Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the value using the sales approach What is the value using the income approach What is the value using cost approach What is

What is the value using the sales approach

What is the value using the income approach

What is the value using cost approach

What is the final determination of value

I NEED THE ANSWER BY 11/9/2021 AT 9PM, will venmo 10$ for someone to answer it

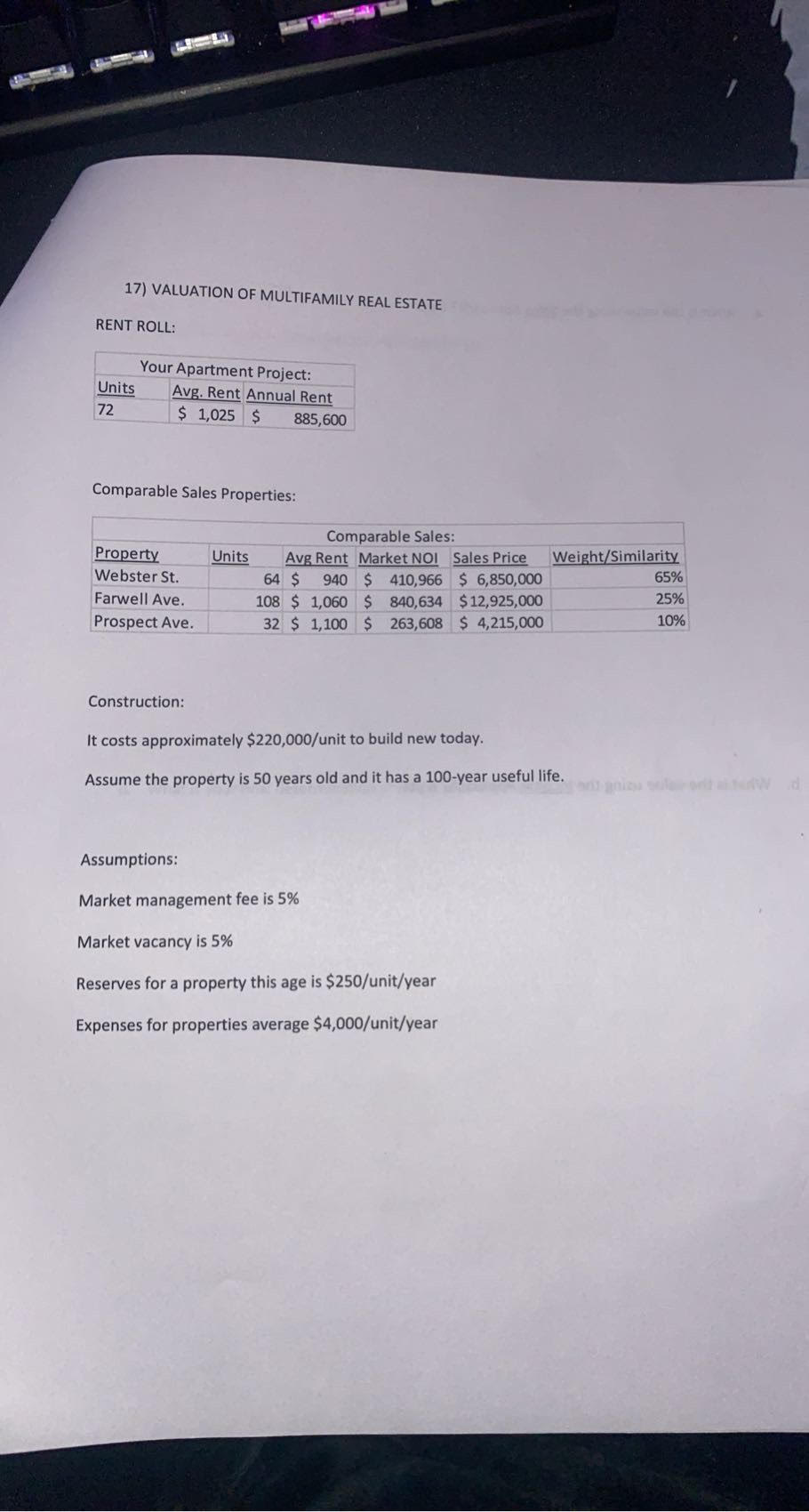

17) VALUATION OF MULTIFAMILY REAL ESTATE RENT ROLL: Your Apartment Project: Units Avg. Rent Annual Rent 72 $ 1,025 $ 885,600 Comparable Sales Properties: Units Property Webster St. Farwell Ave. Prospect Ave. Comparable Sales: Avg Rent Market NOI Sales Price 64 $ 940 $ 410,966 $ 6,850,000 108 $ 1,060 $ 840,634 $ 12,925,000 32 $ 1,100 $ 263,608 $ 4,215,000 Weight/Similarity 65% 25% 10% Construction: It costs approximately $220,000/unit to build new today. Assume the property is 50 years old and it has a 100-year useful life. Assumptions: Market management fee is 5% Market vacancy is 5% Reserves for a property this age is $250/unit/year Expenses for properties average $4,000/unit/year 17) VALUATION OF MULTIFAMILY REAL ESTATE RENT ROLL: Your Apartment Project: Units Avg. Rent Annual Rent 72 $ 1,025 $ 885,600 Comparable Sales Properties: Units Property Webster St. Farwell Ave. Prospect Ave. Comparable Sales: Avg Rent Market NOI Sales Price 64 $ 940 $ 410,966 $ 6,850,000 108 $ 1,060 $ 840,634 $ 12,925,000 32 $ 1,100 $ 263,608 $ 4,215,000 Weight/Similarity 65% 25% 10% Construction: It costs approximately $220,000/unit to build new today. Assume the property is 50 years old and it has a 100-year useful life. Assumptions: Market management fee is 5% Market vacancy is 5% Reserves for a property this age is $250/unit/year Expenses for properties average $4,000/unit/yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started