Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What tax treatment applies to gains and losses on Sec. 1244 stock? COR O A. Losses on the sale or worthlessness of Sec. 1244 stock

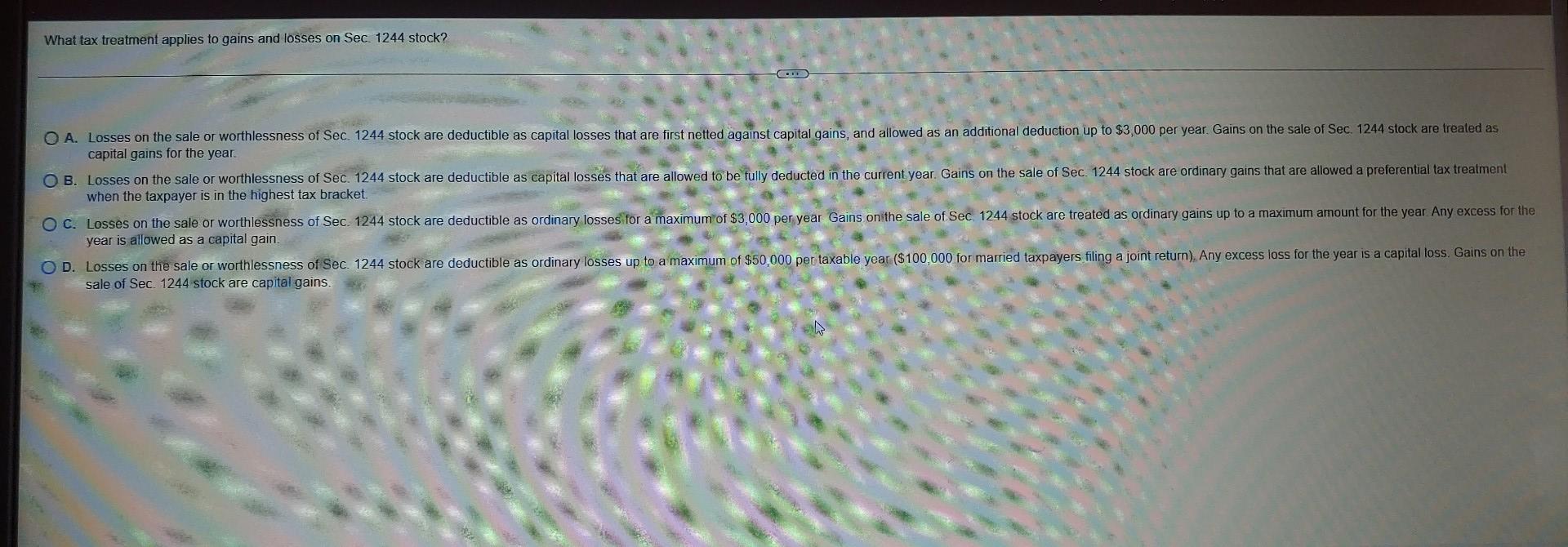

What tax treatment applies to gains and losses on Sec. 1244 stock? COR O A. Losses on the sale or worthlessness of Sec. 1244 stock are deductible as capital losses that are first netted against capital gains, and allowed as an additional deduction up to $3,000 per year. Gains on the sale of Sec. 1244 stock are treated as capital gains for the year. O B. Losses on the sale or worthlessness of Sec. 1244 stock are deductible as capital losses that are allowed to be fully deducted in the current year. Gains on the sale of Sec. 1244 stock are ordinary gains that are allowed a preferential tax treatment when the taxpayer is in the highest tax bracket. O C. Losses on the sale or worthlessness of Sec. 1244 stock are deductible as ordinary losses for a maximum of $3,000 per year Gains on the sale of Sec 1244 stock are treated as ordinary gains up to a maximum amount for the year Any excess for the year is allowed as a capital gain. OD. Losses on the sale or worthlessness of Sec. 1244 stock are deductible as ordinary losses up to a maximum of $50,000 per taxable year ($100,000 for married taxpayers filing a joint return), Any excess loss for the year is a capital loss. Gains on the sale of Sec. 1244 stock are capital gains

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started