Whats the answers

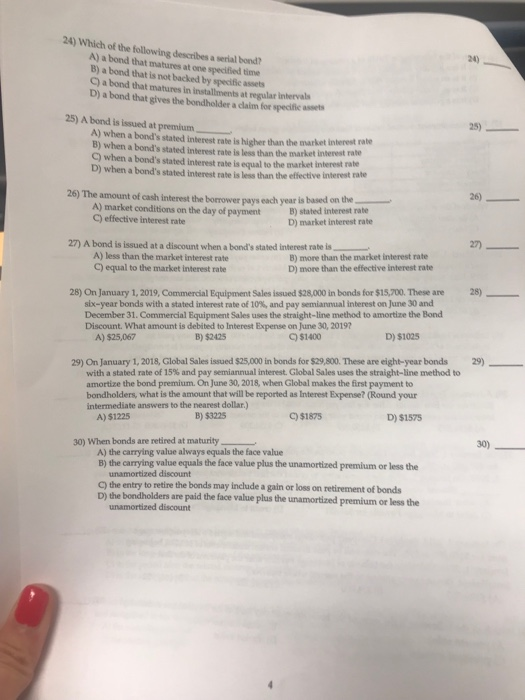

24) Which of the following describes a serial bond? 24) A) a bond that matures at one specified time ) a bond that is not backed by specific assets C) a bond that matures in installments at regular intervals D) a bond that gives the bondholder a claim for specific assets 25) A bond is issued at premium_ 25) A) when a bond's stated interest rabe is higher than the market interest rale B) when a bond's stated interest rate is less than the market interest rate C) when a bond's stated interest rate is equal to the market interest rate D) when a bond's stated interest rate is less than the effective interest rate 26) The amount of cash interest the borrower pays each year is based on the 26) B) stated interest rate D) market interest rate C) effective interest rate 27) A bond is issued at a discount when a bond's stated interest rate is A) less than the market interest rate C) equal to the market interest rate B) more than the market interest rate D) more than the effective interest rate 28) 28) On January 1, 2019, Commercial Equipment Sales issued $28,000 in bonds for $15,700. These are six-year bonds with a stated interest rate of 10% and pay semiannual interest on June 30 and December 31. Commercial Equipment Sales uses the straight-line method to amortize the Bond Discount. What amount is debited to Interest Expense on June 30, 20197 A) $25,067 B) $2425 C) $1400 D) $1025 29) On January 1, 2018, Global Sales issued $25,000 in bonds for $29,800. These are eight-year bonds 29) with a stated rate of 15% and pay semiannual interest. Global Sales uses the straight-line method to amortize the bond premium. On June 30, 2018, when Global makes the first payment to bondholders, what is the amount that will be reported as Interest Expense? (Round your intermediate answers to the nearest dollar.) B) $3225 C)$1875 D) $1575 A) $1225 30) When bonds are retired at maturity 30) A) the carrying value always equals the face value B) the carrying value equals the face value plus the unamortized premium or less the unamortized discount C) the entry to retire the bonds may include a gain or loss on retirement of bonds D) the bondholders are paid the face value plus the unamortized premium or less the unamortized discount