Whats the answers

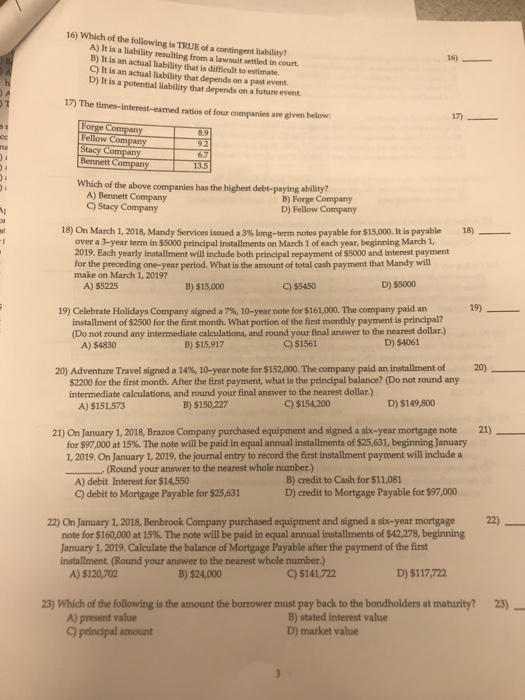

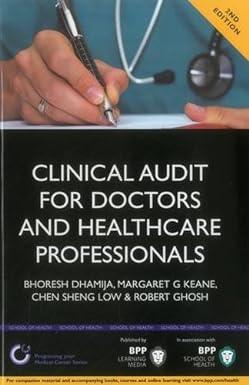

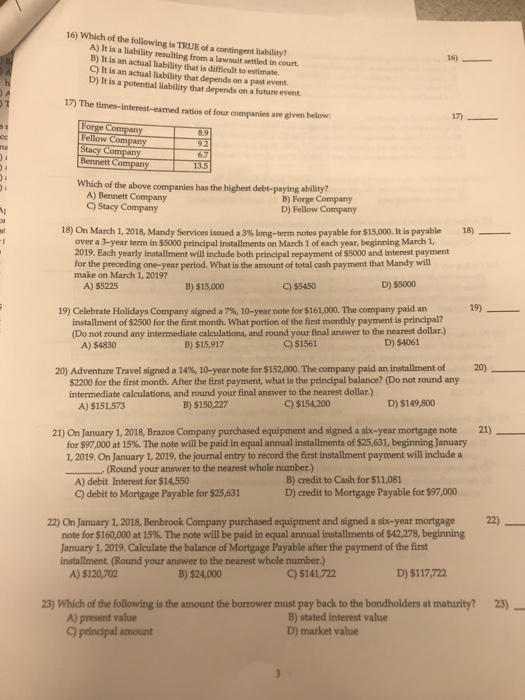

16) Which of the following is TRUE of a contingent liability? A) It is a liability resulting from a lawsuit settled in court B) It is an actual liability that is difficult to estimate. C) It is an actual liability that depends on a past event. D) It is a potential liability that depends on a future event 16) 17 The times-interest-eamed ratios of four companies are given below Fellow 13.5 Which of the above companies has the highest debt-paying ability? A) Bennett Company C) Stacy Company B) Forge Company D) Fellow Company 18) On March 1, 2018, Mandy Services issued a 3% long-term notes payable for S15,000. It is payable 18) - over a 3-year term in $5000 principal installments on March 1 of each year, beginning March 1, 2019. Each yearly installment will include both principal repayment of $5000 and interest payment for the preceding one-year period. What is the amount of total cash payment that Mandy wil make on March 1, 20197 A) $5225 B) $15,000 C) $5450 D) $5000 19) Celebrate Holidays Company signed a 7% 10-year note for $161,000. The company paid an 19) installment of $2500 for the first month. What portion of the first monthly payment is principal? (Do not round any intermediate calculations, and round your final answer to the nearest dollar.) ) $4830 B) $15,917 C) $1561 D) $4061 20) 20 Adventure Travel signed a 14%, 10-year note for$152,000. The company paid an installment of $2200 for the first month. After the first payment, what is the principal balance? (Do not round any intermediate calculations, and round your final answer to the nearest dollar.) A) $151,573 B) $150,227 C) $154,200 D) $149,800 21) On January 1, 2018, Brazos Company purchased equipment and signed a six-year mortgage note 21) for $97,000 at 15%. The note will be paid in equal annual installments of S25631, beginning January 1, 2019.On January 1, 2019, the journal entry to record the first installment payment will include a (Round your answer to the nearest whole number.) B) credit to Cash for $11,081 A) debit Interest for $14,550 C) debit to Mortgage Payable for $25,631 D) credit to Mortgage Payable for $97,000 22) On January 1, 2018, Benbrook Company purchased equipment and signed a six-year mortgage 22) note for $160,000 at 15%. The note will be paid in equal annual installments of $42,278, beginning January 1, 2019. Calculate the balance of Mortgage Payable after the payment of the first installment. (Round your answer to the nearest whole number.) A) $120,702 B) $24,000 C) $141,722 D) $117,722 23) Which of the following is the amount the borrower must pay back to the bondholders at maturity? 23) A) present value C) principal amount B) stated interest value D) market value