Answered step by step

Verified Expert Solution

Question

1 Approved Answer

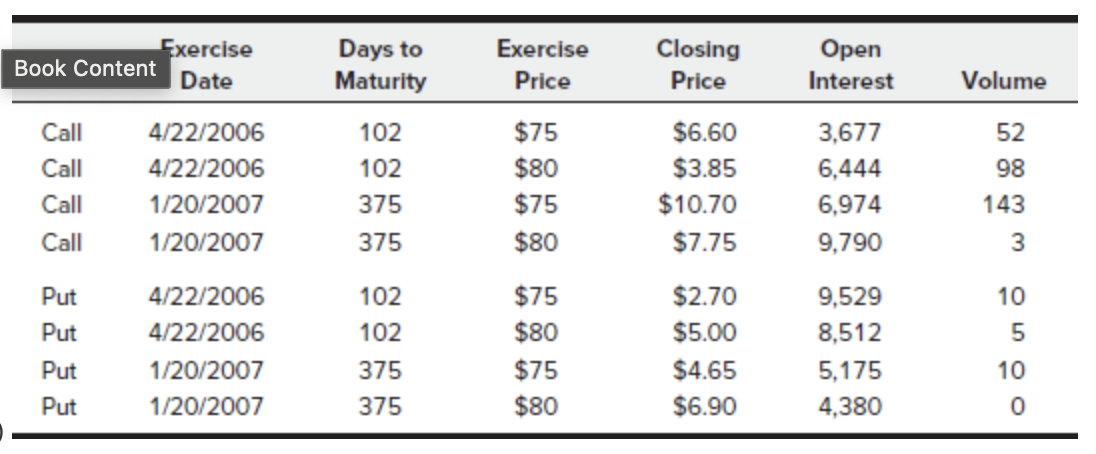

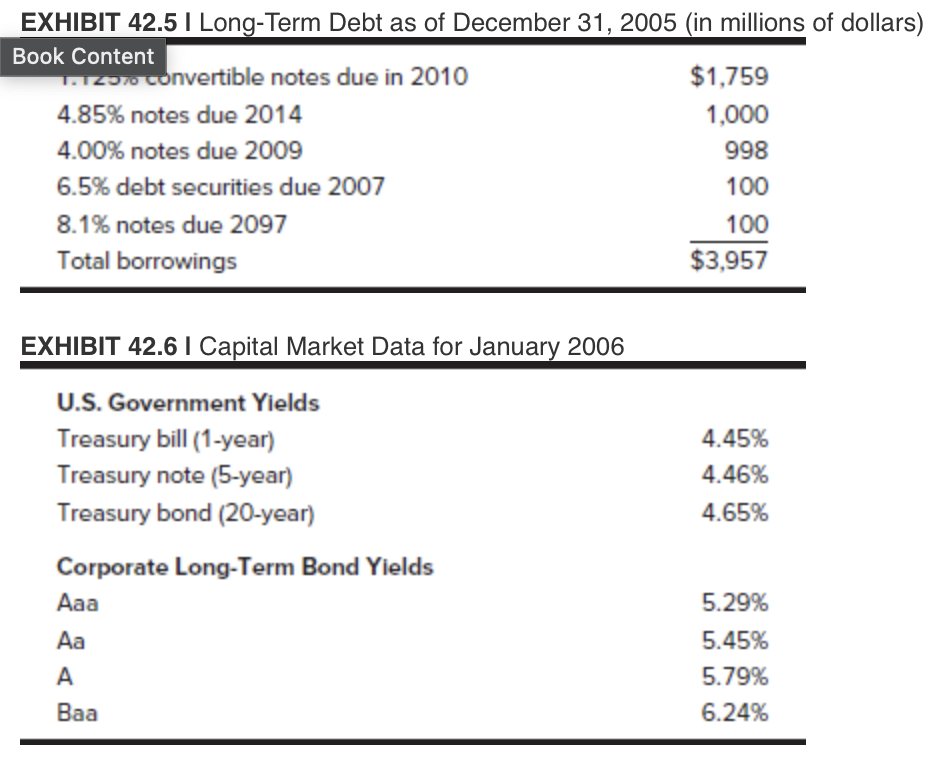

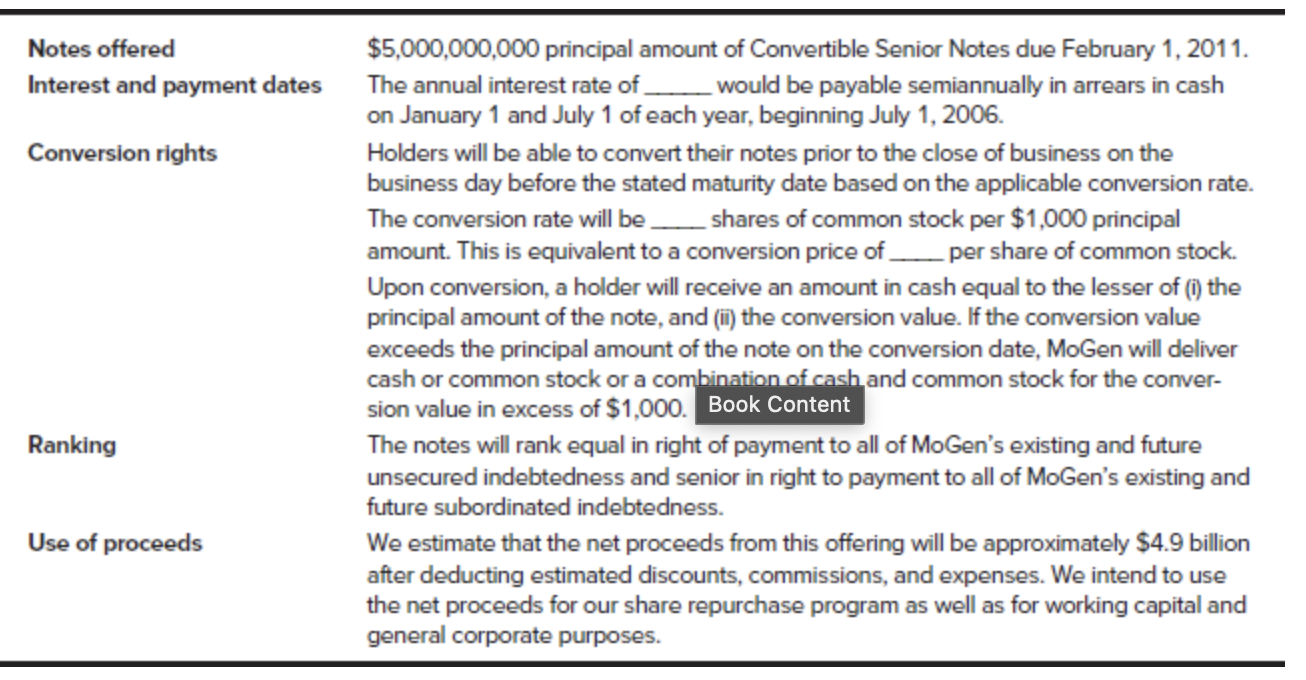

What is the value of the straight bond component? What coupon rate should Manaavi propose in order for the convert to sell at exactly $1,000

- What is the value of the straight bond component? What coupon rate should Manaavi propose in order for the convert to sell at exactly $1,000 per bond? What discount rate did you use to value the straight bond component? Conceptually, what should happen to the coupon rate if Manaavi were to propose a 15% conversion premium? a 40% conversion premium?

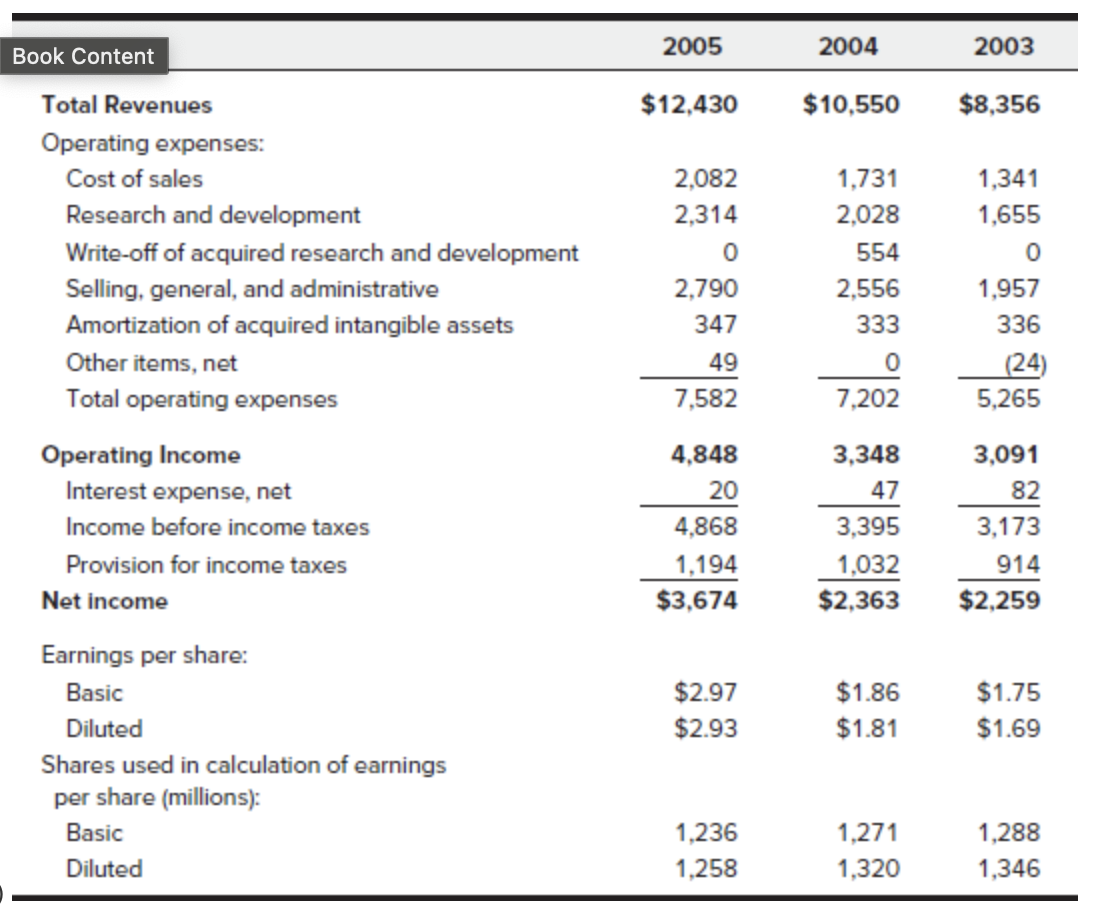

2005 2004 2003 Book Content Total Revenues $12,430 $10,550 $8,356 Operating expenses: Cost of sales 2,082 1,731 1,341 Research and development 2,314 2,028 1,655 Write-off of acquired research and development 0 554 0 Selling, general, and administrative 2,790 2,556 1,957 Amortization of acquired intangible assets 347 333 336 Other items, net 49 0 (24) Total operating expenses 7,582 7,202 5,265 Operating Income 4,848 3,348 3,091 Interest expense, net 20 47 82 Income before income taxes 4,868 3,395 3,173 Provision for income taxes 1,194 1,032 914 Net income $3,674 $2,363 $2,259 Earnings per share: Basic $2.97 $1.86 $1.75 Diluted $2.93 $1.81 $1.69 Shares used in calculation of earnings per share (millions): Basic 1,236 1,271 1,288 Diluted 1,258 1,320 1,346

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to determine the value of the straight bond component and then calculate the appropriate coupon rate for the convertible ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started