Answered step by step

Verified Expert Solution

Question

1 Approved Answer

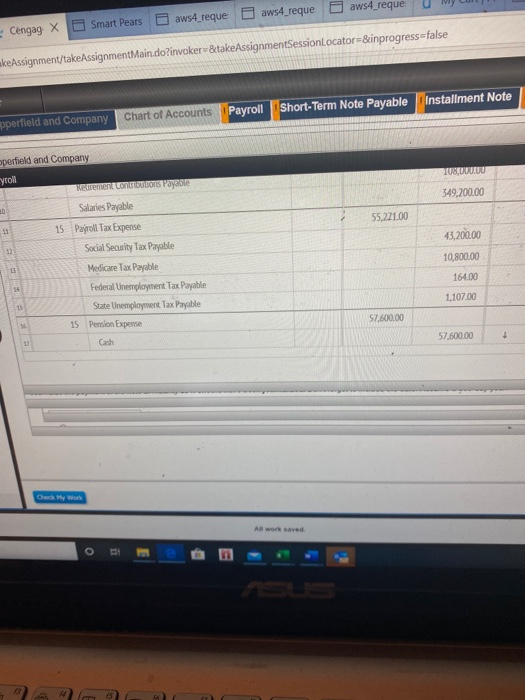

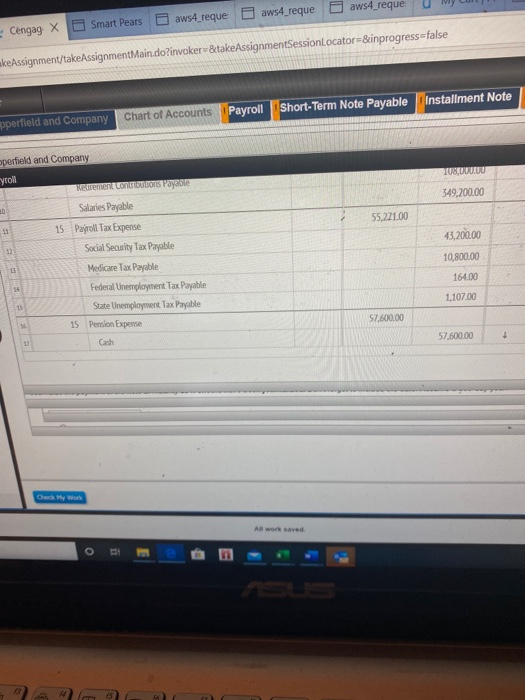

what is the total payroll expense for Copperfield and Company shown in these journal entries? what is Copperfield and Company's share of FICA taxes in

what is the total payroll expense for Copperfield and Company shown in these journal entries?

what is Copperfield and Company's share of FICA taxes in this payroll?

aws4_reque U my aws4_reque a ws4_reque Cengag X Smart Pears akeAssignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Short-Term Note Payable installment Note Chart of Accounts Payroll pperfield and Company perfield and Company yroll erement confort Payeste 349,200.00 Salaries Payable 55,271.00 15 43,200.00 31 10,800.00 164.00 Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable 15 Pension Expense Cash 1.107.00 57.600.00 57.600.00 Check My Work All work saved MO aws4_reque U my aws4_reque a ws4_reque Cengag X Smart Pears akeAssignment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Short-Term Note Payable installment Note Chart of Accounts Payroll pperfield and Company perfield and Company yroll erement confort Payeste 349,200.00 Salaries Payable 55,271.00 15 43,200.00 31 10,800.00 164.00 Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable 15 Pension Expense Cash 1.107.00 57.600.00 57.600.00 Check My Work All work saved MO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started