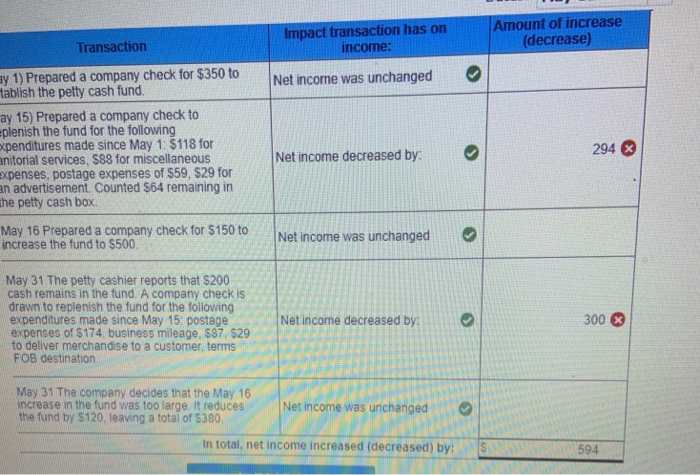

whats the impact on the income

GL0601- Based on Problem 6-2A LO P2 Allen Co. set up a petty cash fund for payments of small omounts. The following trensactions involving the petty cesh fund occurred in May May 1 Prepared a company check for $358 to establish the petty cash fund. Hay 15 Prepared a company check to replenish the fund for the following expenditures nade since May 1. poirts a. Paid $118 for janitorial services b. Paid $88 for miscellaneous expenses. c. Paid postage expenses of 159 d. Paid $29 to The County Gazette (the local newspaper) far an advertisement. e. Counted $64 remaining in the petty cash box. May 16 Prepared a company check for $15e to increase the fund to sse. Nay 31 The petty cashier reports that s280 cash renains in the fund. A conpany check is dran to replenish the fund for the following expenditures made since May 15 Paid postage expenses of $174, 8. Reinbursed the office manager for business mileege, s57 h. Paid $29 to deliver merchandise to a custoner, teres FOB destination Hay 16 Increasse in the fund wes too lange. It reduces the fund by $120, leaving a total of 380. Answer is not complete. General Trial balance Requremert Journa Ledper Trial Balance Impact on income Indicate the impact each transaction had on net income. Enter decreases to net income as negative values. Dates; May 01 " to: May 31 Prey s of 6 Next > Impact transaction has on income Amount of increase (decrease) Transaction 1) Prepared a company check for $350 to tablish the petty cash fund to Net income was unchanged y ay 15) Prepared a company check to plenish the fund for the following xpenditures made since May 1: $118 for nitorial services, $88 for miscellaneous xpenses, postage expenses of $59, $29 for an advertisement. Counted $64 remaining in he petty cash box 294 Net income decreased by: May 16 Prepared a company check for $150 to Net income was unchanged increase the fund to S500 May 31 The petty cashier reports that $200 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 postage expenses of $174, business mileage, $37, $29 Net income decreased by. 300 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large It reduces Net income was unchanged the fund by $120, leaving a total of $380 In total, net income increased (decreased) by: 594