Answered step by step

Verified Expert Solution

Question

1 Approved Answer

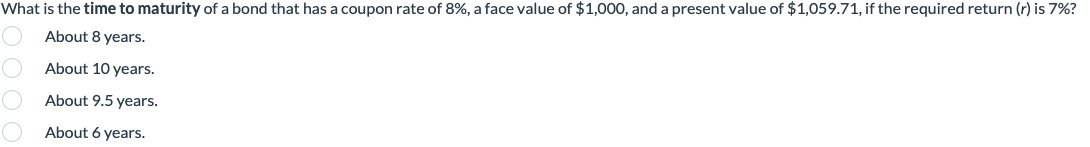

What is the time to maturity of a bond that has a coupon rate of 8%, a face value of $1,000, and a present value

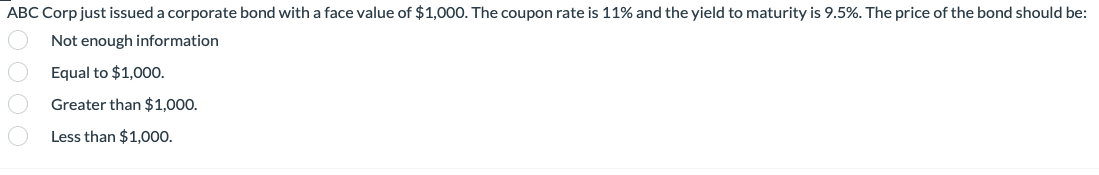

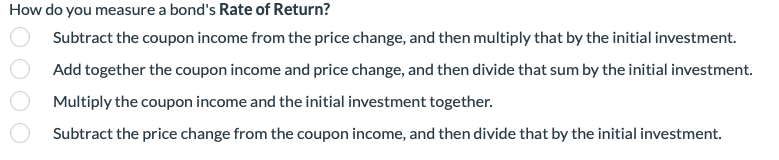

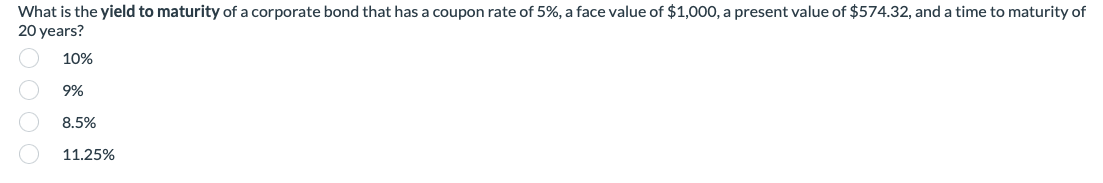

What is the time to maturity of a bond that has a coupon rate of 8%, a face value of $1,000, and a present value of $1,059.71, if the required return (r) is 7%? About 8 years. About 10 years. About 9.5 years. About 6 years. ABC Corp just issued a corporate bond with a face value of $1,000. The coupon rate is 11% and the yield to maturity is 9.5%. The price of the bond should be: Not enough information Equal to $1,000. Greater than $1,000. Less than $1,000. How do you measure a bond's Rate of Return? Subtract the coupon income from the price change, and then multiply that by the initial investment. Add together the coupon income and price change, and then divide that sum by the initial investment. Multiply the coupon income and the initial investment together. Subtract the price change from the coupon income, and then divide that by the initial investment. What is the yield to maturity of a corporate bond that has a coupon rate of 5%, a face value of $1,000, a present value of $574.32, and a time to maturity of 20 years? 10% 9% 8.5% 11.25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started