Question

What would be the company's(Wm. Wrigley Jr.) WACC after the proposed leverage recapitalization if it could maintain BBB debt rating (using 20-year treasury yield as

What would be the company's(Wm. Wrigley Jr.) WACC after the proposed leverage recapitalization if it could maintain "BBB" debt rating (using 20-year treasury yield as the risk-free rate and new beta of 0.87)?

8.09%

10.64%

10.95%

The cost of equity capital after the proposed leveraged recapitalization using 20-year treasury yield as the risk-free rate (new beta would be 0.87) has to be either:

10.9%

11.7%

13.0%

Potential Formulas

WACC = [(E/V) * Re] + [(D/V) * Rd * (1-Tc)]

E/V - Proportion of equity-based financing ; D/V - Proportion of debt-based financing

E - Market value of the firms equity; D - Market value of the firms debt

V - E + D ; Re - Cost of equity ; Rd - Cost of debt ; Tc - Corporate tax rate

Rf - Risk free rate ; B - Beta ; Rm - Market rate

Hint: Try to use the market value of equity to compute the equity weight.

I don't want an answer unless its one of the above.

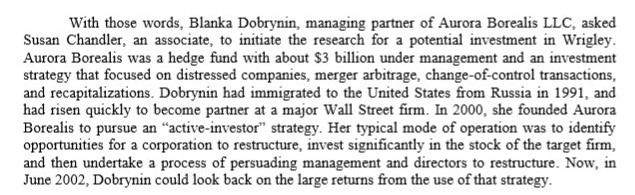

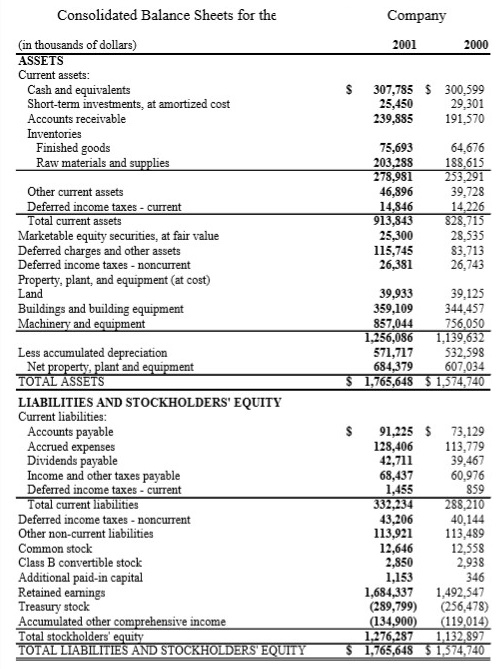

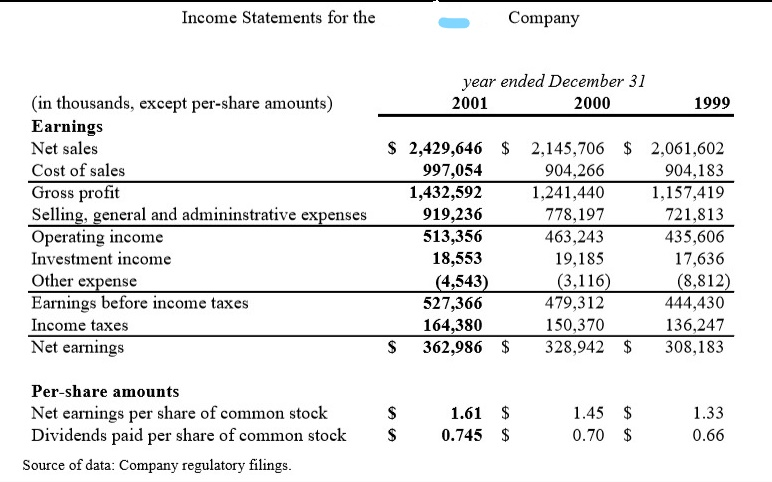

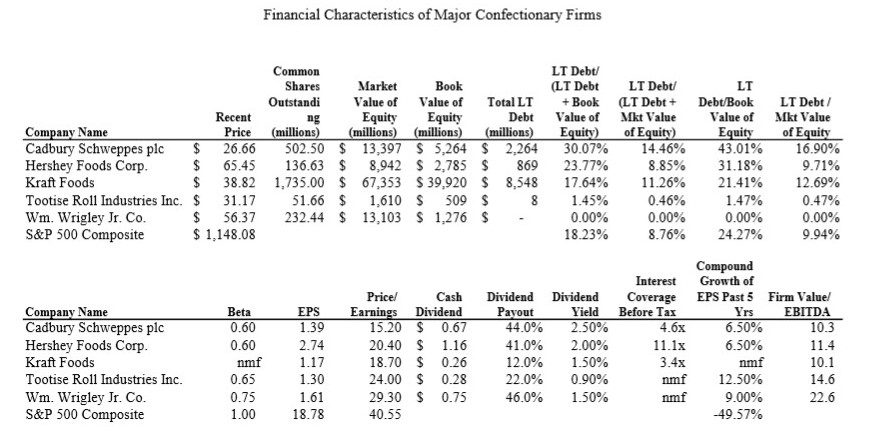

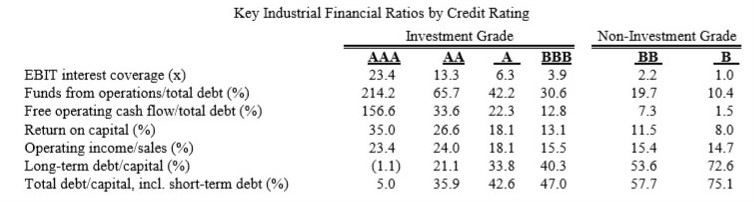

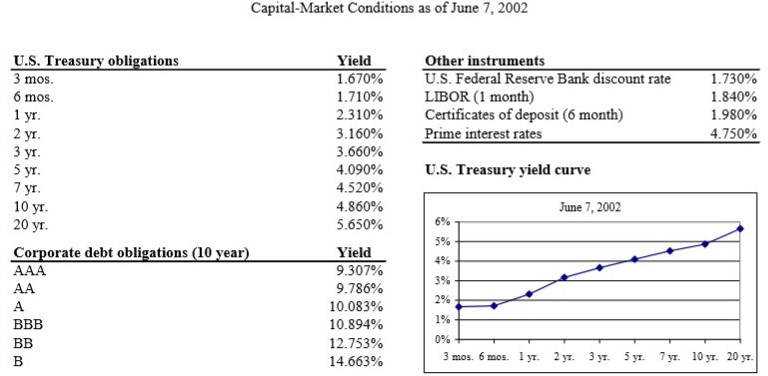

With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley. Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. Chandler noted that Wrigley's market value of common equity was about $13.1 billion. Dobrynin and Chandler discussed the current capital-market conditions and decided to focus on the assumption that Wrigley could borrow S3 billion at a credit rating between BB and B, to yield 13%. Chandler agreed to return soon to discuss the results of her research. The William Wrigley Jr. Company Wrigley was the world's largest manufacturer and distributor of chewing gum. The firm's industry, branded consumer foods and candy, was intensely competitive and was dominated by a gives product profiles of Wrigley and its pees, Over the preceding two years, revenues had grown at an annual compound rate of 10% (earnings at 9%), reflecting Historically, the firm had been conservatively financed. At the end of2001, it had total assets of $1.76 billion and no debt shows, Wrigley's stock price had significantly outperformed the S&P few large playcrs. the introduction of new products and foreign expansiorn 500 Composite Index, and was running slightly ahead of its industry index As Estimating the Effect of a Leveraged Recapitalization Under the proposed leveraged recapitalization, Wrigley would borrow S3 billion and use it either to pay an equivalent dividend or to repurchase an equivalent value of shares. Chandler knew that this combination of actions could affect the firm's share value, cost of capital, debt coverage, earnings per share, and voting control. Accordingly, she sought to evaluate the effect of the recapitalization on those areas. She gathered financial data on Wrigley and its peer companics Impact on share value Chandler recalled that the effect of leverage on a firm could be modeled by using the adjusted present-value formula, which hypothesized that debt increased the value of a firm by means of shielding cash flows from taxes. Thus, the present value of debt tax shields could be added to the value of the unlevered firm to yield the value of the levered enterprise. The marginal tax rate Chandler proposed to use was 40%, reflecting the sum of federal, state, and local taxes. Impact on debt rating A key assumption in the analysis would be the debt rating for Wrigley, after assuming S3 billion in debt, and whether the firm could cover the resulting interest payments. Dobrynin had suggested that Chandler should assume Wrigley would borrow $3 billion at a rating between BB and B. Was a rating of BB/B likely? In that regard, Chandler gathered information on the average financial ratios associated with different debt-rating categories thought that Wrigley's pretax cost of debt would be around 13%. Chandler sought to check that assumption against the capital-market information given in Dobrynin Impact on cost of capital Chandler knew hat the maximum value of the firm was achieved when the weighted average cost of capital (WACC) was minimized. Thus, she intended to estimate what the cost of equity and the WACC might be, if Wrigley pursued this capital-structure change. The projected cost of debt would depend on her assessment of Wrigley's debt rating after recapitalization and on current capital-market rates The cost of equity (Kr) could be estimated by using the capital asset pricing model. gives yields on U.S. Treasury instruments, which afforded possible estimates of the risk-free rate of return. The practice at Aurora Borealis was to use an equity-market risk premium of 7.0%. Wrigley's beta would also need to be relevered to reflect the projected recapitalization. Chandler wondered whether her analysis covered everything. Where, for instance, should she take into account potential costs of bankruptcy and distress or the effects of leverage as a signal about future operations? More leverage would also create certain constraints and incentives for management. Where should those be reflected in her analysis? Impact on reported earnings per share Chandler intended to estimate the expected effect on earnings per share (EPS) that would occur at different levels of operating income (EBIT) with a change in leverage. The heginnings of an EBIT EPS analysis are presented in Estimating the Effect of a Leveraged Recapitalization Under the proposed leveraged recapitalization, Wrigley would borrow S3 billion and use it either to pay an equivalent dividend or to repurchase an equivalent value of shares. Chandler knew that this combination of actions could affect the firm's share value, cost of capital, debt coverage, earnings per share, and voting control. Accordingly, she sought to evaluate the effect of the recapitalization on those areas. She gathered financial data on Wrigley and its peer comparnies Impact on share value Chandler recalled that the effect of leverage on a firm could be modeled by using the adjusted present-value formula, which hypothesized that debt increased the value of a firm by means of shielding cash flows from taxes. Thus, the present value of debt tax shields could be added to the value of the unlevered firm to yield the value of the levered enterprise. The marginal tax rate Chandler proposed to use was 40%, reflecting the sum of federal, state, and local taxes Impact on debt rating A key assumption in the analysis would be the debt rating for Wrigley, after assuming S3 billion in debt, and whether the firm could cover the resulting interest payments. Dobrynin had suggested that Chandler should assume Wrigley would borrow S3 billion at a rating between BB and B. Was a rating of BB/B likely? In that regard, Chandler gathered information on the average financial ratios associated with different debt-rating categories thought that Wrigley's pretax cost of debt would be around 13%. Chandler sought to check that assumption against the capital-market information given Dobrynin With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm, and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm, and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. Consolidated Balance Sheets for the Company (in thousands of dollars) ASSETS Current assets: 2001 2000 Cash and equivalents Short-term investments, at amortized cost Accounts receivable Inventories S 307,785 S 300,599 29,301 239,885 191,570 25,450 75,693 203,288 278,981 46,896 14.846 913,843 25,300 115,745 26,381 64,676 188,615 Finished goods Raw materials and supplies 39,728 14.226 Other current assets Deferred income taxes current Total curent assets Marketable equity securities, at fair value Deferred charges and other assets Deferred income taxes noncurrent Property, plant, and equipment (at cost) Land Buildings and building eqpment 28,535 83,713 26,743 39,933 359,109 857.0 39,125 344,457 756.050 and e ent Less accumulated depreciation 571,717532,598 607.034 Net lant and ent 684,379 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: S 91,225 73,129 128,406 13,779 39,467 60,976 Accounts payable Accrued expenses Dividends payable 42,711 68,437 1.455 Income and other taxes payable Deferred income taxes current current ties Deferred income taxes noncurrent Other non-current liabilities Common stock Class B convertible stock Additional paid-in capital Retained earnings Treasury stock Accumulated other com Total stockholders' equity 40,144 13,921 113,489 12,558 2,938 346 1,684,3371,492,547 (289,799 (256,478) 119,014 1,276,287 1,132.897 43,206 12,646 2,850 1,153 ve income 134 765,64 Income Statements for the Company year ended December 31 2001 (in thousands, except per-share amounts) Earnings Net sales Cost of sales Gross profit Selling, general and admininstrative expenses Operating income Investment income Other expense Earnings before income taxes Income taxes Net earnings 2000 1999 S 2,429,646 $ 2,145,706 $ 2,061,602 904,183 1,157,419 721,813 435,606 17,636 8,812 444,430 136,247 S362,986 $328,942 $ 308,183 997,054 1,432,592 919,236 513,356 18,553 4,543 527,366 164,380 904,266 1,241,440 778,197 463,243 19,185 3,116 479,312 150,370 Per-share amounts Net earnings per share of common stock Dividends paid per share of common stock 1.61 0.745 $ 1.45 $ 0.70 $ 1.33 0.66 S Source of data: Company regulatory filings Financial Characteristics of Major Confectionary Firms LT Debt LT Debt LT Debt Common Shares Market ook LT Outstandi Value of Value of Total LT +Book (LT Debt+Debt/Book LT Debt/ Debt Value of Mkt Value Value of Mkt Value Equity of Equity Recent ng Equity Equity Company Name Cadbury Schweppes plc $ 26.66 502.50 $ 13,397 S 5,264 $ 2,264 30.07% 14.46% 43.01% i6.90% Hershey Foods Corp. $ 65.45 136.63$ 8,942$2,785$ 869 23.77% 8.85% 31.18% 9.71% Kraft Foods Tootse Roll Industries Inc. $ 31.17 51.66$ 1,610 S 500 $ 8 1.45% .46% 47% O.47% Wm. Wrigley Jr. Co. $ 56.37 232.44 $13,103 $1,276 $-0.00% 0.00% 0.00% 0.00% S&P 500 Composite Price (millions) (millions)(millions)(millions)Equiy) of Equity $ 38.82 1,735.00 $ 67,353 $39,920 $ 8,548 17.64% 11.26% 21.41% 12.69% $1,148.08 18.23% 8.76% 24.27% 9.94% Compound Interest Growth of Company Name Cadbury Schweppes plc Hershey Foods Corp Kraft Foods Price/Cash Dividend Dividend Coverage EPS Past5 Firm Value/ Yrs EBITDA 10.3 11.4 Beta 0.60 EPS Earnings Dividend Payout 1.39 Yield Before Ta 6.50% 0.60 2.74 20.40 $ 1.16 41.0% 2.00% 11.1x 6.50% nmf nmf 12.50% nmf 9.00% -49.57% 15.20 0.67 44.0% 2.50% 4.6x nmf 1.17 18.70 $0.26 12.0% 1.50% Tootse Roll Industries Inc. 0.65 1.30 24.00 $ 0.28 22.0% 0.90% 0.75 1.61 29.30 $ 0.75 46.0% 1.50% 3.4x 14.6 22.6 Wm. Wrigley Jr. Co. S&P 500 Composite 1.00 18.78 40.55 Key Industrial Financial Ratios by Credit Rating Investment Grade Non-Investment Grade 13.3 EBIT interest coverage (x) Funds from operations/total debt (%) Free operating cash flow/total debt (%) Return on capital (%) Operating income/sales (%) Long-term debt/capital (%) Total debt/capital, incl. short-term debt (%) 23.4 214.2 156.6 35.0 23.4 6.3 3.9 65.7 42.2 30.6 33.6 22.3 12.8 26.6 18.1 13.1 24.0 18.1 15.5 (1.1) 21. 33.8 40.3 35.9 42.6 47.0 2.2 19.7 7.3 11.5 15.4 53.6 57.7 1.0 10.4 1.5 8.0 14.7 72.6 75.1 5.0 Capital-Market Conditions as of June 7, 2002 Other instruments U.S. Federal Reserve Bank discount rate LIBOR (1 month) Certificates of deposit (6 month) Prime interest rates U.S. Treasury obligations 3 mos 6 mos 1 yr 2 yr 3 yr 5 yr Yield 1.670% 1.710% 2.310% 3.160% 3.660% 4.090% 4.520% 4.860% 5.650% 1 .730% 1 .840% 1 .980% 4.750% U.S. Treasury yield curv yr 10 yr 20 yr June 7, 2002 Yield 9.307% 9.786% 10.083% 10.894% 12.753% 14.663% 6% 596 4% 3% 2% 1% 0% Corporate debt obligations (10 year 3mos. 6mos. 1. . . 5. 7yT. 10 . 20 With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley. Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. Chandler noted that Wrigley's market value of common equity was about $13.1 billion. Dobrynin and Chandler discussed the current capital-market conditions and decided to focus on the assumption that Wrigley could borrow S3 billion at a credit rating between BB and B, to yield 13%. Chandler agreed to return soon to discuss the results of her research. The William Wrigley Jr. Company Wrigley was the world's largest manufacturer and distributor of chewing gum. The firm's industry, branded consumer foods and candy, was intensely competitive and was dominated by a gives product profiles of Wrigley and its pees, Over the preceding two years, revenues had grown at an annual compound rate of 10% (earnings at 9%), reflecting Historically, the firm had been conservatively financed. At the end of2001, it had total assets of $1.76 billion and no debt shows, Wrigley's stock price had significantly outperformed the S&P few large playcrs. the introduction of new products and foreign expansiorn 500 Composite Index, and was running slightly ahead of its industry index As Estimating the Effect of a Leveraged Recapitalization Under the proposed leveraged recapitalization, Wrigley would borrow S3 billion and use it either to pay an equivalent dividend or to repurchase an equivalent value of shares. Chandler knew that this combination of actions could affect the firm's share value, cost of capital, debt coverage, earnings per share, and voting control. Accordingly, she sought to evaluate the effect of the recapitalization on those areas. She gathered financial data on Wrigley and its peer companics Impact on share value Chandler recalled that the effect of leverage on a firm could be modeled by using the adjusted present-value formula, which hypothesized that debt increased the value of a firm by means of shielding cash flows from taxes. Thus, the present value of debt tax shields could be added to the value of the unlevered firm to yield the value of the levered enterprise. The marginal tax rate Chandler proposed to use was 40%, reflecting the sum of federal, state, and local taxes. Impact on debt rating A key assumption in the analysis would be the debt rating for Wrigley, after assuming S3 billion in debt, and whether the firm could cover the resulting interest payments. Dobrynin had suggested that Chandler should assume Wrigley would borrow $3 billion at a rating between BB and B. Was a rating of BB/B likely? In that regard, Chandler gathered information on the average financial ratios associated with different debt-rating categories thought that Wrigley's pretax cost of debt would be around 13%. Chandler sought to check that assumption against the capital-market information given in Dobrynin Impact on cost of capital Chandler knew hat the maximum value of the firm was achieved when the weighted average cost of capital (WACC) was minimized. Thus, she intended to estimate what the cost of equity and the WACC might be, if Wrigley pursued this capital-structure change. The projected cost of debt would depend on her assessment of Wrigley's debt rating after recapitalization and on current capital-market rates The cost of equity (Kr) could be estimated by using the capital asset pricing model. gives yields on U.S. Treasury instruments, which afforded possible estimates of the risk-free rate of return. The practice at Aurora Borealis was to use an equity-market risk premium of 7.0%. Wrigley's beta would also need to be relevered to reflect the projected recapitalization. Chandler wondered whether her analysis covered everything. Where, for instance, should she take into account potential costs of bankruptcy and distress or the effects of leverage as a signal about future operations? More leverage would also create certain constraints and incentives for management. Where should those be reflected in her analysis? Impact on reported earnings per share Chandler intended to estimate the expected effect on earnings per share (EPS) that would occur at different levels of operating income (EBIT) with a change in leverage. The heginnings of an EBIT EPS analysis are presented in Estimating the Effect of a Leveraged Recapitalization Under the proposed leveraged recapitalization, Wrigley would borrow S3 billion and use it either to pay an equivalent dividend or to repurchase an equivalent value of shares. Chandler knew that this combination of actions could affect the firm's share value, cost of capital, debt coverage, earnings per share, and voting control. Accordingly, she sought to evaluate the effect of the recapitalization on those areas. She gathered financial data on Wrigley and its peer comparnies Impact on share value Chandler recalled that the effect of leverage on a firm could be modeled by using the adjusted present-value formula, which hypothesized that debt increased the value of a firm by means of shielding cash flows from taxes. Thus, the present value of debt tax shields could be added to the value of the unlevered firm to yield the value of the levered enterprise. The marginal tax rate Chandler proposed to use was 40%, reflecting the sum of federal, state, and local taxes Impact on debt rating A key assumption in the analysis would be the debt rating for Wrigley, after assuming S3 billion in debt, and whether the firm could cover the resulting interest payments. Dobrynin had suggested that Chandler should assume Wrigley would borrow S3 billion at a rating between BB and B. Was a rating of BB/B likely? In that regard, Chandler gathered information on the average financial ratios associated with different debt-rating categories thought that Wrigley's pretax cost of debt would be around 13%. Chandler sought to check that assumption against the capital-market information given Dobrynin With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm, and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. With those words, Blanka Dobrynin, managing partner of Aurora Borealis LLC, asked Susan Chandler, an associate, to initiate the research for a potential investment in Wrigley Aurora Borealis was a hedge fund with about $3 billion under management and an investment strategy that focused on distressed companies, merger arbitrage, change-of-control transactions, and recapitalizations. Dobrynin had immigrated to the United States from Russia in 1991, and had risen quickly to become partner at a major Wall Street firm. In 2000, she founded Aurora Borealis to pursue an "active-investor" strategy. Her typical mode of operation was to identify opportunities for a corporation to restructure, invest significantly in the stock of the target firm, and then undertake a process of persuading management and directors to restructure. Now, in June 2002, Dobrynin could look back on the large returns from the use of that strategy. Consolidated Balance Sheets for the Company (in thousands of dollars) ASSETS Current assets: 2001 2000 Cash and equivalents Short-term investments, at amortized cost Accounts receivable Inventories S 307,785 S 300,599 29,301 239,885 191,570 25,450 75,693 203,288 278,981 46,896 14.846 913,843 25,300 115,745 26,381 64,676 188,615 Finished goods Raw materials and supplies 39,728 14.226 Other current assets Deferred income taxes current Total curent assets Marketable equity securities, at fair value Deferred charges and other assets Deferred income taxes noncurrent Property, plant, and equipment (at cost) Land Buildings and building eqpment 28,535 83,713 26,743 39,933 359,109 857.0 39,125 344,457 756.050 and e ent Less accumulated depreciation 571,717532,598 607.034 Net lant and ent 684,379 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: S 91,225 73,129 128,406 13,779 39,467 60,976 Accounts payable Accrued expenses Dividends payable 42,711 68,437 1.455 Income and other taxes payable Deferred income taxes current current ties Deferred income taxes noncurrent Other non-current liabilities Common stock Class B convertible stock Additional paid-in capital Retained earnings Treasury stock Accumulated other com Total stockholders' equity 40,144 13,921 113,489 12,558 2,938 346 1,684,3371,492,547 (289,799 (256,478) 119,014 1,276,287 1,132.897 43,206 12,646 2,850 1,153 ve income 134 765,64 Income Statements for the Company year ended December 31 2001 (in thousands, except per-share amounts) Earnings Net sales Cost of sales Gross profit Selling, general and admininstrative expenses Operating income Investment income Other expense Earnings before income taxes Income taxes Net earnings 2000 1999 S 2,429,646 $ 2,145,706 $ 2,061,602 904,183 1,157,419 721,813 435,606 17,636 8,812 444,430 136,247 S362,986 $328,942 $ 308,183 997,054 1,432,592 919,236 513,356 18,553 4,543 527,366 164,380 904,266 1,241,440 778,197 463,243 19,185 3,116 479,312 150,370 Per-share amounts Net earnings per share of common stock Dividends paid per share of common stock 1.61 0.745 $ 1.45 $ 0.70 $ 1.33 0.66 S Source of data: Company regulatory filings Financial Characteristics of Major Confectionary Firms LT Debt LT Debt LT Debt Common Shares Market ook LT Outstandi Value of Value of Total LT +Book (LT Debt+Debt/Book LT Debt/ Debt Value of Mkt Value Value of Mkt Value Equity of Equity Recent ng Equity Equity Company Name Cadbury Schweppes plc $ 26.66 502.50 $ 13,397 S 5,264 $ 2,264 30.07% 14.46% 43.01% i6.90% Hershey Foods Corp. $ 65.45 136.63$ 8,942$2,785$ 869 23.77% 8.85% 31.18% 9.71% Kraft Foods Tootse Roll Industries Inc. $ 31.17 51.66$ 1,610 S 500 $ 8 1.45% .46% 47% O.47% Wm. Wrigley Jr. Co. $ 56.37 232.44 $13,103 $1,276 $-0.00% 0.00% 0.00% 0.00% S&P 500 Composite Price (millions) (millions)(millions)(millions)Equiy) of Equity $ 38.82 1,735.00 $ 67,353 $39,920 $ 8,548 17.64% 11.26% 21.41% 12.69% $1,148.08 18.23% 8.76% 24.27% 9.94% Compound Interest Growth of Company Name Cadbury Schweppes plc Hershey Foods Corp Kraft Foods Price/Cash Dividend Dividend Coverage EPS Past5 Firm Value/ Yrs EBITDA 10.3 11.4 Beta 0.60 EPS Earnings Dividend Payout 1.39 Yield Before Ta 6.50% 0.60 2.74 20.40 $ 1.16 41.0% 2.00% 11.1x 6.50% nmf nmf 12.50% nmf 9.00% -49.57% 15.20 0.67 44.0% 2.50% 4.6x nmf 1.17 18.70 $0.26 12.0% 1.50% Tootse Roll Industries Inc. 0.65 1.30 24.00 $ 0.28 22.0% 0.90% 0.75 1.61 29.30 $ 0.75 46.0% 1.50% 3.4x 14.6 22.6 Wm. Wrigley Jr. Co. S&P 500 Composite 1.00 18.78 40.55 Key Industrial Financial Ratios by Credit Rating Investment Grade Non-Investment Grade 13.3 EBIT interest coverage (x) Funds from operations/total debt (%) Free operating cash flow/total debt (%) Return on capital (%) Operating income/sales (%) Long-term debt/capital (%) Total debt/capital, incl. short-term debt (%) 23.4 214.2 156.6 35.0 23.4 6.3 3.9 65.7 42.2 30.6 33.6 22.3 12.8 26.6 18.1 13.1 24.0 18.1 15.5 (1.1) 21. 33.8 40.3 35.9 42.6 47.0 2.2 19.7 7.3 11.5 15.4 53.6 57.7 1.0 10.4 1.5 8.0 14.7 72.6 75.1 5.0 Capital-Market Conditions as of June 7, 2002 Other instruments U.S. Federal Reserve Bank discount rate LIBOR (1 month) Certificates of deposit (6 month) Prime interest rates U.S. Treasury obligations 3 mos 6 mos 1 yr 2 yr 3 yr 5 yr Yield 1.670% 1.710% 2.310% 3.160% 3.660% 4.090% 4.520% 4.860% 5.650% 1 .730% 1 .840% 1 .980% 4.750% U.S. Treasury yield curv yr 10 yr 20 yr June 7, 2002 Yield 9.307% 9.786% 10.083% 10.894% 12.753% 14.663% 6% 596 4% 3% 2% 1% 0% Corporate debt obligations (10 year 3mos. 6mos. 1. . . 5. 7yT. 10 . 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started