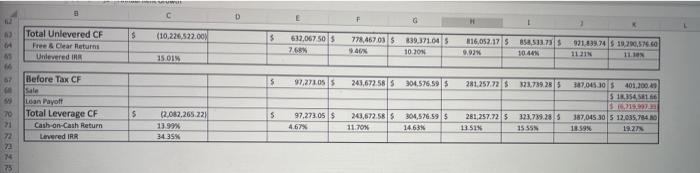

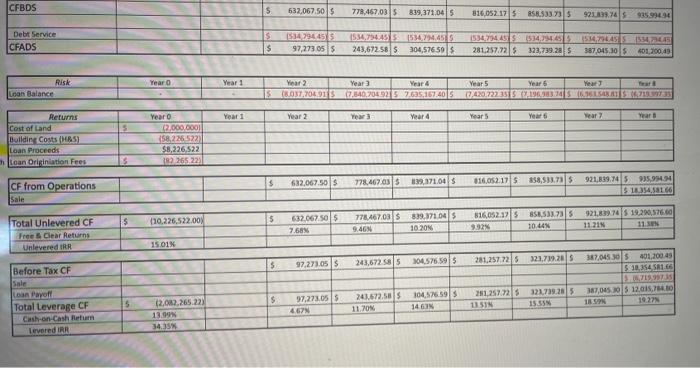

what % of the levered irr (34.35%) comes from cash flow from operations and what % is coming from the sale of the property

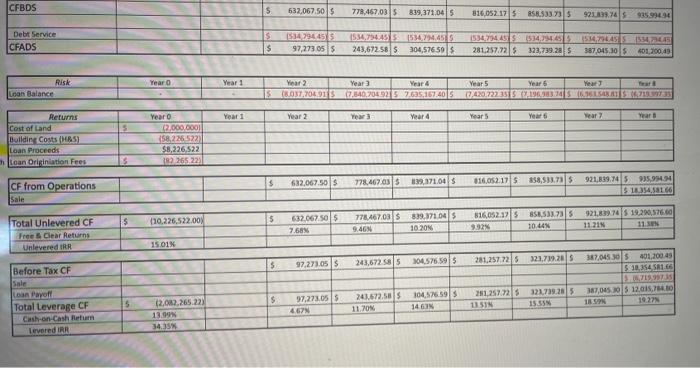

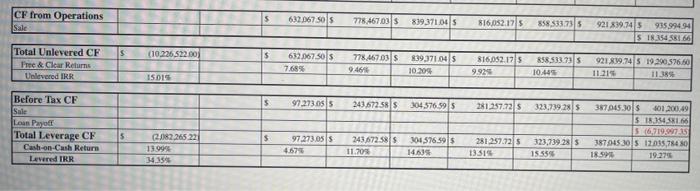

Cash Flow Disposition Levered IRR 34.35% CFBDS 5 632,067505 778,467,035 839,371,0415 816,052.175 858.533735 92139.74 935.9494 Debt Service CFADS $ 153479445) 97,273 055 1534,74451534,744515 243,672.58S 304,576.50 1534794455 281.257.7215 1534 H 323,739.28 387.04.10 401,200.45 Year o Year 1 Risk Loan Balance Year 2 (BO37,7049115 Year Year 17.540,704925 7.635, 167.405 Year 5 Year Year 7,420.722351519683745 635 SAORALSTS Year 1 Year 2 Years Years wear Year Returns Cost of Land Building Costs (5) Loan Proceeds Loan Origination Fees Year 02.000.000 (58,2265223 $8,226 522 182.265.221 5 $ 632,067.50 778.4670 139.171.00 $ 016.052.17 5 358,533.73 CF from Operations Sale 921.839.745 935,95 51.354.58166 $ (10.226,522.00) $ 632.067.505 7.68 778.467.03 $ 9.46 899,3710$ 10.20% 16.052.325 9.92 SSS33.735 10.44 921,839745 19.290,576.60 11.21 Total Unlevered CF Free Clear Returns Unlevered ERR 15.01% $ 243,672 585 97,273.05 321,739.2015 4576 595 281.257.7215 Before Tax CF Isale Loan Payot Total Leverage CF Cash-on Cash Return Levered IRR 317,04530s 401,200.49 $ 10,545R16 1997 367,04530 5 12.187.00 18 1927 104.5765915 $ 251.257.7215 11 241.672.58 11. 97.273.05 467 5 321739.285 15.55 12.012, 265223 13.99 34 35 14.63 CF from Operations Sale $ 632.67 sols 778,467,035 839371045 816,052.1715 858333.735 92139.7415 935 9944 S 18.354 581 66 $ (10.226.522.00) $ 6320675015 Total Unlevered CF Free & Clear Returns Unlevered IRR 778.467.03 9.46 839371045 10-209 816,032.175 9.929 858,533.735 10:44 921819.745 19.290,576.50 11:21 11.385 15015 97.273.05 243.572585 304 376.59 5 281.257.72 323.739 285 Before Tax CF Sale Loan Payoff Total Leverage CE Cash on-Cush Return Levered TRR 387045.301 301,200,49 S 18354 S. 56,719.07.15 387045 305 12015,7840 18.5 19.27 5 $ 2.182.265.221 13.99% 3435 97.273.05 4.57 243,672.585 11.709 104576.59 $ 14.635 281.257.7215 13515 323,739 2815 15.5595 G 9 1 $ (10,226,522.00% $ Total Unlevered CF Free Clear Returns Unteered 632,067505 2.63% 778,46703 140 839.371.00 5 SELESS 16.05.17 S 0.02% NOCOL 10.40 971.43745 19.230,576.60 1121 111 15.01 67 5 97,271.055 243,672.5815 304.576.59 $ 281.257.725 23.739.285 25 SS3 BERS Before Tax CF Sale Loan Payott Total Leverage CF Cash on-Cash Return Lured IRR 387.043015 401,200.00 51154 S, 387,045 30 5 12.015, 764 192 ES 70 $ $ 12 02.082,265.221 13.99% 34.35% 97.273.05 4.67% 243,672.58 11.70% 323.779.285 304,576.59 $ 14635 281.257.725 13 SIN NSS ST NOSE 72 12 Cash Flow Disposition Levered IRR 34.35% CFBDS 5 632,067505 778,467,035 839,371,0415 816,052.175 858.533735 92139.74 935.9494 Debt Service CFADS $ 153479445) 97,273 055 1534,74451534,744515 243,672.58S 304,576.50 1534794455 281.257.7215 1534 H 323,739.28 387.04.10 401,200.45 Year o Year 1 Risk Loan Balance Year 2 (BO37,7049115 Year Year 17.540,704925 7.635, 167.405 Year 5 Year Year 7,420.722351519683745 635 SAORALSTS Year 1 Year 2 Years Years wear Year Returns Cost of Land Building Costs (5) Loan Proceeds Loan Origination Fees Year 02.000.000 (58,2265223 $8,226 522 182.265.221 5 $ 632,067.50 778.4670 139.171.00 $ 016.052.17 5 358,533.73 CF from Operations Sale 921.839.745 935,95 51.354.58166 $ (10.226,522.00) $ 632.067.505 7.68 778.467.03 $ 9.46 899,3710$ 10.20% 16.052.325 9.92 SSS33.735 10.44 921,839745 19.290,576.60 11.21 Total Unlevered CF Free Clear Returns Unlevered ERR 15.01% $ 243,672 585 97,273.05 321,739.2015 4576 595 281.257.7215 Before Tax CF Isale Loan Payot Total Leverage CF Cash-on Cash Return Levered IRR 317,04530s 401,200.49 $ 10,545R16 1997 367,04530 5 12.187.00 18 1927 104.5765915 $ 251.257.7215 11 241.672.58 11. 97.273.05 467 5 321739.285 15.55 12.012, 265223 13.99 34 35 14.63 CF from Operations Sale $ 632.67 sols 778,467,035 839371045 816,052.1715 858333.735 92139.7415 935 9944 S 18.354 581 66 $ (10.226.522.00) $ 6320675015 Total Unlevered CF Free & Clear Returns Unlevered IRR 778.467.03 9.46 839371045 10-209 816,032.175 9.929 858,533.735 10:44 921819.745 19.290,576.50 11:21 11.385 15015 97.273.05 243.572585 304 376.59 5 281.257.72 323.739 285 Before Tax CF Sale Loan Payoff Total Leverage CE Cash on-Cush Return Levered TRR 387045.301 301,200,49 S 18354 S. 56,719.07.15 387045 305 12015,7840 18.5 19.27 5 $ 2.182.265.221 13.99% 3435 97.273.05 4.57 243,672.585 11.709 104576.59 $ 14.635 281.257.7215 13515 323,739 2815 15.5595 G 9 1 $ (10,226,522.00% $ Total Unlevered CF Free Clear Returns Unteered 632,067505 2.63% 778,46703 140 839.371.00 5 SELESS 16.05.17 S 0.02% NOCOL 10.40 971.43745 19.230,576.60 1121 111 15.01 67 5 97,271.055 243,672.5815 304.576.59 $ 281.257.725 23.739.285 25 SS3 BERS Before Tax CF Sale Loan Payott Total Leverage CF Cash on-Cash Return Lured IRR 387.043015 401,200.00 51154 S, 387,045 30 5 12.015, 764 192 ES 70 $ $ 12 02.082,265.221 13.99% 34.35% 97.273.05 4.67% 243,672.58 11.70% 323.779.285 304,576.59 $ 14635 281.257.725 13 SIN NSS ST NOSE 72 12