Answered step by step

Verified Expert Solution

Question

1 Approved Answer

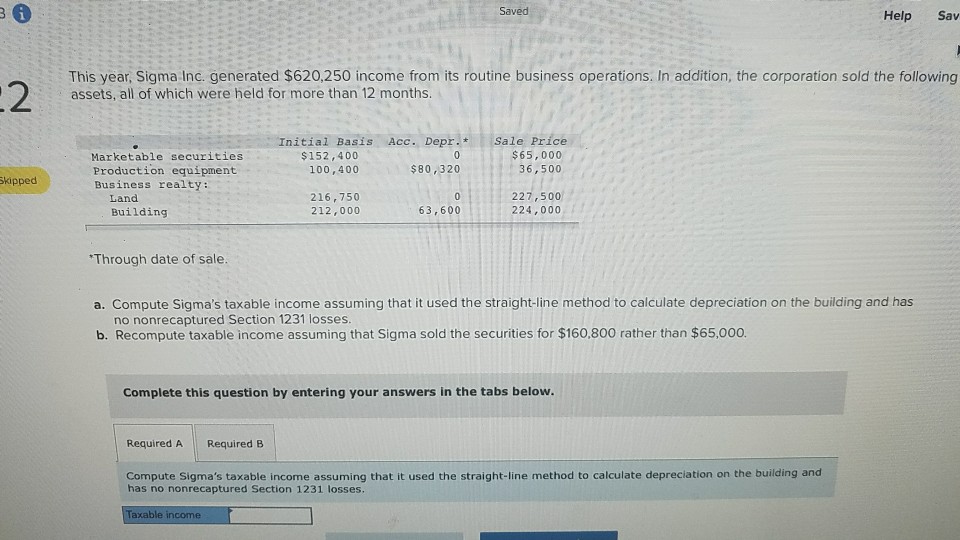

what is the solution and the steps for that question Saved Help Sav 2 This year, Sigma Inc. generated $620,250 income from its routine business

what is the solution and the steps for that question

Saved Help Sav 2 This year, Sigma Inc. generated $620,250 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months. Initial Basis Acc. Depr. Sale Price $65,000 Marketable securities Production equipment Business realty: $152,400 100,400 $80,320 36,500 Skipped Land Building 216,750 212,000 227,500 224,000 63,600 Through date of sale. a. Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. b. Recompute taxable income assuming that Sigma sold the securities for $160,800 rather than $65,000. Complete this question by entering your answers in the tabs below Required A Required B Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 lossesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started