Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the Residual Income for Backpack Division after investing the $300,000 and based on this should the division adopt the new line? A complete

What is the Residual Income for Backpack Division after investing the $300,000 and based on this should the division adopt the new line? A complete answer should include a $ amount and a Yes or No.

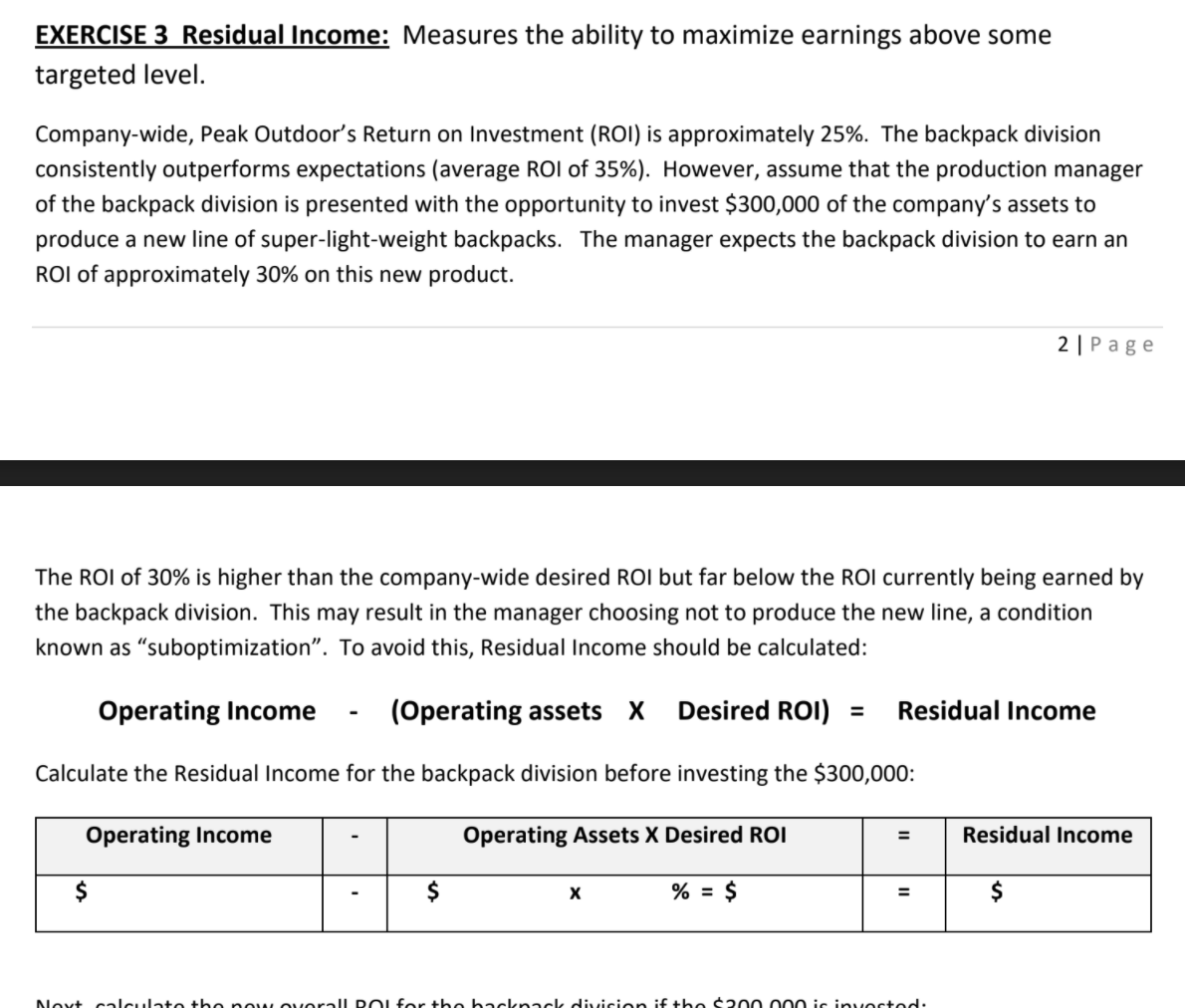

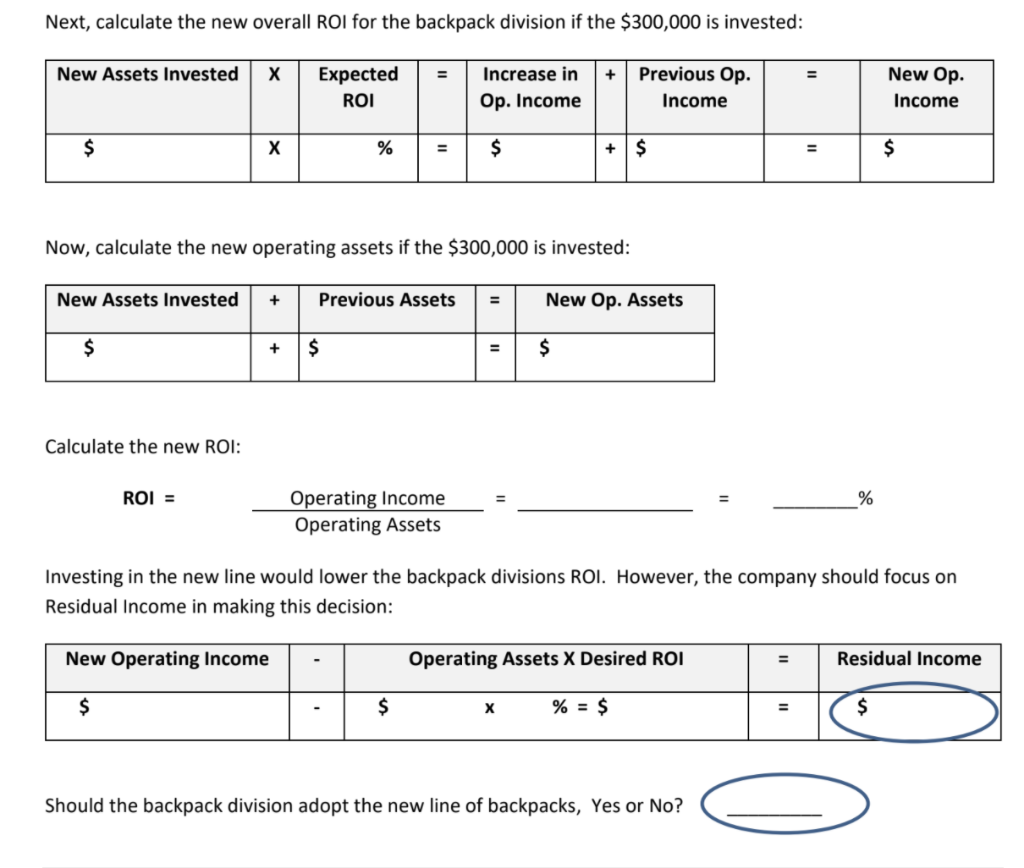

EXERCISE 3 Residual Income: Measures the ability to maximize earnings above some targeted level. Company-wide, Peak Outdoor's Return on Investment (ROI) is approximately 25%. The backpack division consistently outperforms expectations (average ROI of 35%). However, assume that the production manager of the backpack division is presented with the opportunity to invest $300,000 of the company's assets to produce a new line of super-light-weight backpacks. The manager expects the backpack division to earn an ROI of approximately 30% on this new product. 2 Page The ROI of 30% is higher than the company-wide desired ROI but far below the ROI currently being earned by the backpack division. This may result in the manager choosing not to produce the new line, a condition known as suboptimization. To avoid this, Residual Income should be calculated: Operating Income (Operating assets X Desired ROI) = Residual Income Calculate the Residual Income for the backpack division before investing the $300,000: Operating Income Operating Assets X Desired ROI = Residual Income $ % = $ = $ Maut calculate thenewavarall DOL for the baclonac division if the con noi investad. Next, calculate the new overall ROI for the backpack division if the $300,000 is invested: New Assets Invested = + New Op. Expected ROI Increase in Op. Income Previous Op. Income Income $ X % = $ + $ $ Now, calculate the new operating assets if the $300,000 is invested: New Assets Invested + Previous Assets = New Op. Assets $ + $ = $ Calculate the new ROI: ROI = % Operating Income Operating Assets Investing in the new line would lower the backpack divisions ROI. However, the company should focus on Residual income in making this decision: New Operating Income Operating Assets X Desired ROI Residual Income $ $ X % = $ = $ Should the backpack division adopt the new line of backpacks, Yes or NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started