Answered step by step

Verified Expert Solution

Question

1 Approved Answer

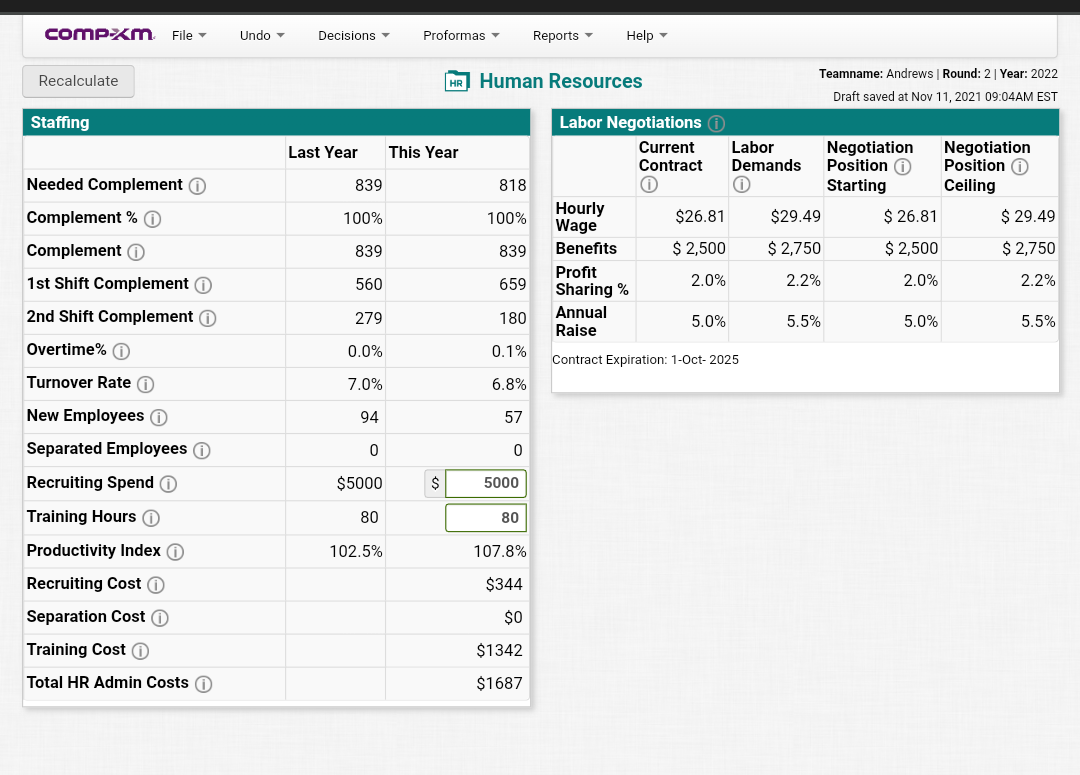

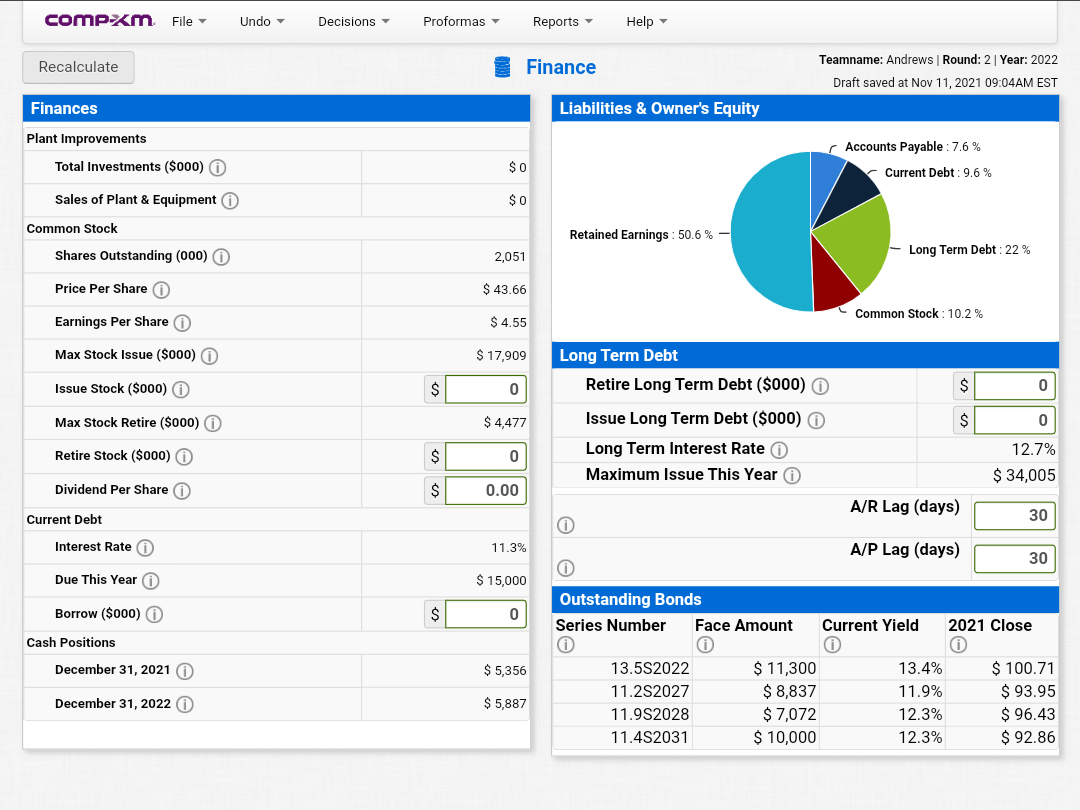

what numbers should I input? COMPxm File Undo Decisions Proformas Reports Help Recalculate HR] Human Resources Teamname: Andrews Round: 2 Year: 2022 Draft saved at

what numbers should I input?

COMPxm File Undo Decisions Proformas Reports Help Recalculate HR] Human Resources Teamname: Andrews Round: 2 Year: 2022 Draft saved at Nov 11, 2021 09:04AM EST Staffing Labor Negotiations Current Contract Last Year This Year 839 818 Needed Complement Complement % 0 Labor Negotiation Demands Position Starting $29.49 $26.81 Negotiation Position Ceiling $ 29.49 100% 100% $26.81 Complement 839 839 $ 2,500 $ 2,750 $ 2,500 $ 2,750 Hourly Wage Benefits Profit Sharing % Annual Raise 560 659 2.0% 2.2% 2.0% 2.2% 1st Shift Complemento 2nd Shift Complemento 279 180 5.0% 5.5% 5.0% 5.5% Overtime% 0.0% 0.1% Contract Expiration: 1-Oct-2025 Turnover Rate 7.0% 6.8% 94 24 57 New Employees Separated Employees o 0 0 $5000 $ 5000 Recruiting Spend o Training Hours 80 80 102.5% 107.8% Productivity Index 0 Recruiting Cost O $344 $0 Separation Cost Training Cost o $1342 Total HR Admin Costs $1687 COMPxm File Undo Decisions Proformas Reports Help Recalculate Finance Teamname: Andrews Round: 2 Year: 2022 Draft saved at Nov 11, 2021 09:04AM EST Finances Liabilities & Owner's Equity Plant Improvements Total Investments ($000) r Accounts Payable : 7.6% $0 Current Debt: 9.6% Sales of Plant & Equipment $ 0 Common Stock Retained Earnings : 50.6 % - Shares Outstanding (000) 2,051 Long Term Debt: 22 % Price Per Share on $ 43.66 Common Stock: 10.2% Earnings Per Share $ 4.55 Max Stock Issue ($000) $ 17,909 Long Term Debt Issue Stock ($000) O $ 0 $ 0 Max Stock Retire ($000) $ 4,477 $ 0 Retire Long Term Debt ($000) O Issue Long Term Debt ($000) Long Term Interest Rate Maximum Issue This Year Retire Stock ($000) $ 0 12.7% $ 34,005 Dividend Per Share o $ 0.00 A/R Lag (days) Current Debt 30 Interest Rate 11.3% A/P Lag (days) 30 Due This Year $ 15,000 Borrow ($000) $ 0 Cash Positions December 31, 2021 $ 5,356 Outstanding Bonds Series Number Face Amount Current Yield 2021 Close 0 13.552022 $ 11,300 13.4% $ 100.71 11.252027 $ 8,837 11.9% $ 93.95 11.9S2028 $ 7,072 12.3% $ 96.43 11.452031 $ 10,000 12.3% $ 92.86 December 31, 2022 $ 5,887 COMPxm File Undo Decisions Proformas Reports Help Recalculate HR] Human Resources Teamname: Andrews Round: 2 Year: 2022 Draft saved at Nov 11, 2021 09:04AM EST Staffing Labor Negotiations Current Contract Last Year This Year 839 818 Needed Complement Complement % 0 Labor Negotiation Demands Position Starting $29.49 $26.81 Negotiation Position Ceiling $ 29.49 100% 100% $26.81 Complement 839 839 $ 2,500 $ 2,750 $ 2,500 $ 2,750 Hourly Wage Benefits Profit Sharing % Annual Raise 560 659 2.0% 2.2% 2.0% 2.2% 1st Shift Complemento 2nd Shift Complemento 279 180 5.0% 5.5% 5.0% 5.5% Overtime% 0.0% 0.1% Contract Expiration: 1-Oct-2025 Turnover Rate 7.0% 6.8% 94 24 57 New Employees Separated Employees o 0 0 $5000 $ 5000 Recruiting Spend o Training Hours 80 80 102.5% 107.8% Productivity Index 0 Recruiting Cost O $344 $0 Separation Cost Training Cost o $1342 Total HR Admin Costs $1687 COMPxm File Undo Decisions Proformas Reports Help Recalculate Finance Teamname: Andrews Round: 2 Year: 2022 Draft saved at Nov 11, 2021 09:04AM EST Finances Liabilities & Owner's Equity Plant Improvements Total Investments ($000) r Accounts Payable : 7.6% $0 Current Debt: 9.6% Sales of Plant & Equipment $ 0 Common Stock Retained Earnings : 50.6 % - Shares Outstanding (000) 2,051 Long Term Debt: 22 % Price Per Share on $ 43.66 Common Stock: 10.2% Earnings Per Share $ 4.55 Max Stock Issue ($000) $ 17,909 Long Term Debt Issue Stock ($000) O $ 0 $ 0 Max Stock Retire ($000) $ 4,477 $ 0 Retire Long Term Debt ($000) O Issue Long Term Debt ($000) Long Term Interest Rate Maximum Issue This Year Retire Stock ($000) $ 0 12.7% $ 34,005 Dividend Per Share o $ 0.00 A/R Lag (days) Current Debt 30 Interest Rate 11.3% A/P Lag (days) 30 Due This Year $ 15,000 Borrow ($000) $ 0 Cash Positions December 31, 2021 $ 5,356 Outstanding Bonds Series Number Face Amount Current Yield 2021 Close 0 13.552022 $ 11,300 13.4% $ 100.71 11.252027 $ 8,837 11.9% $ 93.95 11.9S2028 $ 7,072 12.3% $ 96.43 11.452031 $ 10,000 12.3% $ 92.86 December 31, 2022 $ 5,887Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started