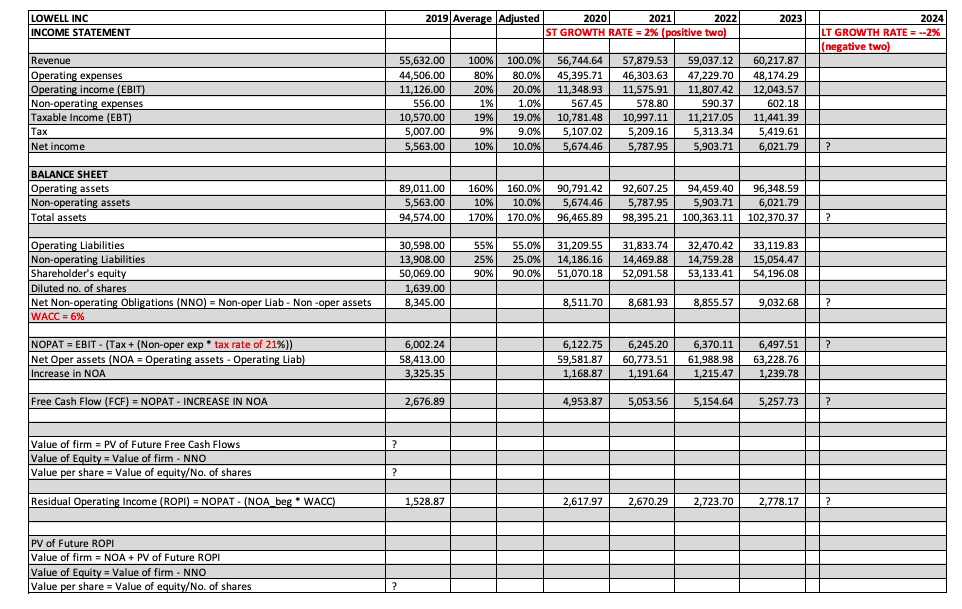

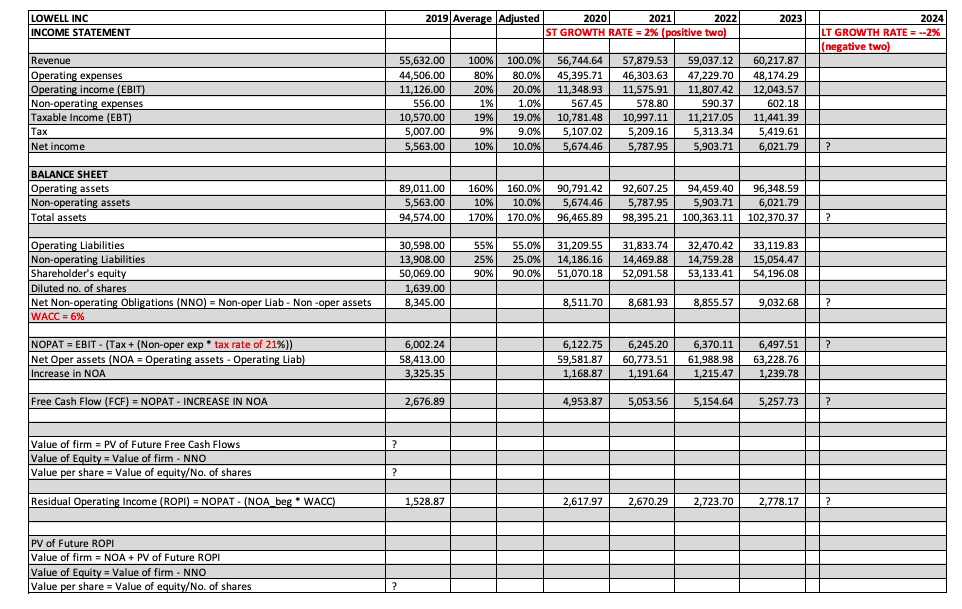

What is the value of the firm using the Free Cash Flow model for Lowell Inc.? Lowell Inc.pdf 84,876.92 O 1 2.93,230.72 None of the options provided 4.87,104.60 5. 88,827.32 LOWELL INC INCOME STATEMENT 2019 Average Adjusted 2023 2020 2021 2022 ST GROWTH RATE = 2% (positive two) 2024 LT GROWTH RATE = --2% (negative two) Revenue Operating expenses Operating income (EBIT) Non-operating expenses Taxable income (EBT) Tax 55,632.00 44,506.00 11,126.00 556.00 10,570.00 5,007.00 5,563.00 100% 80% 20% 1% 19% 9% 10% 100.0% 80.0% 20.0% 1.0% 19.0% 9.0% 10.0% 56,744.64 45,395.71 11,348.93 567.45 10,781.48 5.107.02 5,674.46 57,879.53 46,303.63 11,575.91 578.80 10,997.11 5.209.16 5,787.95 59,037.12 47.229.70 11,807.42 590.37 11,217.05 5,313.34 5,903.71 60,217.87 48,174.29 12,043,57 602.18 11.441.39 5.419,61 6,021.79 Net Income ? BALANCE SHEET Operating assets Non-operating assets Total assets 89,011.00 5,563.00 94,574.00 160% 160.0% 10% 10.0% 170% 170.0% 90,791.42 5,674.46 96,465.89 92,607.25 94,459,40 5,787.95 5,903.71 98,395.21 100,363.11 96,348,59 6,021.79 102,370.37 30,598.00 13,908.00 50,069.00 1,639.00 8,345.00 55% 25% 90% 55.0% 25.0% 90.0% 31.209.55 14,186.16 51,070.18 Operating Liabilities Non-operating Liabilities Shareholder's equity Diluted no. of shares Net Non-operating Obligations (NNO) = Non-oper Liab - Non-oper assets WACC = 6% 31.833.74 14.469.89 52,091.58 32,470.42 14,759.28 53,133.41 33.119.83 15,054.47 54,196.08 8,511.70 8,681.93 8,855.57 9,032.68 ? ? NOPAT = EBIT - (Tax + (Non-oper exp * tax rate of 21%)) Net Oper assets (NOA = Operating assets - Operating Liab) Increase in NOA 6,002.24 58,413.00 3,325.35 6,122.75 59,581.87 1,168.87 6,245.20 60,773.51 1,191.64 6,370.11 61,988.98 1,215.47 6,497.51 63,228.76 1,239.78 Free Cash Flow (FCF) - NOPAT - INCREASE IN NOA 2,676.89 4,953.87 5,053.56 5,154.64 5,257.73 ? ? Value of firm = PV of Future Free Cash Flows Value of Equity = Value of firm - NNO Value per share = Value of equity/No. of shares ? Residual Operating Income (ROPI) = NOPAT - (NOA beg * WACC) 1,528.87 2,617.97 2,670.29 2,723.70 2.778.17 PV of Future ROPI Value of firm = NOA + PV of Future ROPI Value of Equity = Value of firm - NNO Value per share = Value of equity/No. of shares