Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what would the annual max be for the 401(k) under 50? this is all the information i have been given for this assignment SALS document

what would the annual max be for the 401(k) under 50?

this is all the information i have been given for this assignment

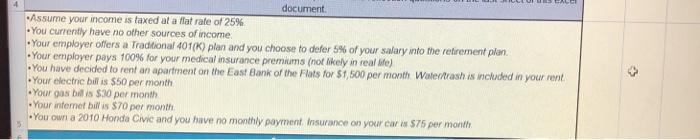

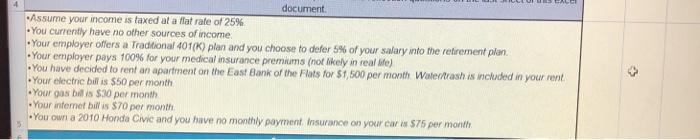

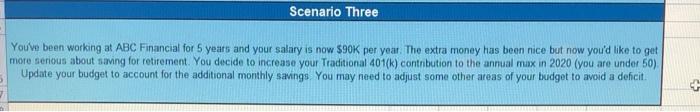

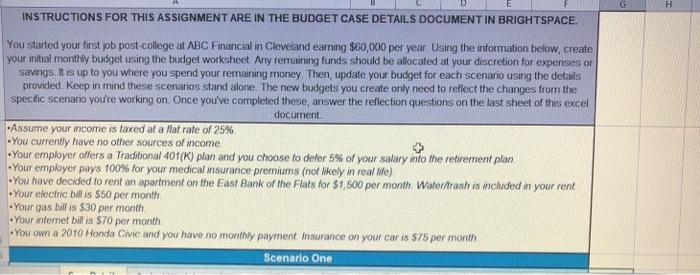

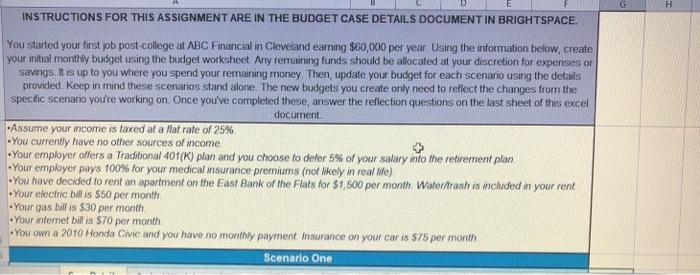

SALS document Assume your income is laxed at a flat rate of 25% You currently have no other sources of income Your employer offers a Traditional 401(k) plan and you choose to defer 5% of your salary into the retirement plan. Your employer pays 100% for your medical insurance premiums (not likely in reale) -You have decided to rent an apartment on the East Bank of the Flats for $1,500 per month Watextrash is chided in your rent Your electric bilis S50 per month Your gas bilis $30 per month Your internet billis $70 per month - You own a 2010 Honda Civic and you have no monthly payment Insurance on your car is $75 per month Scenario Three You've been working at ABC Financial for 5 years and your salary is now 590K per year. The extra money has been nice but now you'd like to get more serious about saving for retirement. You decide to increase your Traditional 401(k) contribution to the annual max in 2020 (you are under 50) Update your budget to account for the additional monthly savings. You may need to adjust some other areas of your budget to avoid a deficit 5 INSTRUCTIONS FOR THIS ASSIGNMENT ARE IN THE BUDGET CASE DETAILS DOCUMENT IN BRIGHTSPACE. You started your first job post-college at ABC Financial in Cleveland earning $60,000 per year Using the information below, create your initial monthly budget using the buiget worksheet Any remaining funds should be allocated at your discretion for expenses or savings. It is up to you where you spend your remaining money then update your budget for each scenario using the details provided. Keep in mind these scenarios stand alone. The new budgets you create only need to reflect the changes from the specific scenario you're working on Once you've completed these, answer the reflection questions on the last sheet of this excel document Assume your income is taxed at a Mt rate of 25% You currently have no other sources of income Your employer offers a Traditional 401(K) plan and you choose to deler 5% of your salary into the retirement plan Your employer pays 100% for your medical insurance premiums (not likely in real Me) You have decided to rent an apartment on the East Bank of the Flats for $1,500 per month Watertrash is mcluded in your rent Your electric bill is $50 per month Your gas bil is $30 per month Your internet bilis 70 per month You own a 2010 Honda Civic and you have no monthly payment Insurance on your car is $75 per month Scenario One 16 Scenario Three 15 You've been working at ABC Financial for 5 years and your salary is now 590K per year The extra money bs been nice but now you'd like to get more senious about Saving for retirement You decide to increase your Traditional 401(k) contrbution to the anual max in 2020 [you are under 50) 16 Update your budget to account for the additional monthly sanngs. You may need to adjust some other areas of your budget to avoid a delicit 17 SALS document Assume your income is laxed at a flat rate of 25% You currently have no other sources of income Your employer offers a Traditional 401(k) plan and you choose to defer 5% of your salary into the retirement plan. Your employer pays 100% for your medical insurance premiums (not likely in reale) -You have decided to rent an apartment on the East Bank of the Flats for $1,500 per month Watextrash is chided in your rent Your electric bilis S50 per month Your gas bilis $30 per month Your internet billis $70 per month - You own a 2010 Honda Civic and you have no monthly payment Insurance on your car is $75 per month Scenario Three You've been working at ABC Financial for 5 years and your salary is now 590K per year. The extra money has been nice but now you'd like to get more serious about saving for retirement. You decide to increase your Traditional 401(k) contribution to the annual max in 2020 (you are under 50) Update your budget to account for the additional monthly savings. You may need to adjust some other areas of your budget to avoid a deficit 5 INSTRUCTIONS FOR THIS ASSIGNMENT ARE IN THE BUDGET CASE DETAILS DOCUMENT IN BRIGHTSPACE. You started your first job post-college at ABC Financial in Cleveland earning $60,000 per year Using the information below, create your initial monthly budget using the buiget worksheet Any remaining funds should be allocated at your discretion for expenses or savings. It is up to you where you spend your remaining money then update your budget for each scenario using the details provided. Keep in mind these scenarios stand alone. The new budgets you create only need to reflect the changes from the specific scenario you're working on Once you've completed these, answer the reflection questions on the last sheet of this excel document Assume your income is taxed at a Mt rate of 25% You currently have no other sources of income Your employer offers a Traditional 401(K) plan and you choose to deler 5% of your salary into the retirement plan Your employer pays 100% for your medical insurance premiums (not likely in real Me) You have decided to rent an apartment on the East Bank of the Flats for $1,500 per month Watertrash is mcluded in your rent Your electric bill is $50 per month Your gas bil is $30 per month Your internet bilis 70 per month You own a 2010 Honda Civic and you have no monthly payment Insurance on your car is $75 per month Scenario One 16 Scenario Three 15 You've been working at ABC Financial for 5 years and your salary is now 590K per year The extra money bs been nice but now you'd like to get more senious about Saving for retirement You decide to increase your Traditional 401(k) contrbution to the anual max in 2020 [you are under 50) 16 Update your budget to account for the additional monthly sanngs. You may need to adjust some other areas of your budget to avoid a delicit 17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started