Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the purpose of an audit performed by a CPA? Do audits signify to financial statement users that no fraud and embezzlement occurred at

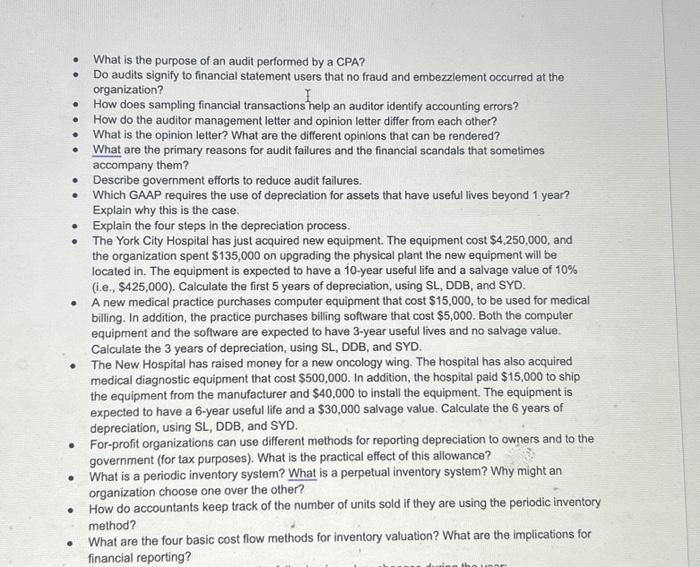

What is the purpose of an audit performed by a CPA?

Do audits signify to financial statement users that no fraud and embezzlement occurred at the organization?

How does sampling financial transactions help an auditor identify accounting errors?

How do the auditor management letter and opinion letter differ from each other?

What is the opinion letter?

What are the different opinions that can be rendered?

What are the primary reasons for audit failures and the financial scandals that sometimes accompany them?

Describe government efforts to reduce audit failures. Which GAAP requires the use of depreciation for assets that have useful lives beyond 1 year? Explain why this is the case.

Explain the four steps in the depreciation process. The York City Hospital has just acquired new equipment. The equipment cost $4,250,000, and the organization spent $135,000 on upgrading the physical plant the new equipment will be located in. The equipment is expected to have a 10-year useful life and a salvage value of 10% (i.e., $425,000). Calculate the first 5 years of depreciation, using SL, DDB, and SYD.

A new medical practice purchases computer equipment that cost $15,000, to be used for medical billing. In addition, the practice purchases billing software that cost $5,000. Both the computer equipment and the software are expected to have 3-year useful lives and no salvage value. Calculate the 3 years of depreciation, using SL, DDB, and SYD.

The New Hospital has raised money for a new oncology wing. The hospital has also acquired medical diagnostic equipment that cost $500,000. In addition, the hospital paid $15,000 to ship the equipment from the manufacturer and $40,000 to install the equipment. The equipment is expected to have a 6-year useful life and a $30,000 salvage value. Calculate the 6 years of depreciation, using SL, DDB, and SYD.

For-profit organizations can use different methods for reporting depreciation to owners and to the government (for tax purposes). What is the practical effect of this allowance? What is a periodic inventory system? What is a perpetual inventory system? Why might an organization choose one over the other?

How do accountants keep track of the number of units sold if they are using the periodic inventory method?

What are the four basic cost flow methods for inventory valuation? What are the implications for financial reporting? d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started