Answered step by step

Verified Expert Solution

Question

1 Approved Answer

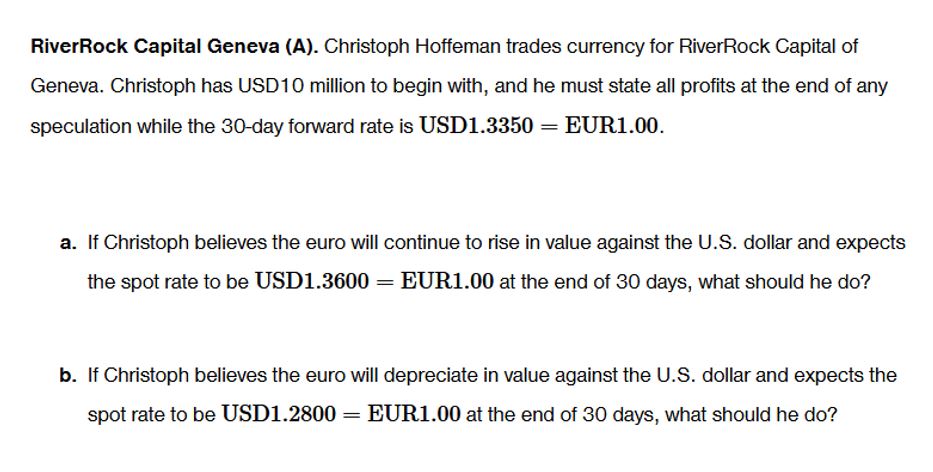

what's the answerRiverRock Capital Geneva ( A ) . Christoph Hoffeman trades currency for RiverRock Capital of Geneva. Christoph has USD 1 0 million to

what's the answerRiverRock Capital Geneva A Christoph Hoffeman trades currency for RiverRock Capital of

Geneva. Christoph has USD million to begin with, and he must state all profits at the end of any

speculation while the day forward rate is USD EUR

a If Christoph believes the euro will continue to rise in value against the US dollar and expects

the spot rate to be USD EUR at the end of days, what should he do

b If Christoph believes the euro will depreciate in value against the US dollar and expects the

spot rate to be USD EUR at the end of days, what should he do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started