depreciation expense would be the same percentage of gross fixed assets as was in 2019. \begin{tabular}{|lrr|} \hline INCOME STATEMENT & 2018 & 2019 \\ \hline Net sales & 1,316 & 1,658 \\ Cost of goods sold & 332 & 673 \\ Salaries & 90 & 100 \\ Rental expenses & 26 & 18 \\ Depr. Expense & 12 & 30 \\ Interest expense & 560 & 338 \\ Tax expense & 48 & 71 \\ Net income (loss) & 248 & 428 \\ & & \\ BALANCE SHEEt & & \\ Cash & 2018 & 2019 \\ Accounts receivable & 26 & 20 \\ Inventory & 72 & 82 \\ Total Current Assets & 85 & 78 \\ GFA & 183 & 180 \\ Accd depre & 1,138 & 1,575 \\ Net fixed assets & 110 & 140 \\ Total Assets & 1,028 & 1,435 \\ Accounts payable & 1,211 & 1,615 \\ Bank line of credit & 39 & 52 \\ Current portion due on term loan & 0 & 225 \\ Total Current Liabilities & 70 & 70 \\ Long-term debt & 109 & 347 \\ Total Liabilities equity & 875 & 805 \\ Total Liabilities and Equity & 1,152 \\ \hline \end{tabular}